APIs, or small lines of code as we laymen understand it, is a capsule that powers fintech. And fintech is a term that points to a company or tech powering financial services.

Right from simple chatbots, payment processing platforms to crypto and blockchain industries, the world of fintech is quite huge.

Also known as financial infrastructure companies, fintech uses APIs to offer customer-centric products and fill the gaps of legacy banking practices.

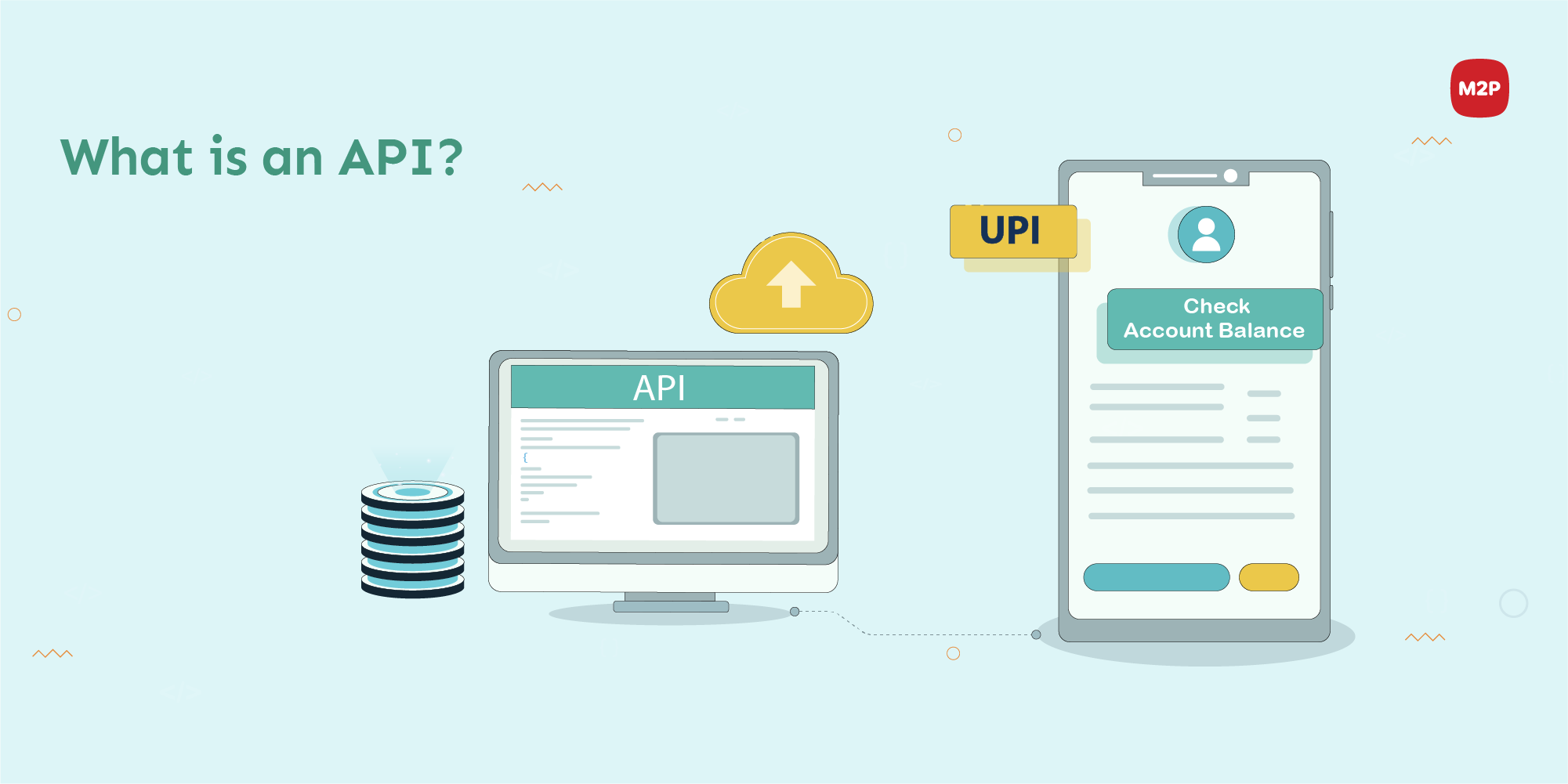

What is an API?

The standard textbook definition of APIs or Application Programming Interfaces define them as a set of functions and syntax that create applications capable of accessing the data of an operating system, program, or just about any other service.

For example, checking your bank balance via a UPI app is a classic API use in action. In fact, APIs are changing how we interact with the world, and all these actions happen in real-time.

Besides, APIs come with a host of benefits in this post-fintech world:

Cost-effectiveness

Decades ago, banks were only used for primitive services like opening and maintaining an account. Withdrawals and deposits dominated back in the day, and other services like investments were relatively rare. Even if they were available, it was a costly affair. But now, with the help of APIs, we have access to a wide range of banking services, right from the comfort of our homes.

Empowers fintech

Earlier banks were quite secretive about their client information. It was a good thing, but it did not give accessibility. But now APIs have opened the floodgates, and many apps and services have come to the fore. The best feature is that the customer will still be able to retain control of their privacy.

Real-time access

Now banking is no more a 9 to 7 activity. It is available to a customer 24/7 and from any part of the world. APIs have achieved real-time money transference with minimal effort. They have also given companies access to a repository of data. It can be used to create highly personalized financial services and enhance the decision capabilities of the business.

APIs have propelled Fintech as a “Here-to-stay technology.”

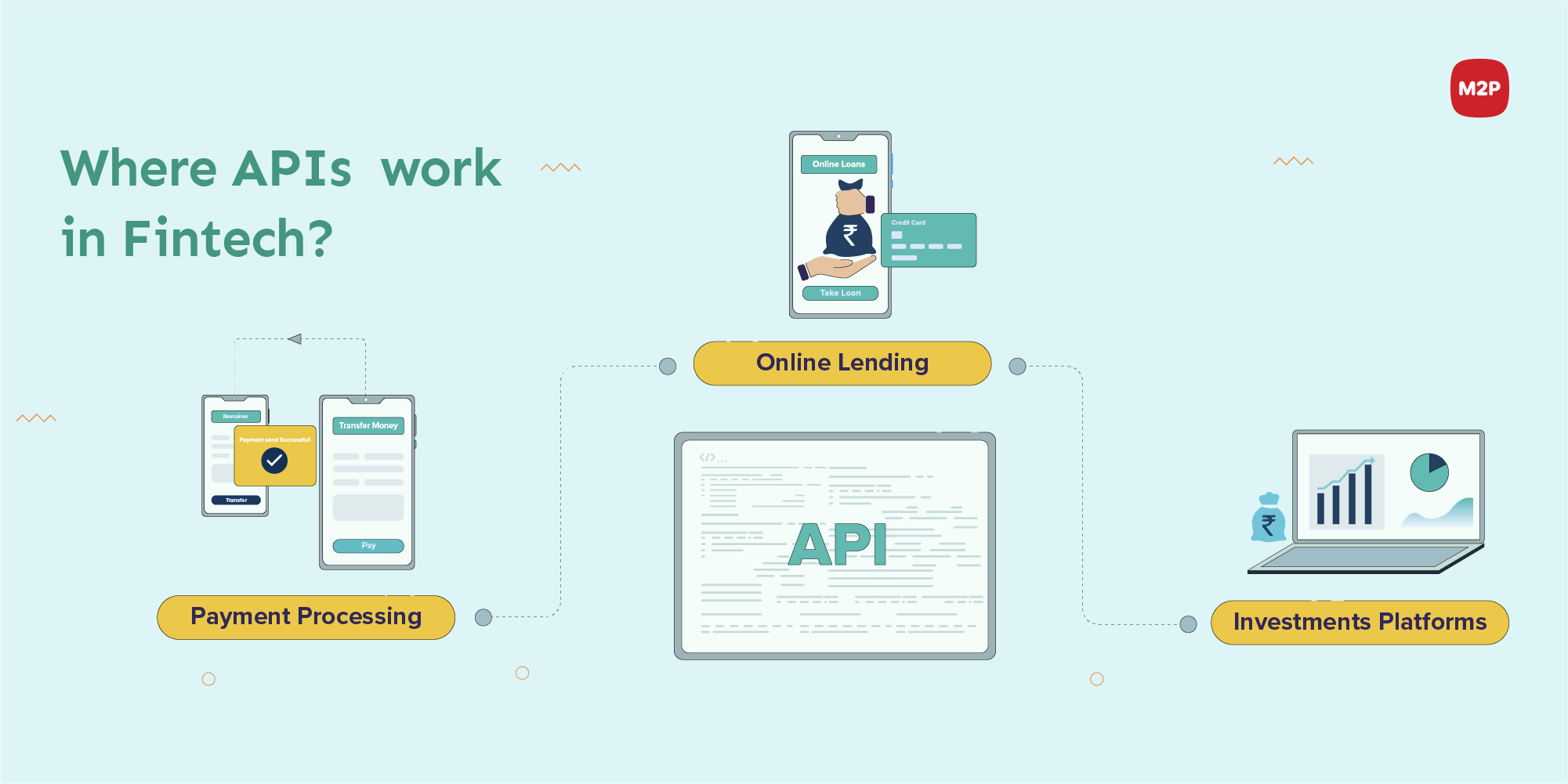

APIs in Fintech

The world of payments

Payment processing APIs simplify and expand the payment options for merchants and customers. As we now shop online from any part of the world, merchants can accept payments through various payment methods. It streamlines the checkout process and offers options that a customer can comfortably choose.

Peer to Peer management

P2P was once a way to let users download files from other users, but now they are a general term in lending and currency. APIs in P2P not only facilitate transactions, but they also come with significantly lower operational costs. P2P lending also automates the lending process and shortens the time taken for loan approval to disbursal.

Investments

Investments are a platform that is usually available to a select few and is not for the unbanked. But APIs have simplified investments and provided access to many eager investors. They have been instrumental in capturing that hidden pool of customers who were intimidated by lengthy paperwork.

Endless possibilities

The concept of API is fairly new and has a scope for endless possibilities. It has created an open marketplace for collaborative innovation among established financial institutions and upcoming Fintech companies.

They have also brought forth a “Sandbox Option”, which gives entrepreneurs or businesses to see their ideas take life without the mandatory regulatory policies. On completion of a successful test run, the concept can be brought to fruition with necessary policies in place.

What does the future hold?

As detailed above, the APIs are here to stay with fintech focusing on creating ripples in every industry:

- End-users — access to more personalized services and increased transparency

- Developers — Create new areas of code that increase functionality and innovative services

- Entrepreneurs — See their fintech ideas come to life and disrupt many industries

- Banks — Create more revenue streams and expand their customer base

In short, APIs have transformed fintech and banks as a platform that offers enhanced user experience with convenience at its core.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments

Trackbacks/Pingbacks