It’s been 3000 years. Not a single day passes without the usage of money.

Be it physical or digital, the movement of money signifies value and hope to the millions involved. Money transfer operators, banks, and fintechs have played a remarkable role in enabling seamless money transfer in a quick, secure, and convenient manner.

Shift from Cash to Cashless

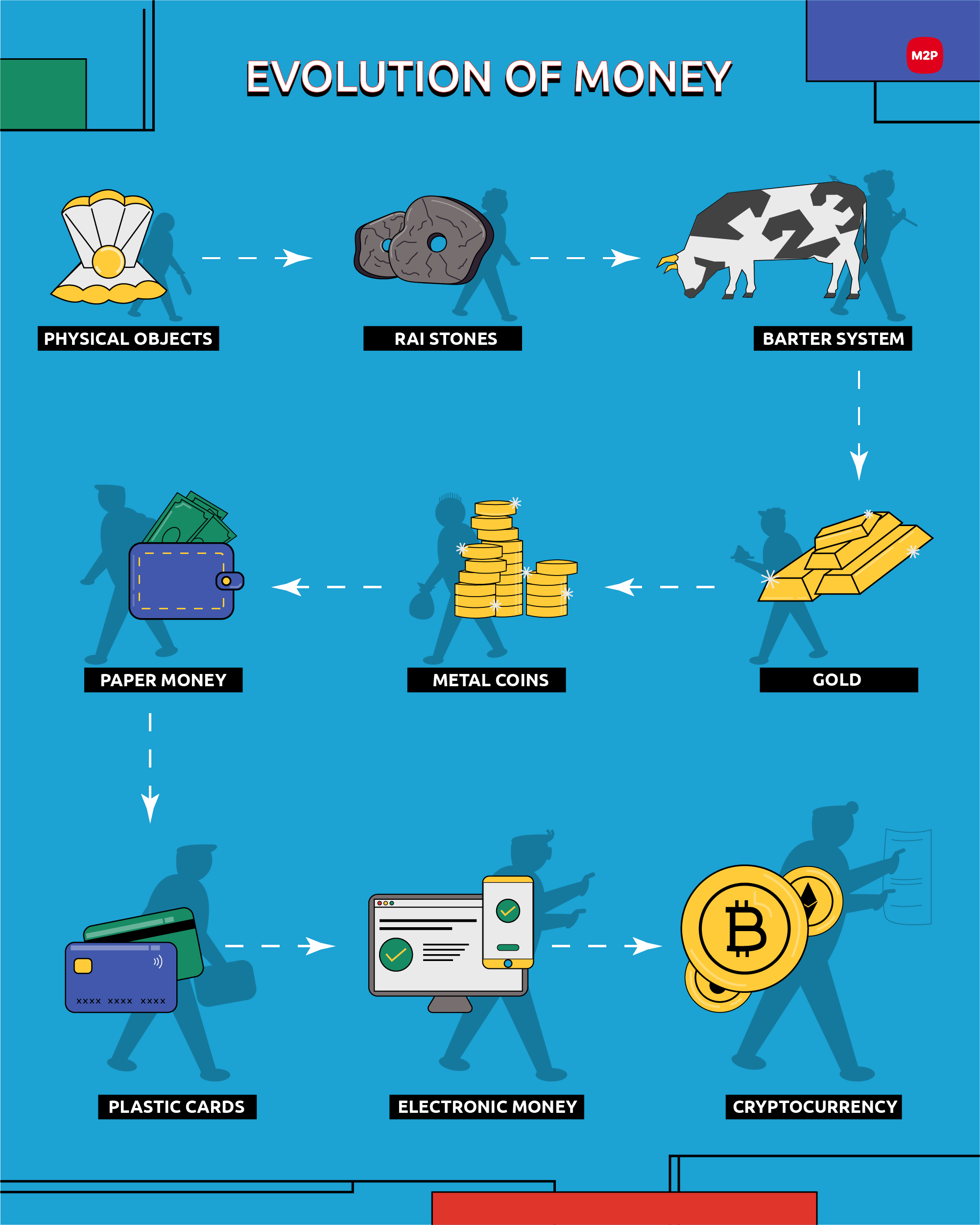

Money was not always fancy as crisp notes and lightweight coins three thousand years ago. It had a humble beginning taking the form of cowrie shells, rail stones, farm produce, and livestock to be used as exchange. Slowly precious metals like gold, silver, and copper were used in trade. Then cash in the form of metal coins and currency notes came into prevalence.

Today, the world has transitioned from cash to a cashless economy. Payment cards, QR codes, contactless modes, cryptocurrencies, and digital currencies are hogging the limelight as they are super convenient, simple, and secure ways of moving money and making payments.

Evolution of Money Transfer

Changes in customer expectations, the need for enhanced experiences, and the growing cyber security issues demanded an evolution in money transfer. Payment apps, digital wallets, wearables, and real-time payment platforms are doing their best in fulfilling this quest by enabling quick, simple, and secure Peer to Peer (P2P) and Peer to Merchant (P2M) transfers and payments.

Curious to know when and how money transfer began?

Here you go.

Hawala

The hawala system is the oldest form of money transfer that dates back to the 8th century. Known as the “money transfer without money movement,” it was actively used in India, the Middle East, and South Asia.

Heavily based on trust between hawala agents, the transfer is usually done without any promissory notes. The hawala agents could be friends, family, or trusted acquaintances who settle debts between parties with cash, property, or services.

Here’s how hawala works.

The sender gets in contact with a hawala dealer A to transfer money to another country. As soon as the money, commission, and beneficiary details are shared, the sender receives a unique secretive code. Then the hawala dealer A contacts dealer B from the recipient country. Dealer B then delivers the amount to the designated receiver after revealing the secretive code. The unique code will reconfirm if the receiver is the right individual or not.

The hawala system is still in use as an alternative to the remittance channels and traditional banking systems.

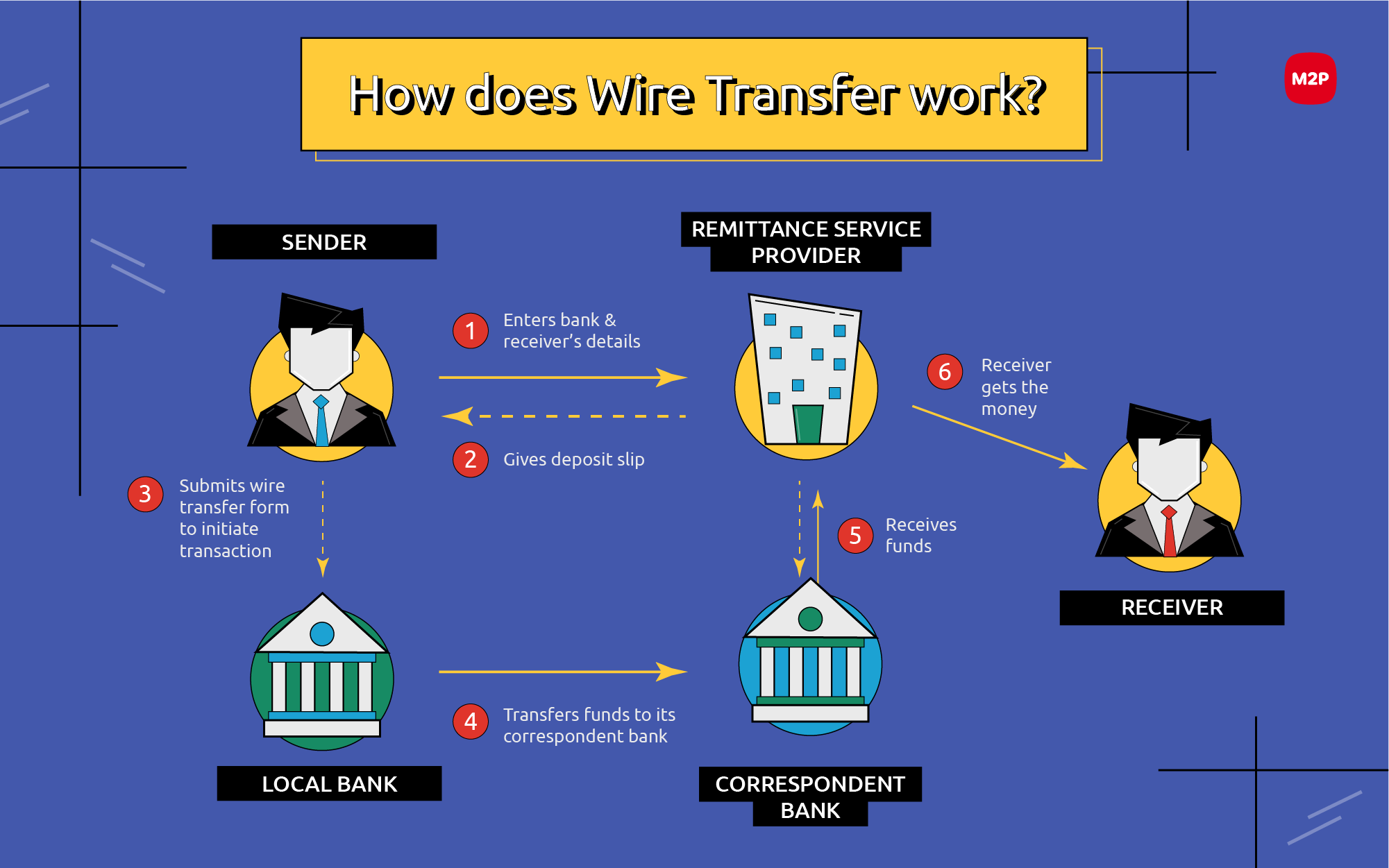

Wire Transfer

Next in line was wire transfer, the electronic mode to transfer money through a global network. It was known for its fast, irreversible, foreign, or domestic electronic money transfers. In the 19th century, Western Union was the first money transfer operator to introduce wire transfers.

Here the sender had to reach out to the office with the money, and the operator would send a message and ‘wire’ those funds to the destined location. Codes and passwords were used between the parties involved to ensure security. Soon wire transfer became an integral part of moving or exchanging money internationally, and it still is.

Payment Cards

Metal money was the first precursor to the present-day cards. It was issued by Western Union in 1914. A few years later, in 1928, the Charga-plate was introduced in the US, which was offered by merchants to their regular customers. They became popular among the department stores, as they could issue cards on their own. These were the first transactional cards in history.

Later in the year 1946, John C. Biggins of Flatbush National Bank of Brooklyn introduced the “Charg-It” card, which allowed people in a two-square-block radius to charge purchases to the bank. Charg-It was an easy way for consumers to use the card at multiple businesses. Merchant however had to leave sales slips with the bank.

Then came the Diners’ Club card in 1950, which was the first real credit card. Called a Charge Card, its cardboard form gained massive popularity and acceptance among users. It charged merchants a 7% fee on every transaction and delivered one monthly bill on dining expenses to the cardholders.

A decade later, the turning point in card transactions happened. Banks introduced ATM machines. After this move, cards were used at ATMs to withdraw cash and make deposits.

In the early 90s, credit card adoption in India was slow. People who travelled to foreign countries were the only ones to use the Diners cards in India in the 1960s. It nearly took 15 years for the Diners card to reach 8,000 registered users in India.

In 1980, the Central bank of India brought in credit cards in association with Visa and Master Card. As a result, debit and credit cards became the dominant source for non-cash payments, which retailers and consumers readily accepted.

SWIFT Transfer

In 1973, SWIFT transfers came into existence. They were typically wire transfers but done via the Society for Worldwide Interbank Financial Telecommunications (SWIFT) network. This global messaging network helped improve the speed, transparency, and consistency of payments. It changed the perception of how the credit system worked and became a globally recognized provider of secure financial messaging.

Growth of Online and Mobile Money Transfers

In the late 90s and early 2000s, electronic deposits, digital remittances, and mobile money transfers became prominent. The following payment systems facilitated money transfers from anywhere, anytime, without any hassles.

Introduced by the National Payments Corporation of India (NPCI) and the RBI in 2015, the Unified Payment Interface (UPI) is an easy way to transfer money in real-time from one bank to another. Here, the UPI ID acts as the virtual payment address, and UPI PIN is the security password to authenticate the transaction. These are only two things required to transfer money. UPI eliminates the need to enter complex bank account details to initiate a money transfer.

- IMPS

Immediate Payment Service is an instant fund transfer service and can be simply defined as NEFT+RTGS. It ensures real-time interbank funds transfer in the Indian banking system provided by banks. The cap on transaction limit is set very low to avoid fraudulent complaints. In order to make an IMPS transfer, you just need to know the destination account holder’s IMPS id (MMID) and their mobile number.

- RTGS

The ‘Systemically Important Payment System,’ Real Time Gross Settlement (RTGS) System was introduced in 2004. It is a secure electronic fund transfer system that provides real-time online settlements for bank transactions across the country.

- NEFT

National Electronic Fund Transfer (NEFT) was introduced in 2005 and soon became one of India’s prominent electronic fund transfer systems. It is the most secure way of transferring funds from one bank account to another. Here, the funds are transferred using the Reserve Bank of India’s NEFT infrastructure, which is a nationwide payment system facilitating safe and secure transactions all over the country.

Now, this is not all. There are several other money transfer modes that involve virtual and cryptocurrencies. We’ll cover them in subsequent articles.

Feel we’ve missed out on something. Let us know in the comments below.

The road ahead

Newer technologies and API-based tech stacks are paving the way for quicker, robust, hassle-free money transfer processes. Banks and money transfer operators leverage fintech partnerships to enable great remittance experience, cut costs, and manage backend integrations and tech infrastructure. Robust security verifications and risk management systems promise a secure, real-time flow of money across borders.

Want to know more about digital money transfers? Write to us at business@m2pfintech.com

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments