M2P Fintech

Fintech is evolving every day. That's why you need our newsletter! Get the latest fintech news, views, insights, directly to your inbox every fortnight for FREE!

Swiping a credit card for purchases has been a standard practice for decades. All we need to do is swipe the card, and the transaction is complete. If it is an E-commerce transaction, entering the card details and other requisite information does the trick. And the time taken to complete this happening is mere seconds. But there are many steps between the card swipe and receipt of the swipe. All those actions are an intricate part of how credit card processing happens on the inside.

Simplifying Wikipedia’s terms: The Credit card is a payment card used by consumers to pay the merchant in exchange for goods or services. It is a promise between the card issuer and the cardholder to abide by a few drafted financial terms & conditions — the cost of the goods + interest rates or late fees.

It is a calculative risk taken by many parties involved in the transaction.

From transferring the funds securely to collecting the payment from the user later, it revolves under a virtual promise. So that the importance of understanding credit card processing is to avoid any mishaps.

Credit Card Processing is the funnel through which the data related to the Consumer Credit Card and purchase are transmitted from their Credit Accounts to Merchant Account. As consumer uses their credit card to buy a product, a virtual process happens swiftly between many financial participants to allow or decline the purchase.

The credit card processing framework is a blueprint that serves as a guide for payments to go in the right direction during the transaction, and when they take a toll, it acts as an investigator.

The credit card processing network actively processes millions of transactions with the help of rigid network infrastructure and various stakeholders behind each network architecture.

Each task is a mini approval request raised and approved in a circular motion by the financial entities involved in the process.

Card Holder: The consumer is the credit cardholder.

Merchant: The owner of the online selling platform or the offline store where the goods or services are placed for the consumers to buy.

Example: Amazon (online store) Costco HyperMarket (offline store)

Payment Processor: These are the companies that communicate and relay information from Consumer’s credit card to both Issuing and Acquiring Bank. All this occurs at lightning speed. Payment processors collect, receive, and accept the payment using a combination of hardware and software advancements. They ensure the security and fraud protection measures in the transactions.

Card Network: Visa, MasterCard are the dominant examples of the card network, followed by American Express and Discover. They are virtual payment infrastructure facilitating the communication between merchant and issuer bank. Along with these international players, we have an India-borne network RuPay, launched by NPCI (National Payment Corporation of India).

American Express and Discover are also issuers in the credit card industry. Discover also owns and operates Discover Bank. In India, Discover-branded credit cards are seen in collaboration with HDFC Bank and Diners Club International.

Issuing Bank: An Issuing Bank (or “Issuer”) is an entity that provides Credit/Debit Cards to customers (VISA, Master, American Express, etc.). It authenticates a customer’s purchase at a store/online site. When a payment is made at a store, funds are transferred from the issuing bank (which authenticates the transaction) to the acquiring bank.

Acquiring Bank: An Acquiring Bank (or “acquirer” or “merchant’s bank”) is an entity that maintains the merchant’s bank account. With the help of the acquiring bank, the merchant can process debit and credit card payments, access payment gateways, and receive payments from transacting customers.

Any eCommerce entity or a brick-and-mortar store can collect online payments only after signing a contract with an acquiring bank. Once the contract is signed, the merchant can receive online payments, and the acquirer takes care of it on behalf of the merchant.

In short, acquirers accept payments while issuers make payments. Also, the Acquirers provide their services to businesses, whereas Issuers offer their services to individuals. Acquirers and Issuers are like two sides of the same coin; though there are subtle differences in how they work, one cannot exist without the other.

Credit card processing, which happens in a fraction of seconds, is a complex process in the background. We have tried demystifying the process in 7 simple steps:

The consumer, who is also the cardholder, confirms the purchase at the POS (Point of Sale) terminal or the checkout webpage of the e-commerce website.

To complete the purchase, the consumer swipes the credit card or submits his card details to begin the payment. The transaction here will follow two flows; if it is a POS transaction, the POS device will read the card information. In the case of e-commerce websites, the consumer enters card details in the payment gateway.

There are multiple levels involved in the card data transmission and the purchase amount.

Encrypted details sent to Payment Processor- The card reader or the payment gateway passes the transaction information in an encrypted format to the payment processor.

Payment Processor to Card Network- The payment processor collects and transmits information to the Credit Card Network.

Card Network to Issuer Bank- The Consumer’s Bank or the Issuing Bank which has issued the Credit Card, receives the information.

The Consumer’s Bank verifies the availability of sufficient funds for the purchase. It also checks the legitimacy of the purchase. Once all these checks are done, it sends an approved or declined message to the Credit Card Network.

Authorization response from the Card Network is sent to the Payment Gateway or the Card reader, displaying the response at the Purchase window. Once the authorization is approved, the merchant can deliver goods to Consumer.

Merchant’s Bank or the Acquiring Bank receives the approved authorizations and credit card payments in a batch from Merchant for settlement. The payments are processed by the Bank on behalf of merchants.

The merchant bank further raises the Credit Card issuing bank request for batch settlement. The issuing bank, in turn, makes a settlement payment to the merchant bank the following day. Once funds are received by the Merchant Bank; certain amount towards interchange fees, acquirer fee, etc. are deducted before depositing the remaining to the merchant’s account. The settlement process typically takes 2–3 Business days.

In case of refunds, payment disputes, or fraud reports, the process begins at the issuer end and then flows to the acquirer. In these cases, too, the issuer will authorize, and the acquirer authenticates. Though the minor details may differ from case to case, the overall process is the same. This activity is also known as the Chargeback process. Here the issuing bank will reverse the transaction in question by withdrawing money from the acquirer and returning it to the cardholder.

The merchant can dispute the chargeback through Representment, where the acquirer must gather evidence on the merchant’s behalf to prove the original transaction validity. The issuer will examine the collected facts and offer an outcome supporting either the merchant or the cardholder.

A credit card processing service handles the data transfer that happens between the card machine and the bank. It processes all kinds of credit card transactions, both offline and online. Also known as Merchant Service Providers, these companies are authorized by card networks such Visa, MasterCard, etc. They help businesses open merchant accounts and manage their daily card transactions for a fee.

The whole operation of credit card settlement and processing is notoriously confusing and complex. Still, it’s made easy for a price, and that is your credit card processing fees. This amount is charged to the merchant based on the payment processor he is using.

Payment processors like the fintech providers who provide the payment infrastructure in the selling platform are the ones that collect this fee. It is then split among the other active players in the credit card processing framework.

Credit card processing fees are broken into

Interchange: The commission fee that goes to the issuer bank, non-negotiable.

Assessments: The commission fee that goes to the card network brand, non-negotiable.

Markup: The commission fee that goes to the payment processor, negotiable.

Payments are sensitive everywhere. Lose a tooth nobody cares but lose a penny in the transaction everybody loses their temperance.

It is essential to place your business into the next generation of the digital world that demands trust, fast, easy, and scalable fintech solutions. Only when your chosen payment processing technology can act as more than an enhancement can one survive the competition.

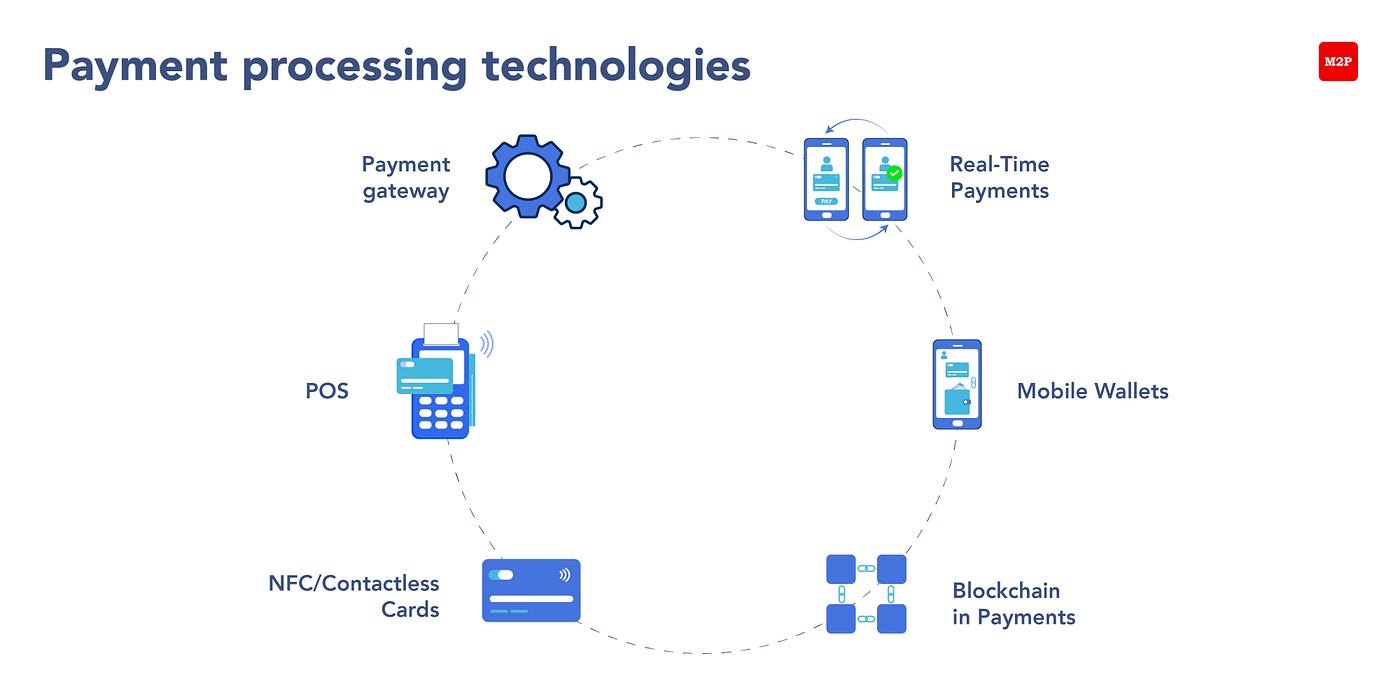

To process a credit card, settle the credit card funds, and secure the payment process, the fintech industry caters to the technology accordingly. Irrespective of online or offline stores, payment processing, needs to happen few seconds to place an active bet in the competition. And here are some of the technologies

Mobile POS terminal (mPOS)- It is a device used at stores for retail card transactions

Payment Gateway- It is the key component of the payment processing system, and it sends the customer information to the acquirer

Real-Time Payments (RTP)- As the name suggests, RTP payments are initiated and settled almost instantly. Ideally, this technology is available 24*7*365

Mobile Wallets- It is a virtual wallet that stores an individual’s card details on a mobile device. They are used to make payments without the need for a physical card.

Blockchain in Payments- It is a promising tech for payment processing. Many companies worldwide are exploring its potential in the same.

NFC/Contactless Cards- NFC is available in smartphone payment gateways. It allows users to store multiple card data on their mobile, thereby reducing the need to carry cash.

I know this is a lot to take in. We wish for an easy backend process, too, with fewer complications involved.

However, that’s a job for us to worry about while you think only of choosing the right credit card processing system. The only thought you should have is about bringing in a suitable payment processor to make your credit card transactions occur in a fraction of seconds for a lower fee.

Want to know more on this? Write to us at business@m2pfintech.com.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.