A few years ago, banking was always considered an arduous task with its complexity. But now, when we think of banking, ‘digital transaction’ springs up to our minds immediately, which makes our job simpler. Thanks to Neo banks, it redefines banking in the most user-friendly way and makes it more popular in recent years. Ergo, many customers now prefer using fingers for banking rather than their feet to visit the brick-and-mortar banks.

Why such hype for Neo banks?

What makes it stand out in the banking sector?

We have unraveled everything you need to know about Neo banks in this blog. So, let’s get started right away.

What is a Neo Bank?

Neo Bank is a type of digital bank that works entirely online without a physical branch. It is a customer-focused banking sector that attracts present-day tech-savvy users. They are also recognized as fintech that is demystifying the financial ecosystem actively.

With Neo banks’ advanced features, the users can manage money wisely by using only their mobile phones. Moreover, compared to traditional banks, neo banks offer cheaper and faster banking services that include money transfers, lending, mobile-first financial solutions, and many more.

Three working modes of Neo Banks

Though Neo banks appear to be an app that controls financial services, the working is differentiated into three modes.

(i) Partners with Traditional banks

It is a front-end focused neo bank which does not carry a banking license on its own and partners with a traditional bank to offer a wide range of core banking services. These types of neo banks include non-licensed fintech companies affiliated with existing licensed banks that offer seamless services and products for the bank’s customers. This collaboration ensures banks as their partner and not their opponent.

(ii) Bank’s Digital Avatar

Here, the traditional banks develop their own digital-only initiative like neo banks to offer their services more digitally to their customers. They also go on par with the technology advancements to launch neo banking services. The banks that offer digital services through online portal comes under this category of neo banks.

(iii) Neo Banks with a digital banking license

They are called a Full-Stack neo bank that works only in countries that approve stand-alone digital entities and acquire a license from the Central Bank or the corresponding authority.

Neo Banks Vs. Digital Banks Vs. Traditional Banks

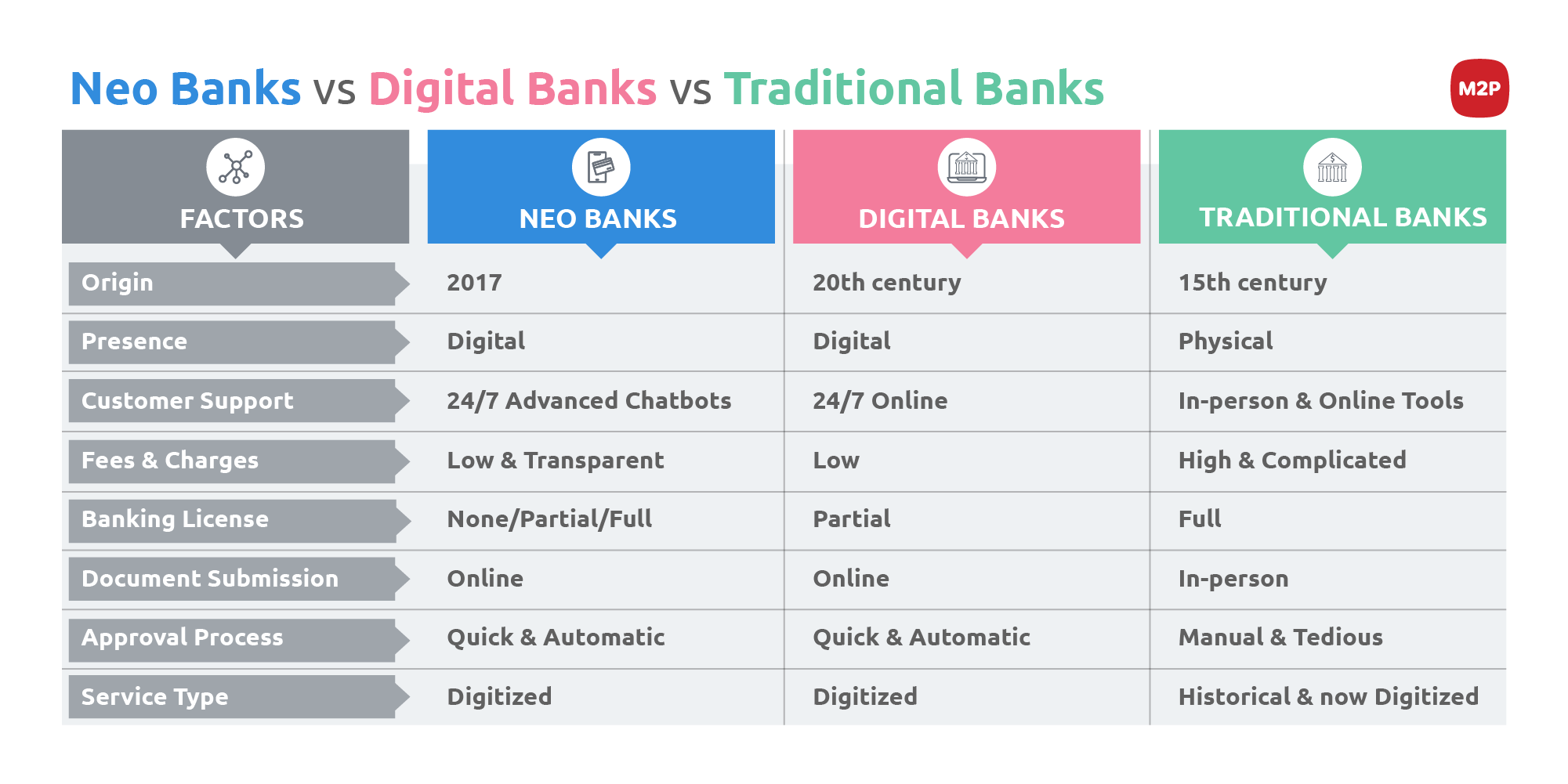

Banking is now a field where people are offered a lot of options to choose from. There are different kinds of banks that offer different services and qualities. The below image brings out the characteristics between three popular banks — Neo Banks, Digital Banks, and Traditional Banks.

As the name says, traditional banks are the oldest of all with the most trustworthy customer relationship. They also specialize in a wide range of services and products but with tons of paperwork and, at times, online data, which demands extremely long wait times. But nowadays, traditional banks have also adopted digital tools like e-mail, SMS, application, website, etc.

The next entrant is the digital banks, which are similar to Neo banks since they also offer banking services online. To simply put, they are traditional banking with a digital touch that allows users to manage finance 24/7 via an electronic/online platform. Digital banks eliminate customers’ visits to physical bank branches and automate traditional banking services with no paperwork. They uplift traditional services with a simple equation — Online Banking + Mobile Banking = Digital Banking.

As you can see, Neo bank is an upgraded version that suits the present-day banking needs digitally and is user-friendly. Neo banks stand out with their simplified customer-centric banking approach with wise financial management. Users are satisfied with their 100% quick and easy digitized services with anywhere anytime accessibility, making them the most profitable business model.

What makes Neo banks a lucrative fintech offering?

Neo banks are one of the profitable business models that emerged in the recent few years. With their ingenious services, these financial institutions are hitting the jackpot in ways that benefit themselves and their users.

The below-listed features substantiate neo banks’ success:

- Fewer fees and faster banking services make it more popular and cost-effective even among underbanked sectors.

- Neo bank is a customer-centric banking avatar as they automate services according to their users’ preferences.

- They blend emerging technologies like Artificial Intelligence and Machine Learning to end the tedious banking process.

- Customers enjoy various financial services like account creation, international transactions, or any services, quicker at any time and any place.

- AI and data insights-driven app that tracks every transaction and generates reports as per user’s requirements.

- Smart saving and Investment options are now possible with just a smartphone.

- Neo banks act as a digital crust, making the core banking services crisper and accessible for their users.

- They fill the digital gap and enable traditional banking services to Gen Z.

- Collecting and analyzing data to give their users highly personalized and customized services.

As a result, banking turned smarter with neo banks and easily reached out to unbanked and underbanked sectors. It also impacts banking today and tomorrow with its unmatchable digitized financial services.

Neo bank and its rising popularity

The Covid-19 pandemic was the main reason which triggered its popularity when people were concerned about physical cash for safety reasons. People were more exposed to digital banking, which made brick and mortar banks have a healthy collaboration with neo banks. Their out-of-the-box strategies gave sudden popularity for neo banks.

Starting from targeting the Gen-Z audience with product marketing, neo banks focus on the end-user experience by tailoring their User Interface to give the best possible user experience. Also, the customer gets to enjoy a better interest rate minus the need for lengthy paperwork.

Furthermore, neo-banks have the ability to offer services based on popular customer opinion, and they further improve the stickiness by tailoring the services individually. When customers feel their opinions are being heard and fulfilled, they stick with the service provider. Neo banks now deploy this strategy to target specific audiences.

These digital-only banks are ruling the banking space since 2017 with their innovative strategies and methods. We have Finin India’s first consumer-facing neo bank, fueled by our own M2P’s API, which gives users a better track of their finances. Finin offers features like a detailed break-up of user spending and completely digital services with high bank-level security.

Backed by banking licenses of the traditional banks, neo banks are adding increasing value by the day to the financial ecosystem; in fact, they can be termed as the new-age banks of today.

Turning stumbling blocks into stepping stones

Even though it is one of the profitable business models in the industry, challenges are to everyone. Neo banks have limited banking services and products, unlike traditional banks, since they are relatively new. Indeed, we could see this challenger bank with a wide range of products and services in few years.

Traditional banks being a string participant for decades with unbeatable trust relationships with their customers, neo banks find it difficult to gain trust. But, with collaboration with traditional banks, they are definitely coming up with great strategies and services to establish as a trustable one among customers.

Neo banks are withstanding in this ambitious field with many robust financial institutions around. Every entrant, including traditional banks, would have faced their stumbling blocks and crisis, which led to the products and services we enjoy now. So, neo banks being an active player is turning every stumbling block into a stepping stone in its way.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

I like the efforts you have put in this, thank you for all the great blog posts.