by Suja Jude | Jun 30, 2022 | M2P FINTECH

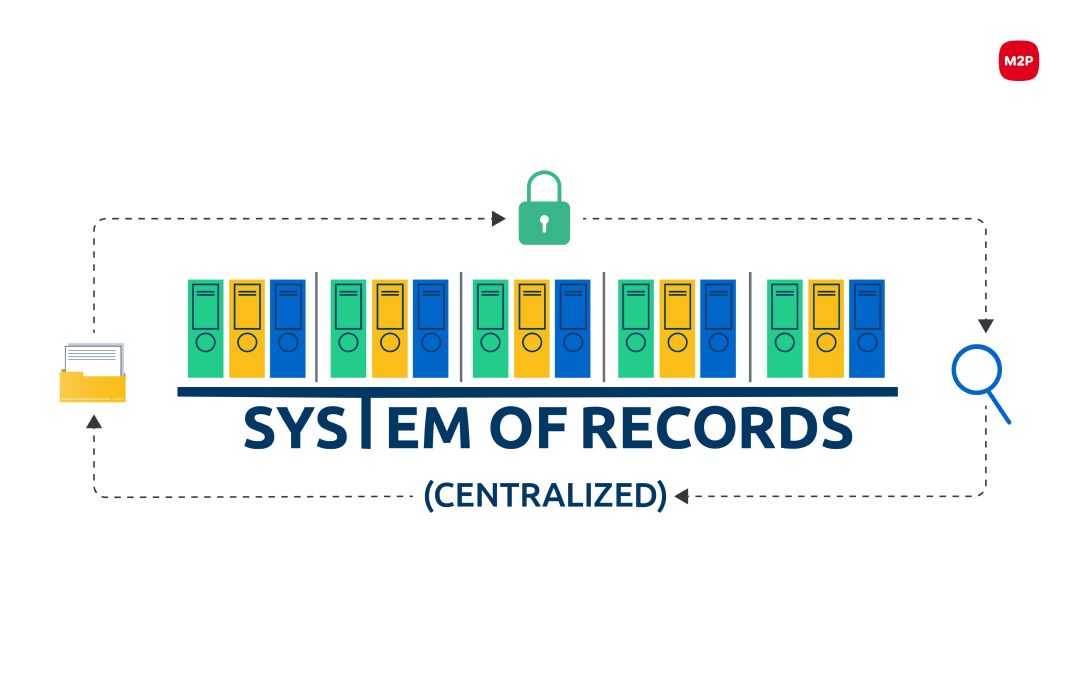

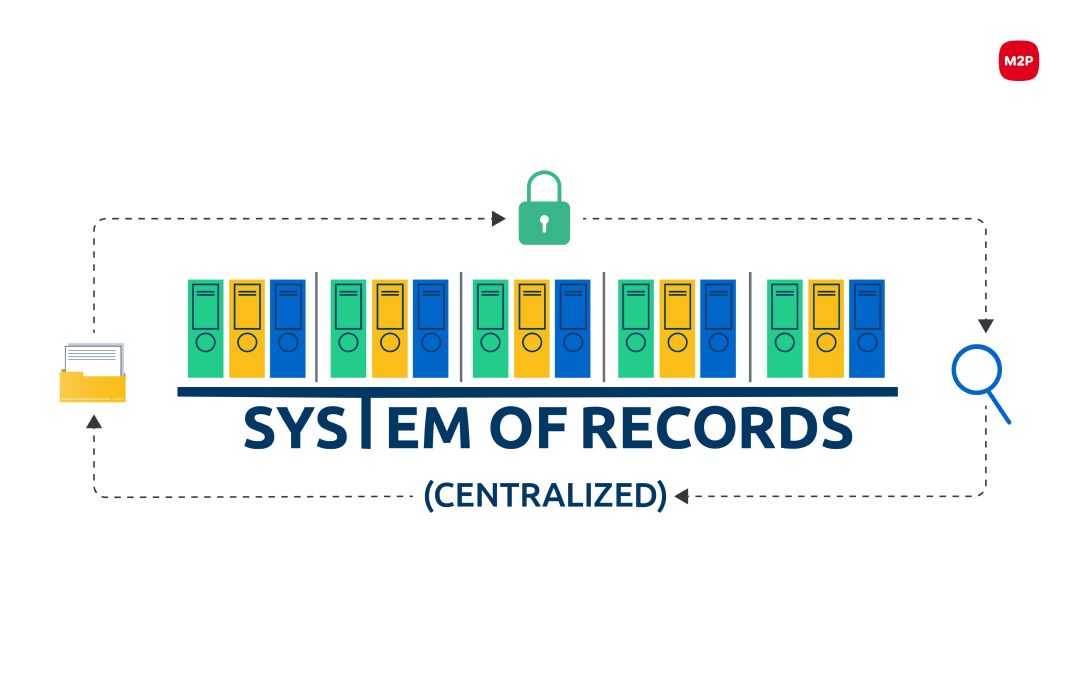

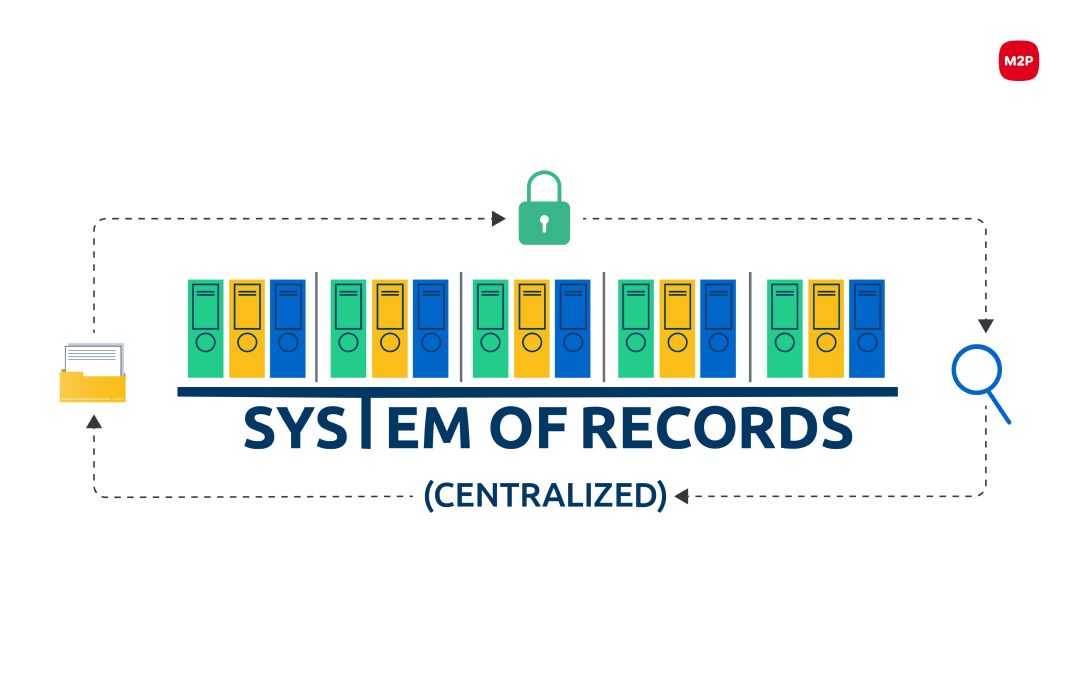

Wallet limit breaches and data duplications are crucial problems for prepaid card issuers. They hold the risk of consumers overriding the loading and spending limit. That’s why RBI mandated that all prepaid programs deploy a centralized System of Records (SOR)...

by Divya Shivaji | May 31, 2022 | M2P FINTECH

Stumped with KYC implementation? You are not alone. Several Financial Institutions (FIs) are working out their way through KYC puzzle to oust financial crimes and ensure compliance. Now, KYC is critical for any financial institution. It is indeed the first step when...

by Divya Shivaji | Sep 13, 2021 | M2P FINTECH

Are you curious to learn the fintech vocabulary? Here are 50 terms we collated for your fintech lingo. 1. 3D Secure 3D Secure is a three-domain (3D) structure connecting the issuer, the acquirer, and the merchant page to prevent fraudulent transactions. It is a...

by Divya Shivaji | Aug 3, 2021 | M2P FINTECH

Know Your Customer/ Know Your Client (KYC) is a mandatory process that verifies and authenticates a customer’s identity. All legal and financial institutions must validate their customers to prevent any illegal or fraudulent activities as per Reserve Bank of India’s...

Recent Comments