Getting credit for groceries and paying utility bills through e-commerce platforms have become a routine for most of us. Standing in queues at bill counters and bank counters to make payments and withdraw money have become passé now. To make instant payments from anywhere, anytime, all you need is a smartphone, relevant apps, and some data.

Fintech innovations have digital payments a breeze. But in today’s hectic life, we don’t marvel at or appreciate these innovations as they don’t stand out, but rather remain blended into our habits.

Well, that is embedded finance!

The dictionary meaning for Embedded means “implanted deep,” so simply put, embedded finance is:

The implanting of financial services onto non-financial platforms, technologies, or product mechanisms with the intent to offer financial products to customers right at the source.

Embedded finance has now become a buzzword as it offers businesses new revenue streams and elevates customer experiences. From a user perspective, it becomes easier for the customer to access financial products at the same source instead of diverging to other vendors.

Origin of embedded finance

For centuries, financial services had been a birthright of banks and allied financial institutions. With numerous restrictions in place, it was challenging, albeit practically impossible, for others to offer these services. However, as days went by, there was the rise of the Open Banking movement followed by the uprising of fintechs all over the world. Entry barriers for non-financial players were relaxed and other non-banking institutions were able to function on par with the banking industry.

The embedded finance buzz started with payments where the user can pay for the ride or product without navigating to another app. Today, banking, insurance, consumer lending, and wealth management have also come under the embedded finance umbrella

These advancements have opened avenues for non-financial entities to offer financial services with APIs as the driving force. As a result, they don’t need to go through the painful process of setting up a fintech divisions or overhauling their systems.

According to Lightyear Capital’s recent study, Embedded finance is all set to touch $230 billion in revenue by 2025 and can reach up to $1 trillion in value. Fueling this growth is the confluence of technology companies that serve in different capacities.

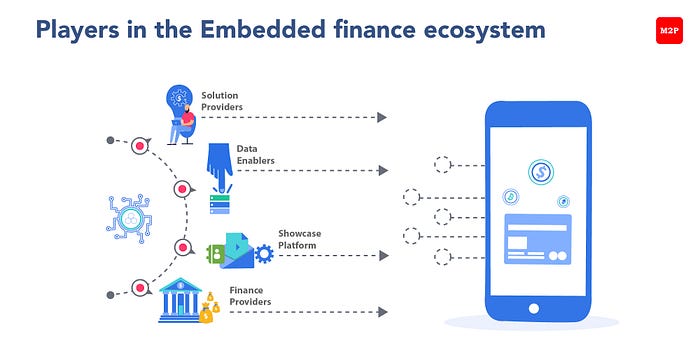

Key players in embedded finance

The embedded finance landscape primarily has four players:

Solution providers

These players embed plug-and-play financial solutions onto online platforms with improves focus on customer segments and loyalty. They are usually fintech companies that offer solutions tailored to the showcase platform requirements. Their business models are typically pay-as-per-use, on-demand, and hybrid.

Data enablers

These are players who transport information back and forth between the solution providers and showcase platform. They use APIs, SDKs, and connectivity like BaaS as part of their technological infrastructure. They enhance or revamp an existing solution while BaaS providers rent out their core infrastructure to power the services.

Showcase platform

It can be a standalone site or a network where the solution is embedded and is accessible. It presents a frictionless buying experience to the end customer. The customers can access these platforms through the web, mobile, and POS. They create a link between the banks and consumers by providing end-to-end financial services.

Financial Institutions and other regulated bodies

These are banks, NBFCs, investment, and insurance entities, whose services are extended by the solution providers to the showcase platform. The core services of underwriting, risk management, regulatory compliance, and credit risks are taken up here. All these players work together to unbundle and re-bundle financial services as per the business requirement and target customer segment.

Growth drivers and benefits

The growth drivers listed below make embedded finance the most happening Fintech innovation today.

- Radical change in customer behavior and expectations

- Willingness to try non-traditional channels for credit

- Lesser hesitancy in sharing personal data

- Ongoing COVID-19 pandemic

Furthermore, these growth drivers comprise benefits (discussed below) that push businesses to adopt embedded finance as part of their strategy.

Better payment experience

One of the major hurdles faced by ecommerce businesses is the loss of control in the customer checkout journey. Instead of redirecting customers to external portals, they must ensure that the entire process happens in one place. Embedding payment APIs in the ecommerce platform comes with a dual advantage of delivering superior payment experience and understanding customer payment habits. In addition, financial interaction between the players will be well-synchronized, leading to faster checkout and settlement processes.

Increase in revenue and key revenue metrics

Showcase platforms can unlock new revenue sources and offer Alternative Payment Methods to their customers. For example, if the target customers are Gen-Z, then fielding Buy Now, Pay Later (BNPL) solutions would make perfect sense. Furthermore, they can also deliver an increase in CLTV (Customer Lifetime Value), Average Order Value (AOV), and customer retention.

Automated book keeping

Keeping the financial books in order is the primary responsibility of every business. Unfortunately, this process is manual, time-consuming, and error-prone, resulting in mismatched entries, loss of receipts, and other serious errors. But, by embedding financial APIs, businesses can automate record-keeping, enhance operations strategy, free up resources for strategic initiatives, and deter fraudulent activities.

Reduced cost and increased margins

Embedded finance gives financial institutions access to the most lucrative set of customers. They can tap into the distribution capabilities of the e-commerce platforms by offering niche payment and credit experiences. Additionally, the process of underwriting and the effective management of credit’s lifecycle will lead to a significant increase in margins and reduced costs for customers.

Affordable, customized, and niche

Today’s customers are always on the lookout for choices that are affordable yet customized. Embedded finance offers the user an assortment of user-friendly, flexible, and cost-effective financial services. Moreover, they can be further modified to fit the requirements by making it a contextual finance offering.

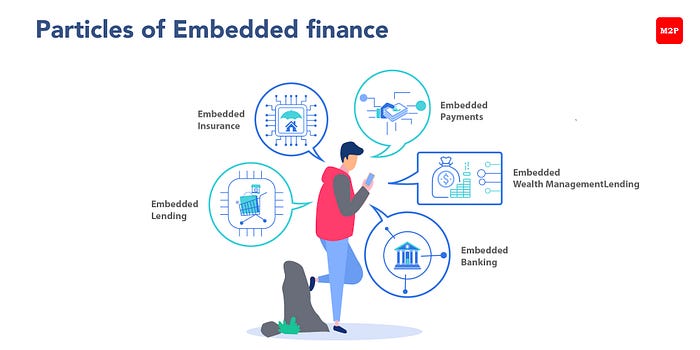

Manifestations of embedded finance

While there is a common understanding the embedded finance is primarily payment solutions, its manifestations also extend to other financial services.

Embedded payments

With the advent of digital wallets, we often leave our physical wallets back home. Unfortunately, the wallet left behind can sometimes push us to reconsider the purchase. But embedded payments can make that purchase possible and pain-free. An embedded payment app and a few clicks are all that’s needed to alleviate that pain completely.

Some famous use cases of embedded payments are ride-sharing apps like Uber or Lyft, where you don’t need to hand the driver money for the ride. Instead, you pay for the ride in the app once you reach your destination. Even Starbucks offers an app where people can order and pay from their phones. They also get an additional incentive of rewards that can be redeemed against future orders.

Embedded lending

Lending traditionally means visiting a bank or any allied financial institution and filling out a ton of paperwork. But today, embedded lending lets a customer avail credit right at the point of purchase without the extra hassle. For example, Klarna and AfterPay allow customers to divide their purchases into Equated Monthly Instalments (EMIs), and club other offers to improve customer stickiness to the platform.

Embedded insurance

An insurance agent, website, or broker are the options available when choosing to buy an insurance policy. It is an excruciatingly long process with its own literature, which can often intimidate the customer. But today, embedded insurance simplifies this process by offering it as part of the purchasing experience. For example, Tesla offers its customers insurance as part of the purchase. These embedded insurances are also a tad cheaper when compared to a third-party insurance providers.

Embedded wealth management/ investment

The last decade of technological innovation has opened many avenues for wealth building. Many individuals have started building a portfolio to build/increase wealth. But wealth management remains a mystery to many due to its complicated nature. Embedded investment programs intend to change that scenario by offering easy and affordable access to stocks and funds. A classic example would be Acorns, an embedded investment app that rounds a user’s spare changes from purchases. The app user is completely set free from having to track stocks and their behavior to manage their wealth. The portfolio is automatically adjusted by Acorns as per the current market situation.

Embedded banking

Embedded banking allows both financial institutions and companies to offer banking services to their customers. Sometimes, it can also serve as a replacement for the traditional financial offering. For example, the ride-sharing app Lyft offers a debit card to its drivers, thereby enabling them to get instant payment. It also gives them the choice of setting up a separate savings account through its program. Likewise, Shopify’s banking feature encourages the merchants on its platform to set up a separate bank account for business revenue instead of using their personal accounts.

Frequently Asked Questions (FAQs)

Got questions on embedded finance? Keep reading as we answer some of the most frequently asked questions.

Are embedded banking and embedded finance one and the same?

The answer is no. Embedded finance is an umbrella term that encompasses all financial services. Those services can be offered by both banking and non-banking businesses. Further, it is predominantly designed with a customer perspective in mind. Whereas embedded banking can remove or mask the role of traditional banks. It integrates banking services such as digital wallets, BNPL programs, integrated banking services, etc. into non-financial businesses.

Why is there a rising demand for embedded finance in the market?

Many trends have ignited the need for embedded finance offerings. Understanding them will help businesses to know why there is a rising demand for embedded finance. A few of these key trends are listed below.

- Customers today seek holistic experiences facilitated by an integrated ecosystem of people, products, and financial offerings on a single platform.

- With the rise of fintechs, there has been an exponential increase in technological adoption. But banks are restricted from offering innovative customer-friendly services for payments and lending by several factors including regulatory authorities. Hence Banking as a Service (BaaS)emerged as the most viable resort.

- Over the last few years, directives like PSD2, and Open Banking have popularized the development and use of APIs. Companies are modernizing IT and BaaS to upsell and cross-sell product offerings.

- Businesses are looking for ways to transcend traditional revenue streams and increase their profits based on targeted offerings and payment experiences.

- Digital experiences have now become paramount, and non-financial entities want to offer embedded finance as part of their product module.

- Partnering with upscale brands that boast brand loyalty has become the perfect platform for banks to reach the Gen-X crowd.

How fintechs are becoming part of the embedded finance revolution?

Fintech essentially helps banks and other businesses to launch financial solutions rapidly at low costs. Furthermore, they offer unique platforms for B2B and B2C businesses, based on their individual requirement. The B2B customers enjoy a complete and holistic view of the embedded financial offering, as they exercise total control over their product deployment, feature set-up, and product flow. While B2C companies adopt retail banking platforms and more of a direct-to-customer approach.

The differentiation existing at this end of the spectrum is the API technology that facilitates and simplifies solutions as per individual business models.

What are we doing at M2P?

M2P started out as a Payments as a Service company, the first step towards embedded finance. Over the years we have made our mark in embedded lending and banking solutions. Our Pay@ease product offers a three-dimensional advantage to the customer, merchant, and bank by providing access to finance, EMIs, lesser instances of cart abandonment, and diverse customer segments right at the point of sale.

M2P empowers businesses like Ola with a full suite of payment options, a physical card, and a credit line for their drivers to utilize when they face a cash crunch.

Furthermore, Finin (India’s first Neo-Bank) has deployed our Bank-in-box solutions to provide instant savings bank a/c, virtual and physical debit cards along with bill payments. One can also activate their goal-based saving feature in the app with no extra fuss.

How does the future look for embedded finance?

As it is a contextual offering, embedded finance offers the customer the ease and convenience to conduct transactions without too many interventions. In addition, it enables businesses to possess a unique individual identity and enhance customer experience. Embedded finance also provides opportunities for industries to upsell and cross-sell financial products. In a nutshell, embedded finance will dramatically change the way your business works.

Embedded finance brings about collaboration and sustained innovation among banks, fintechs, and businesses. They bring about a fresh perspective to enhance the user experience by simplifying and transforming cumbersome processes. Fintechs will be able to form strategic partnerships and at the same time be competitive in their offerings. But, all this will happen in a hush-hush manner as that is the very point of embedded finance.

Want to know more about embedded finance? Write to us at business@m2pfintech.com.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments