India’s digital lending market recorded a 132% CAGR between 2017 and 2022 and is expected to reach 350 billion dollars in value by 2023. The upswing in the number of consumers using digital avenues for banking proliferated digital loans by 40 to 60%.

In today’s lending landscape, credit underwriting is fundamental and pivotal in gauging the credibility of the borrower. Assessing credit risk remains the top priority for lenders as it determines the viability and profitability of the business. It helps lenders assess if the borrower can pay back a loan. Although the way lenders evaluate their applicants may vary across products, the basic framework is the same.

In this article, let’s focus on credit underwriting and how alternate data sources can change the dynamics of the process.

What is Credit Underwriting?

Credit underwriting is a systematic risk assessment method performed to appraise the creditworthiness of a loan or insurance policy applicant. It is a crucial function of banks, NBFCs, and other Financial Institutions (FIs) in the lending business as it helps measure the applicant or borrower’s risk profile.

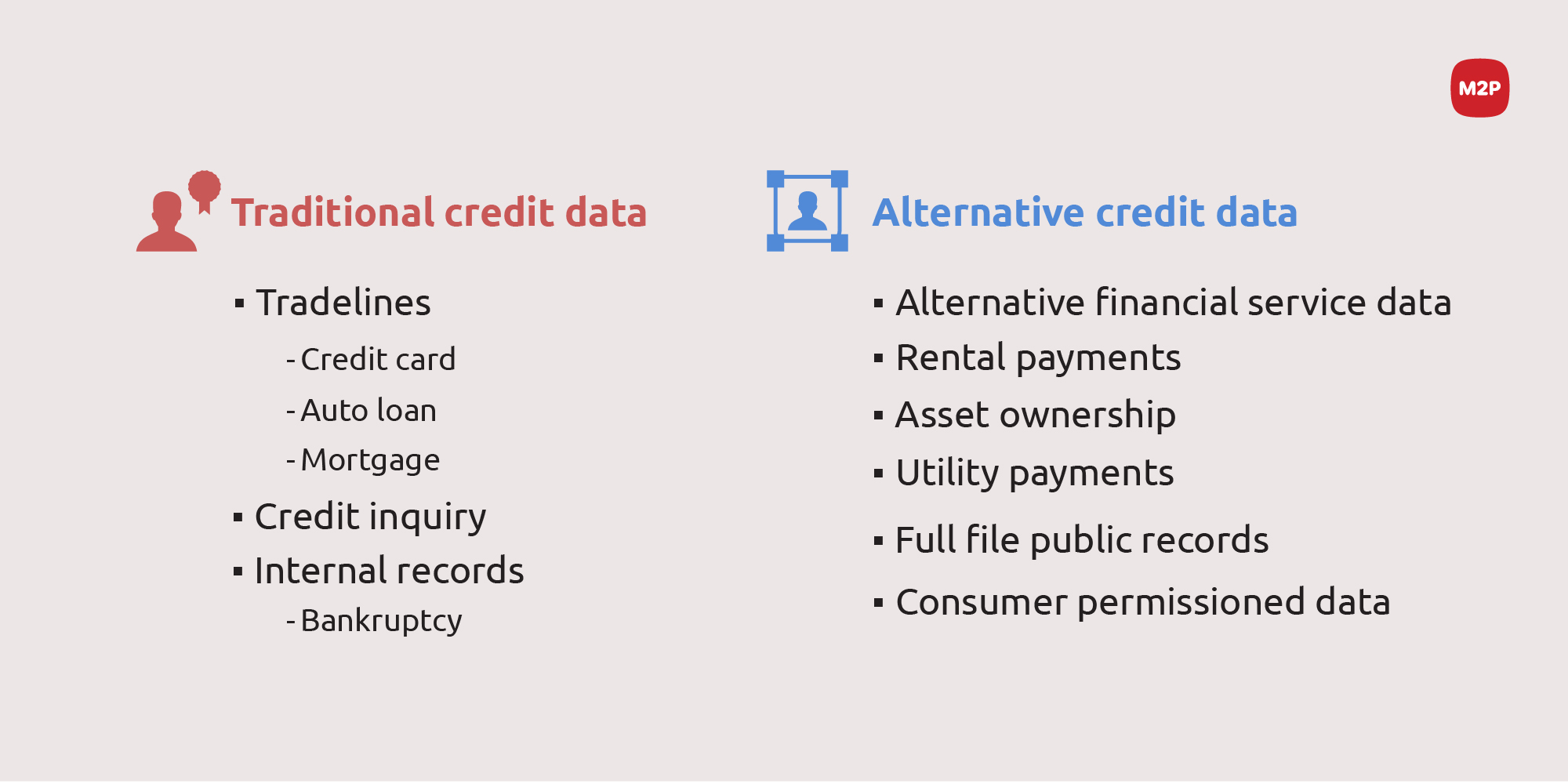

Traditionally, Financial Institutions utilize credit reports generated by manually examining customers’ financial data from credit applications, credit bureaus (CIBIL), and lender databases. The metrics used to evaluate credit include the source of income, age, number of dependents, bank statements, repayment capacity, past and current debts, health, nature of employment, and other assets.

It is essential to note that some loans require an in-depth review of primary data like income and current debt. In contrast, others involve a comprehensive analysis of the applicant’s financial history.

Steps in Credit Underwriting

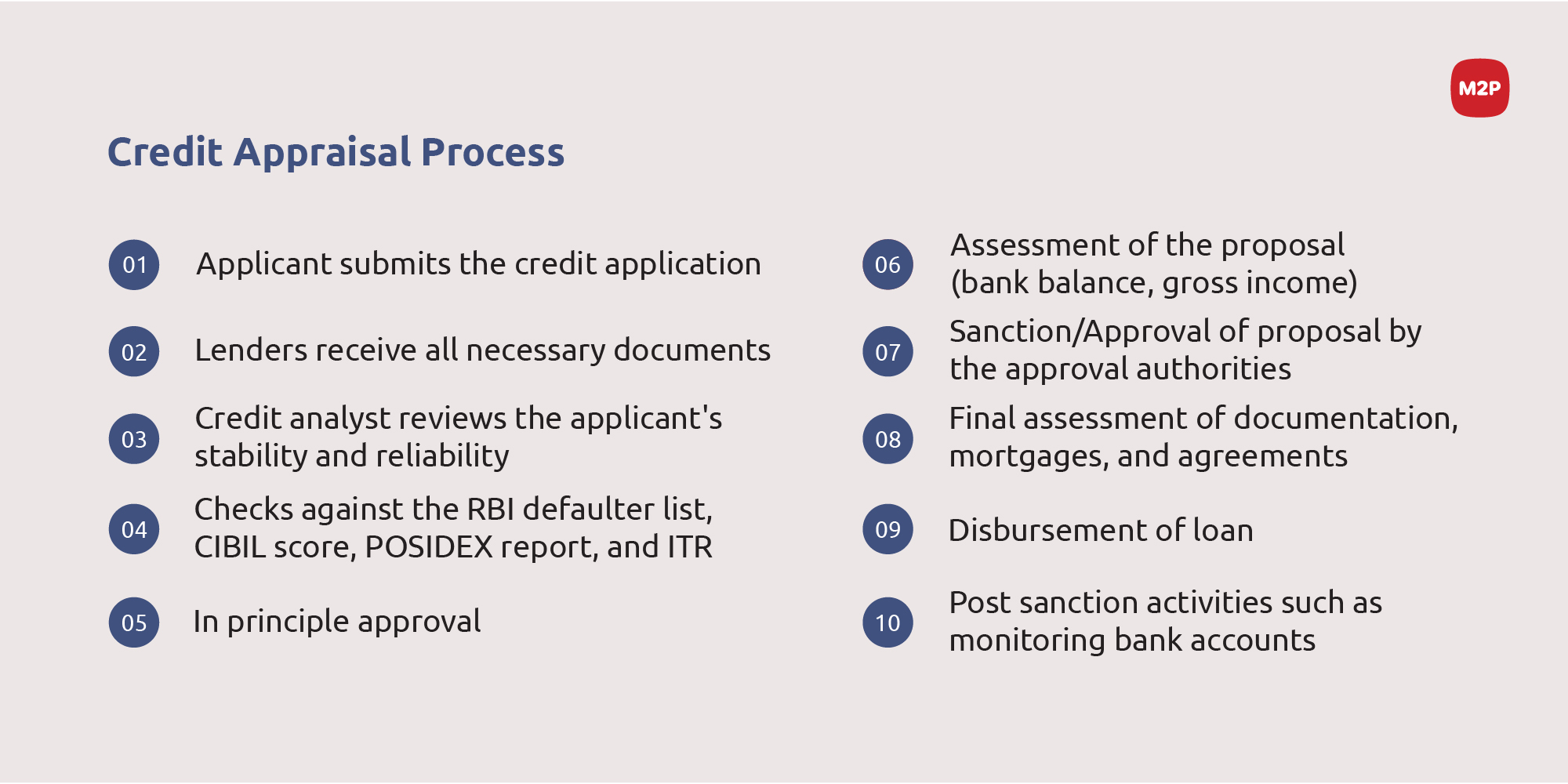

The credit appraisal process differs from product to product and also based on the lender type. Here is a broad overview of the steps of credit appraisal.

- Credit Processing – In this stage, the applicant fills out and submits a credit application, either in person or online. Lenders garner all necessary data such as loan details, business or individual information, and primary risk-related information for screening the applications. Each FI has a checklist to validate if all essential information is collected.

- Analysis and Review – The lender scrutinizes the application, analyses the accuracy of the information/documents, and determines the creditworthiness. A credit analyst checks against the RBI defaulter list, CIBIL score, POSIDEX report, and ITR. In addition, the lenders assess the overall political and economic risks and evaluate the financial stability and reliability of the applicant.

- Documentation – From credit application to foreclosure of impaired loan and realization of security, each level in the credit cycle is recorded. The documentation is filed in an appropriate cross-indexing system to facilitate review and follow-up. Moreover, all credit applications must be documented regardless of approval or rejection.

- Approval/Sanction – Each FI has predetermined guidelines on the credit approval process for each product. The credit analyst identifies and measures the credit risk against the guidelines and forwards a recommendation to the approval authorities. The approval authorities examine the request and decide whether to reject or sanction the loan. Typically, authorities deal with new credit approvals, renewals of existing credits, and modifications in the terms and conditions of previously approved credits.

- Credit Administration – In this stage, loan agreements are duly prepared, credit files are updated, and renewal notices are sent methodically. FIs allocate credit administration functions to a designated department or individual in credit operations, depending on the size and complexity of the credit portfolio.

- Disbursement – Once the loan is approved, the letter of offer comprising the disbursal amount and the terms and conditions, etc., is sent to the customer or the borrower. The borrower should duly sign the duplicate copy and return it to the FI. Upon receipt of the letter, institutions proceed with the formalities including final documentation, registration of collateral, insurance cover, and vetting of documents by a legal expert. Before funds are released the borrower must comply with pre-disbursement conditions and the loan must be approved by the relevant authorities in the financial institution.

Shift in the Metrics Matrix

Evolution in consumer behavior and the surge in technology adoption resulted in a paradigm shift in digital credit. This made FIs switch from mainstream practices and adopt innovative approaches to render a faster and seamless borrowing experience. Further, the emergence of fintech and the evolution of Artificial Intelligence and API-enabled services broadened the bandwidth of risk assessment. They included data points from alternative sources that genuinely contribute to determining the quality and value of the loan applications. These data points go beyond the regular financial specifics and dwell deep into customers’ buying/spending patterns and behaviors. Such data points obtained from non-traditional sources are known as alternative credit data.

What is Alternative Credit Data?

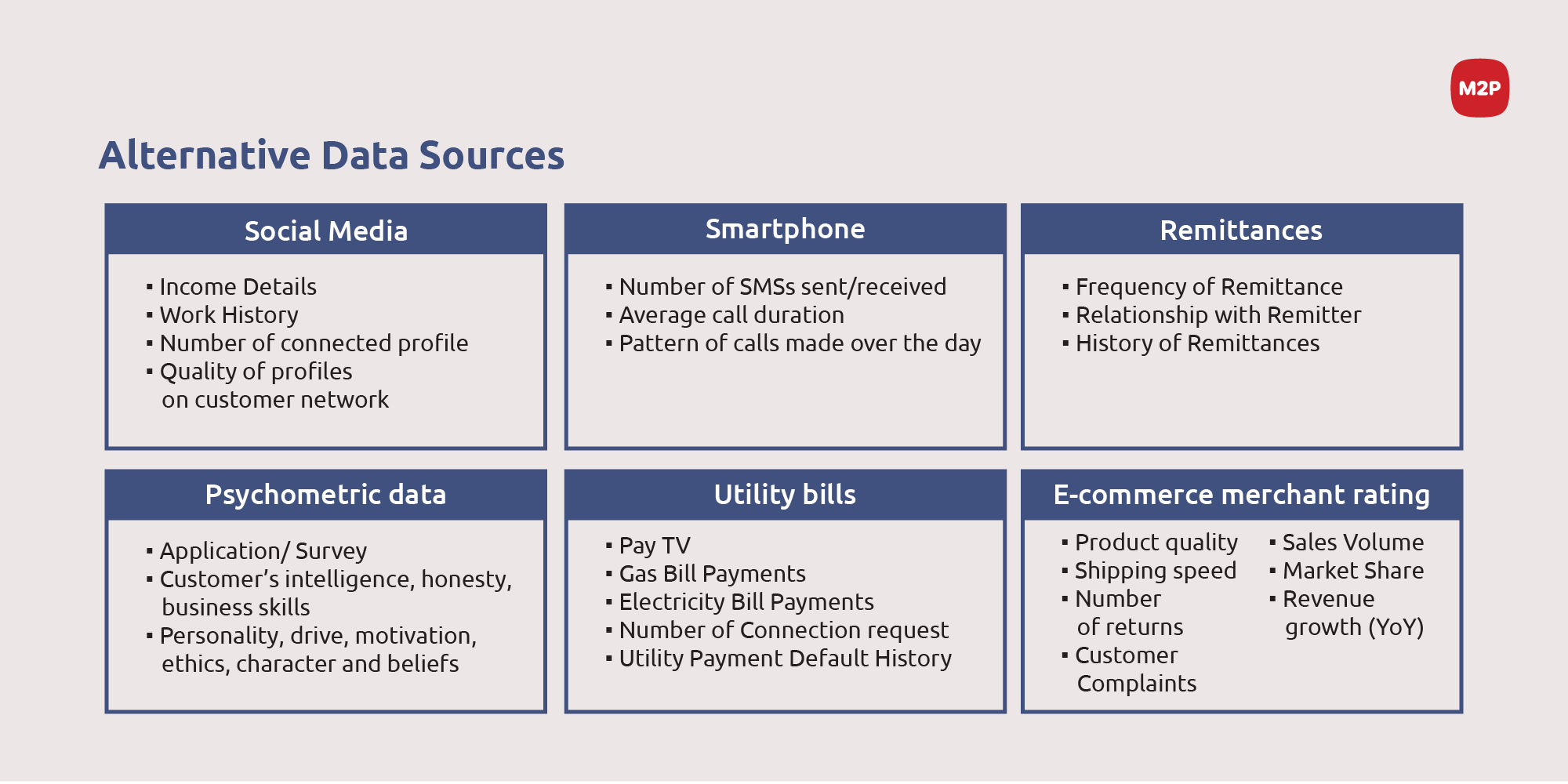

The alternative data is a collection of information including a customer’s utility, rental, insurance, other bills payment track record, employment and travel history, governmental and e-commerce transactions, and property records. The data points exhibit the customer’s habits, preferences, behavior, and character that help lenders better understand an individual’s financial reliability and stability.

Why Alternative Data?

Over the last few years, alternative data and behavior metrics have created ripples in the financial sector. However, fintechs and other FIs are just at the tip of the untapped potential of alternative data. Utilizing the correct alternative data and metrics can significantly enhance predictive models such as risk modeling, lead scoring, and fraud detection.

Drives Financial Inclusion

According to a world bank report, there are 1.7 billion unbanked individuals in developing economies like India, Bangladesh, Pakistan, China, Indonesia, and Mexico. In India, lack of credit scores is the stumbling block to achieving financial inclusion. This is predominantly because most working professionals are deprived of access to financial services due to a low or non-existent credit score. Alternative data sources unlock a gamut of opportunities to empower such consumer groups with economic power. It also serves as a significant value addition to applicants and credit grantors.

Alternative sources for data and metrics enable fintechs and NBFCs to tap into the unbanked and underbanked population. The alternative data sources are less susceptible to manipulation, and it serves as a source to score the applicants who are underbanked, credit invisible, or generally labeled ‘no-hit’ or ‘thin-file’ by traditional models. The insights from alternative data enhance credit access for such consumer groups, who are usually overlooked. For example, first-time credit card/loan applicants do not have a credit history or background that meets specific criteria. Alternative data points help FIs profile such applicants to process their credit requirements.

Augments Business

Alternative datasets provide a comprehensive and well-rounded picture of consumers’ behavior. This helps FIs make better decisions on who to target and design & develop superior products to ensure a higher adoption rate and sustainability in the market. On the other hand, a more accurate assessment of a consumer’s risk status ensures loans/credits are both profitable as well as low-risk. Alternative data enables FIs make the following enhancements and stay ahead of the winning curve.

- Boosts business agility and market responsiveness

- Capture new market segments

- Develop competitive interest rates

- Create more tailored products and services

- Identify low-risk candidates for automatic loan pre-approval

- Offer loans and credit efficiently

- Eliminate high-risk applicants by having access to extensive data on risky borrowers

Fraud Detection

The key source for alternative data is digital platforms that provide information through digital automation. Artificial intelligence (AI), Machine Learning (ML), deep data analytics, and anonymous metadata can help detect anomalies in business operations or an individual’s transactions. For example, using AI-enabled tools that employ alternative data, lenders can detect financial fraudsters as early as in the pre-qualification stage.

Unlocking Value from Alternative Data

Alternative data is the new oil. Before we know it, most legacy banks will join the bandwagon and include alternative data sets in their standard lending strategies. The key to capturing the value of alternative data is recognizing and analyzing the cost/benefit balance and determining the ideal blend of data sources and their impact on profitability.

For more insights on credit underwriting and alternative sources write to us at business@m2pfintech.com.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments