Reserve Bank of India (RBI) released the latest Digital Lending (DL) guidelines on September 2nd, 2022. This notification confirmed the implementation of the recommendations specified in Annex-1 of the RBI press release**, published a few weeks ago.

Before deep diving into these guidelines, let us understand the RBI’s role as a regulator in the Indian economy.

Brief history of RBI

A book by Dr. B. R. Ambedkar sparked the idea of setting up a central banking institution for India. Subsequently, on April 1, 1935, RBI started its operations based on the RBI act of 1934. The act provides the statutory basis for the functioning of the bank. Yet, RBI remained a private institution till it was nationalized in 1949. Since then, RBI has been regulating, moderating, and monitoring the financial aspects of the country’s fiscal and economic position.

The primary functions of RBI include the following.

- Monetary Authority – Implementing and monitoring monetary policies

- Currency issuance – Producing, managing, issuing, and exchanging quality currency notes and coins

- Regulator & Financial administrator – License issuance, bank mergers, branch expansion, and liquidity of assets

- Managing foreign exchange – Maintaining Rupee value outside India, managing Indian FOREX reserves, and helping foreign trade payments

Other than these, RBI’s role also includes stabilizing India’s financial reserves. They work with players such as financial institutions, regulatory bodies, fintechs, and government agencies to ensure the smooth flow of financial services. To summarize, all private and public banks are monitored by RBI to build trust and safety among their users.

In the last eight years, fintechs, online/mobile banking, and other technological advancements have modernized the financial ecosystem worldwide. Digital transformation in financial services is on a rapid growth spurt. And in recent years, digital lending has been a prominent topic in the industry with its share of pros and cons.

So, what is digital lending?

According to RBI reports, Digital Lending (DL) is “A remote and automated lending process, majorly using seamless digital technologies in customer acquisition, credit assessment, loan approval, disbursement, recovery, and associated customer service.”

Now that the definition clearly states what constitutes digital lending, let’s see who the players are and their roles in the DL realm.

Key players in the DL arena

- Borrower- End customer who is the recipient of the loan amount.

- Lenders- Traditional players include Non-Banking Financial Companies (NBFCs) and Banks. They can be further divided into:

- Balance sheet lenders- Those who have a record of the loan in their books

- Marketplace lenders- Those who connect borrowers and balance sheet lenders

- Lending Service Providers (LSPs)- They are the fintechs that carry out one or more of the lender’s activities like acquiring potential borrowers, disbursement, and collection among several others. LSPs could either be in or out of the regulatory purview of the financial regulator.

- Fringe lenders: They are shadow and unlicensed lenders who do not come under the purview of any registered entity. Monitoring these lenders is difficult as they do not have a proper identity trail.

The key players listed above contribute to the remarkable growth of the industry.

Steady growth prospects

The pandemic era witnessed phenomenal growth in online transactions. There was a significant rise in digital lending platforms and applications. As a result, applying for and borrowing money from a digital lender got simplified, thus giving rise to thousands of Digital Lending Applications (DLAs).

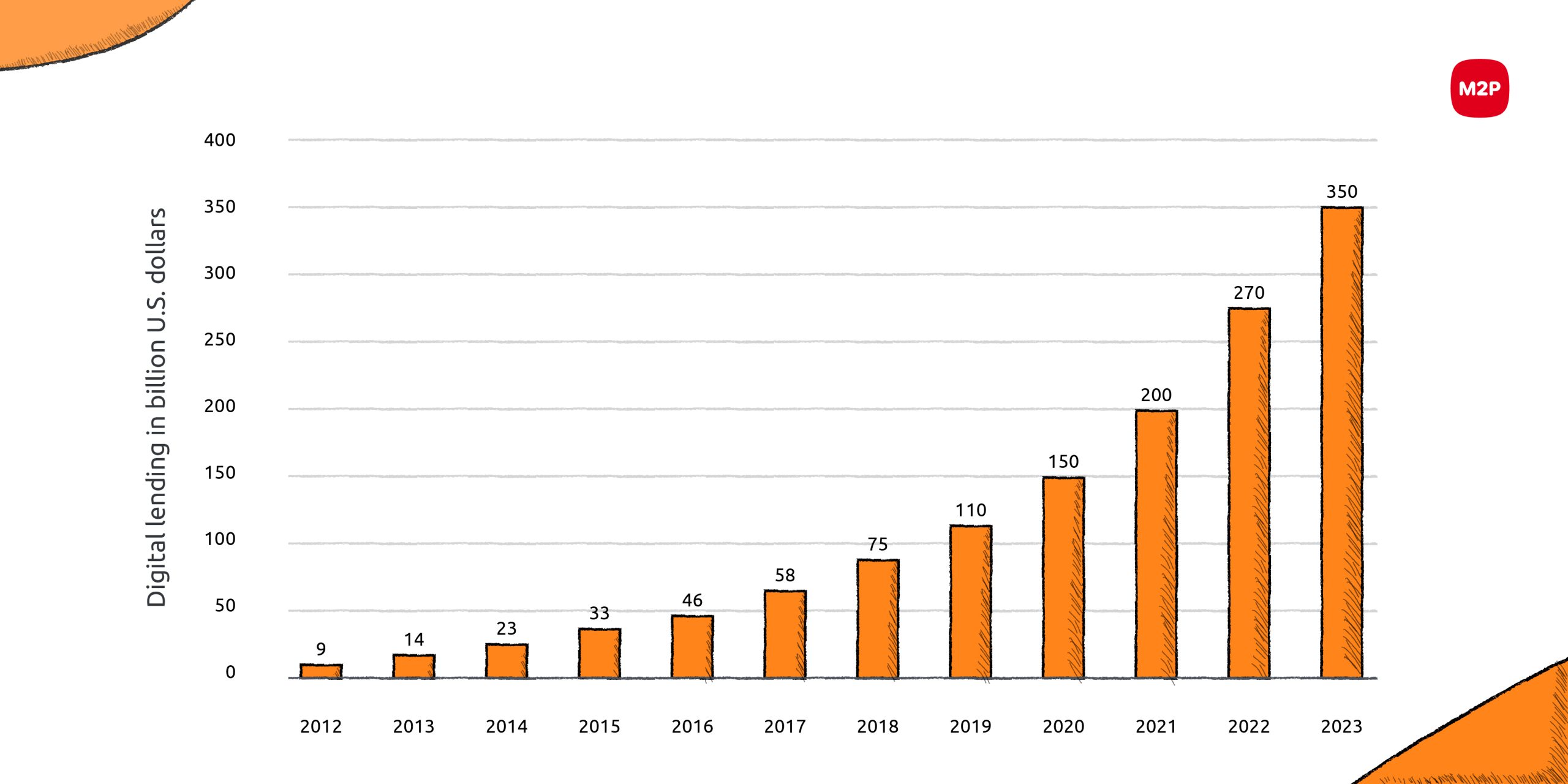

Digital Lending (DL) recorded one of the highest growth in India, from $9bn in 2012 to around $110 bn in 2019. By 2023, the value of the digital lending industry is expected to reach $350 Bn dollars.

When we talk about DL, First Loss Default Guarantee (FLDG) is the term we hear quite often. It is one of the many triggers of RBI’s DL regulation.

Let’s get a quick glimpse into what FLDG is.

What is FLDG?

We’ll start with a simple example. In trading communities, family businesses are carried on from one generation to the next. When entrepreneurs emerge in these situations, loans are given to them based on the family’s credibility. The reason is that if they do not make a payment, the lender can recover it from the borrower’s family.

Likewise, in the case of First Loss Default Guarantee (FLDG), whenever a borrower defaults, a third party (fintech, in this case) comes in to compensate the lender. This mechanism is FLDG.

Here’s how FLDG works.

- Typically, fintechs partner with financial institutions by proposing to widen their customer base by targeting a particular customer segment

- They zero in on that niche and turn them into leads using different marketing strategies

- NBFCs agree to take on these loans on their books with a threshold of guaranteed interest

- This guaranteed interest will be backed by the FLDG arrangement between the lender (NBFC) and LSP (fintech)

Few NBFCs were renting out their licenses through FLDG. This enabled LSPs to build a proxy portfolio which some industry experts claim to be a risk to the lending system.

Need for RBI Working Group

While FLDG contributed to the industry’s increasing volume, several unregulated entities came into the picture. They exploited customer data and resorted to illicit collection activities. Many borrowers faced serious trouble as they were unaware of the real nature of these entities. An alarming rise in customer complaints resulting from the actions of the unregulated entities placed digital lending on RBI’s radar.

To address and streamline the same, RBI set up a Working Group (WG) to understand the risks and set up necessary controls in the DL industry.

What did the Working Group find out?

On January 13, 2021, RBI set up a WG consisting of thirty-six stakeholders. The purpose was to study the DL industry and its activities in detail and to implement the right regulatory approach.

The WG surveyed and studied the industry and presented a report (containing two annexures) to RBI on November 18, 2021. The report’s findings were based on the following pillars.

- Discussions with the stakeholders

- Survey and data analysis

- Review of extant regulatory / Supervisory framework and industry practices

- Review of global practices and literature

After considering the recommendations, RBI officially announced the implementation of the DL guidelines on September 2, 2022.

DL guidelines implemented

DL guidelines implemented

Annexure – I

The following recommendations were accepted by RBI for immediate implementation.

Customer Protection

- Loan disbursals and payments should be between the borrower’s bank account and the lenders without any third-party pool account involved

- Regulated Entities (REs) should directly pay the fees and charges to the Lending Service Providers (LSPs) instead of charging the borrower directly

- Before the execution of the loan contract, the borrower must be given a standard Key Fact Statement (KFS)

- Contents of KFS – Annual Percentage Rate (APR), Recovery method, Grievance addressal, cooling-off/ look-up period

- Any change in credit limit must require the borrower’s explicit consent

- Borrowers must be given the option of exiting digital loans during the cooling-off period by paying the principal and the applicable APR without any penalty

- All borrower’s complaints should be resolved by a RE and LSPs engaged nodal grievance redressal officer

- The borrower can escalate it to the RBI if the complaint is not resolved within 30 days

Technology and Data

- Data collection should be done with the borrowers’ explicit consent with audit trails

- DLAs should collect only specific data of the borrowers pertaining to Know your Customer (KYC) and onboarding

- Borrowers must be provided with consent to accept, deny, or delete the data collected by the DLAs/LSPs

Legal and Regulatory

- Any lending sourced through DLAs (of the RE or the LSP employed by RE) must be disclosed to Credit Information Companies (CICs) by REs

- If REs are using the FLDG model, they shall adhere to the provisions of the Master Direction – Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021, dated September 24, 2021

WG recommendations accepted in principle

Annexure – II

The following recommendations were accepted in principle but require further examination.

Customer Protection

- Any time a RE or LSP looks at or asks for credit information from a CIC, the borrower will be notified by email or text message

Technology and Data

- Banks will keep an eye on accounts often used from a different or overseas IP address that doesn’t match the account holder’s KYC profile

- Baseline technology standards to be laid down by RBI primarily include secure application logic and an auditable log for every user action

- REs should ensure that the underwriting algorithms are well-researched and auditable enough to point out discrimination factors

- Artificial Intelligence (AI) used by digital lenders should be ethical and focus on protecting customer interests, security, and privacy

Legal and Regulatory Framework

- A Self-Regulatory Organization (SRO) to be set up which will focus on framing a code of conduct for recovery and a model standardized LSP agreement for Balance Sheet Lenders

- While the recommendation concerning FLDG is still under examination, REs must ensure financial products involving third-party compensation for defaulters should comply with the Master Direction – Reserve Bank of India (Securitization of Standard Assets) Directions

Conclusion

The latest guidelines emphasize the importance of protecting borrowers by curbing the misuse of digital lending apps. The REs are given time until November 30, 2022, to develop systems and processes that are compliant with the ruling.

Undoubtedly, fintech-led digital lending will certainly undergo changes. The larger perspective is to protect the customers and the economy from unscrupulous practices and uphold the trust of the banking system.

Reference**: Annexure 1 of RBI press release

Want to know more about digital lending? Write to us at business@m2pfintech.com.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments