M2P Fintech

Fintech is evolving every day. That's why you need our newsletter! Get the latest fintech news, views, insights, directly to your inbox every fortnight for FREE!

Are we heading towards a cashocalypse?

Is it the end of times for physical banknotes and coins?

The answer is a big YES and NO!

Yes, because cashless is the new normal today. As the e-commerce industry booms and the pandemic fear looms, several countries worldwide have embraced digitized payments as the new way to go.

And no, because the era of cash is not catastrophically drawing to a close. Money is just evolving to take a progressive digitized structure in the form of e-money, central bank digital currencies, cryptocurrencies, cards, e-wallets, and much more.

Over the past decade, the proliferation of online commerce, fintech, and digital payments has plummeted cash’s share in global payments. According to the 2020 McKinsey Global Payments Report, the percentage of cash payments dropped from an average of 95.7% in 2010 to 77.9% in 2020 in select emerging markets. And in mature markets, the average cash payments fell further from 58.9% in 2010 to just 28.1% in 2020.

Today economies wage a strategic war on cash to create cashless societies that prefer transacting without corporal money. The safety, speed, convenience, and seamlessness of virtual payment instruments make them a potent enabler for cashless societies worldwide.

In layman’s terms, a cashless society is an economic (r)evolution where transactions take place without physical currency notes and coins. People, banks, and businesses prefer cash-free payment modes over hard cash.

Is nostalgia tickling your brain somewhere?

Yeah, the word ‘cashless’ may ring a bell for baby boomers who’ve heard their parents or grandparents converse about the barter system, a system of exchange transaction where cash was not involved.

But hey! Clear your head now.

Modern cashless transactions do not involve barter exchanges. You need to pay for your purchases, money transfers, and other transactions using digital money, credit cards, debit cards, prepaid cards, cryptocurrencies, contactless technology, or mobile wallets.

Money and payments have evolved significantly over 1000 years of human history, from barter to cash and now digitized cashless methods.

Now let’s dive into important types of cashless payments.

Cashless payments power cashless societies. They are the lifeblood of cashless economies.

Without regulated digital payment modes, any cashless society would turn chaotic and crime-ridden in no time. So let’s check out some non-cash payment methods that are in vogue today.

Cheques and Demand Drafts (DDs) are some of the earliest cashless payment options banks provided. They facilitate salary disbursements, utility payments, foreign exchange, and money transfers, and function as travelers’ cheques, public assistance vouchers, guarantee instruments, and postal orders.

Though the clearance process is automated, the inherent weakness in signature authentication and the inability to stop payment at will, make them vulnerable to forgery, embezzlement, and identity theft. Federal banks worldwide are introducing reforms for high-value cheques to help counter security issues.

Did you know?

Over 36% of global online shoppers prefer paying via prepaid cards(digital wallets), 32% through credit cards, and 21% using debit cards. (Worldpay Global Payments Report).

Standing tall in the cashless payment arena is the universe of cards. Depending on the issuing authority, features, and usage, you can classify them into credit cards, debit cards, charge cards, virtual cards, and prepaid cards. They can be used for POS purchases, ATM transactions, cross-border payments, remittances, and foreign exchange.

Even though card usage is rampant across the globe, a few countries love their card payments a little more than the others.

When confronted with unexpected purchases, nothing can come to your rescue quicker than your good old credit cards. They enable instant cashless payments with fantastic reward points, cashback options, and flying miles.

Issued by banks, credit unions, and NBFCs, credit cards are payment cards that provide short-term financing that is linked to the cardholder’s credit rating and limit. The user can pay for purchases, payments and even avail cash withdrawals within the allocated credit limit. But credit cards could attract exorbitant interests and charges if the repayments are not made on time.

Currently, there are 2.8 billion credit cards worldwide. And the global credit card market is expected to grow at 11% CAGR from $100.05 billion in 2020 to reach $107.69 billion in 2025. Citibank, American Express, Mastercard, Visa, JPMorgan Chase, Mango Financial, BBVA Compass Bancshares, Total System Services, PNC Financial Services, and Capital One Financial are major players in the credit card market.

Also called bank cards or check cards, debit cards offer a safe payment option that will not land you in debt. Usually linked to the cardholder’s bank account, debit cards help you make cashless purchases and ATM withdrawals. But you cannot enjoy as many rewards as credit cards. And there are no interests or charges levied like in credit cards. But you may have to pay an ATM transaction fee if you withdraw cash from unaffiliated teller machines or overdraft fees if you opt for overdraft protection.

The global debit card market is expected to grow from $91.37 billion in 2020 to $97.92 billion in 2025 at 1% CAGR. Capital One Financial, American Express, Visa, MasterCard, Citigroup, PayPal, Bank of America, JPMorgan Chase, PayU, and State Bank of India are major players in the global debit card market.

Virtual cards are nothing but credit and debit cards in digital format. They can be kept in smartphones or other smart devices to be used for online purchases. Its 16 digit card number and user credentials are autogenerated through tokenization , and the cards have built-in controls for single-use or multi-purpose credit and transactions. Over 80% of virtual card use cases are in the B2B segment and 20% in consumer spending.

Slated to exceed $5 trillion by 2025 and generate $14 billion in revenue for card providers by 2022, these cards are highly secure with great anti-fraud features. They also enable businesses to control overspending with greater transaction visibility. As you can create a unique virtual card for every transaction, there is no scope for exceeding credit limit, unpaid bills, and you can effortlessly cancel or delete virtual cards on demand.

Even though so many cashless card payment modes are available, nothing can break the simple charm of prepaid cards. Expected to touch $4.1 trillion by 2027, the prepaid cards market is a mighty force to reckon with.

These prepaid payment instruments need not be linked with bank accounts or credit lines, and their underlying digital wallets are super safe, economical, and dependable for retail and corporate usage. Prepaid cards can be used across applications to manage payroll, gifting, healthcare, insurance payments, travel, transit, student expenses, and even benefits such as govt grants and assistance. Banks, businesses, and fintechs issue these stored value cards to grow and sustain themselves in this age.

Today mobile phones permeate every aspect of our living, and payments via mobile wallets are inevitable. Valued at $1 billion in 2019, the mobile wallet market is expected to reach $7 billion by 2027.

As underbanked markets such as Africa, Asia, and Latin America have high mobile money penetration, mobile wallet payments thrive in these regions. Increased mobile usage, P2P payments, and government initiatives have fueled the growth of the mobile wallet market. The payment processing models that mobile wallets use include mobile billing, SMS-based transactions, mobile web payments, and Near-Field Communications (NFC), among others. M-Pesa, MTN, Orange, Ali Pay, WeChat, Daviplata, Tigo Money, Google Pay, Apple Pay, and Samsung Pay are leading players in the mobile wallets space.

Contactless is another crucial channel that enables cashless payments in retail stores and door deliveries. To make contactless payments, the consumer needs to swish or wave the credit card, debit card, key fob, EMV card, or device near the card reader in the POS terminal. Unlike other types of digital payment, this mode requires the payer and the payee to be in close proximity to complete the transaction. This is because contactless payments do not use wi-fi or a broad area cellular network. Instead, it requires radio-frequency identification (RFID) or near field communication (NFC) that can cover only short distances.

Devices or systems installed at the Point of Sale (POS) to access and process cashless payments are called POS terminals. They can be physical, virtual, or mobile according to the checkout options. AI-enabled POS systems are indispensable as they can understand customer preference in addition to helping prepare invoices, track inventory, manage customer profiles, and record sales data. The AI-led POS terminal market value is expected to reach $10.9 bn by 2026.

Mobile POS terminals are the most popular cashless payment modes as a high investment is not required from the business owners. It is easily accessible on smartphones, tabs, and other wearables. Over 1,490.5 million people make payments using mobile POS payments as of 2021.

Check out our article on the future of payments processing to know more about other major cashless payments methods.

A cashless society benefits not just consumers but businesses and economies as well. Digital payments in a cashless society expedite customer checkouts, lowers costs, delivers better payment security protection, and simplifies deployment and compliance with anti-financial crime regulations.

Augmenting non-cash payment options into checkout ecosystems is critical for businesses looking to expand globally and thrive in the age of cross-border e-commerce.

Here are key benefits you can enjoy from cashless societies.

Did you know that 97% of consumers will not buy a product if the checkout process is inconvenient?

Yes, convenience is a top priority for consumers worldwide. Cashless payments offer ultimate convenience by facilitating quick, seamless, and secure digital payments anywhere, anytime. You need not go searching for a bank or ATM to withdraw money before purchasing. All you need is a card or mobile wallet to expedite checkouts in online and in-store setups. In addition, tracking your spending and aligning with your budget becomes a breeze when you pay digitally.

In a cashless economy, all monetary assets are digitized and accounted for. This will reduce not just high-ticket financial crimes such as money laundering, counterfeit currency circulation, black money hoarding, and tax evasion, but also thefts and burglary, as there is no physical cash left to steal. As these financial crimes reduce, so will corruption in the long run. Also, you and your employees can pay for business expenses and even travel without worrying about the safety of carrying stashes of cash anywhere.

Even if credit cards or smart devices are stolen, or data breaches or unauthorized transactions are done, the service provider will provide you proper coverage and protection. Law enforcement officials can easily track illicit digital transactions to chase and bring criminals to justice.

Cashless payments mitigate the risk of employee embezzlement and overspending, and counterfeit circulation. Businesses can also save on the cost and risk involved with cash withdrawal, counting, and transportation.

In a cashless society, the transactions and payments will be straightforward. Businesses will fund their employee expenses or pay vendors directly. Government subsidies and grants will promptly reach the needy through prepaid cards or other authorized payment instruments. There will be no need for middlemen or agents who guzzle benefits from the funnel.

The cashless economy will serve as an equalizer enabling equal payment ecosystem access to the people across demographics. Underbanked and unbanked people from the remotest corners can trade and transact without worrying about foreign exchange or banking procedures. Just a mobile phone with an internet connection will suffice for domestic and cross-border payments.

As digital transactions are super-fast and error-free, businesses can deliver quick and outstanding checkout experiences to customers. Businesses can enjoy increased customer satisfaction and revenue and lesser cart abandonments.

International payments will be super easy in a cashless world. There is absolutely no need to haggle and buy foreign currency at competitive rates from exchange houses or forex peddlers. When you make international business payments using cards or any cashless mode, the currency exchange happens in the backend, and you can enjoy seamless cross-border payments.

Collecting and tracking real-time economic data is simple in a cashless society. Governments and regulatory authorities need not spend a bomb to conduct surveys to track data. Money movement can be monitored on a real-time basis to derive insights and make data-driven decisions.

Becoming 100% cashless is a utopian dream for many. Though several countries have kickstarted their cashless initiatives long ago, the pandemic accelerated the journey by triggering a deluge in cashless payment adoption. Governments and regulatory authorities worldwide are also making gargantuan moves by liberalizing economies and encouraging digital payment methods.

The graph below tracks the rise of cashless payments from 2013, well projected to 2023.

Each country journeys on a unique trail towards creating a cashless society.

Let’s take a quick look into some of them.

Over 79% of the Indian population is in love with the concept of digital payments. And they are raring to go cashless!

The government has implemented several initiatives to make the digital India dream a reality. Starting from the 2016 demonetization, steady measures have been taken to enrich the cashless ecosystem through liberalization and incentivization of United Payments Interface (UPI), Bharat Interface for Money (BHIM ), Unstructured Supplementary Service Data (USSD), Prepaid Payment Instruments (PPIs), and digital wallets. Further, e-RUPI, Aadhar enabled Payment Systems (AEPS), NCMC mobility cards, BharatQR code, FASTag, and several other convenient digital payment solutions are driven by the government to encourage the adoption of a cashless society in India.

And the icing on the cake is the sizzling fintech ecosystem in India which serves as the bastion for fintech firms offering innovative cashless solutions worldwide. Born in India, fintech companies like M2P deliver financial inclusion, ensuring no business, bank, or financial institution lags in the evolving global cashless society.

Like every other game-changing Chinese invention, the cashless society in China is pioneering too. Even while the pandemic drove safe digital payments, china became a forerunner in launching the Central Bank Digital Currency (CBDC) digital Yuan (RMB) and facial recognition payments, thereby accelerating contactless transaction and card usage.

With over 46% of the Chinese opting for the cashless society concept, around 60% of China’s 1.3 billion population is expected to use mobile payments by 2023. The government and regulatory authorities are taking serious initiatives to ensure financial inclusion among rural and non-tech savvy Chinese.

With 56% of the population opting for a cashless society in Singapore, the nation is making strides in digital payments. A robust POS infrastructure, complemented by a QR code payment system, is preferred as a safe payment mode here. With over 44 POS terminals per 1,000 individuals, Singapore holds the record for the highest number of POS terminals in the Asia-Pacific region.

The Productivity Solution Grant (70% to 80% subsidy for POS installation), the launch of the unified Singapore Quick Response Code (SGQR), and Hawkers Go Digital Program are significant initiatives to drive financial inclusion and cashless society in Singapore.

With 2/5th of consumers using digital wallets, Malaysia holds 1st place in e-wallet adoption in the Southeast Asian region. Over 69% of Malaysians are supportive of the concept of a cashless society in Malaysia. Hence going cash-free will not be a far-fetched dream.

The Malaysian business ecosystem has 98.5% SMEs and MSMEs. Therefore, it is well poised to modernize the payments landscape by encouraging more credit and debit card payments, mobile wallet usage, and other e-payment modes.

Ewallet payments thus far have registered a 4X increase in revenue, a 6X rise in new user addition, and a steady 20% increase in month-on-month digital transactions. Several initiatives are taken by the government and regulatory authority to drive financial inclusion and cashless transactions. In fact, to encourage digital payments, the Malaysian government offered an award payment of RM30 (about $7.37) to every citizen above 18 years under its e-Tunai Rakyat (people’s e-cash) program.

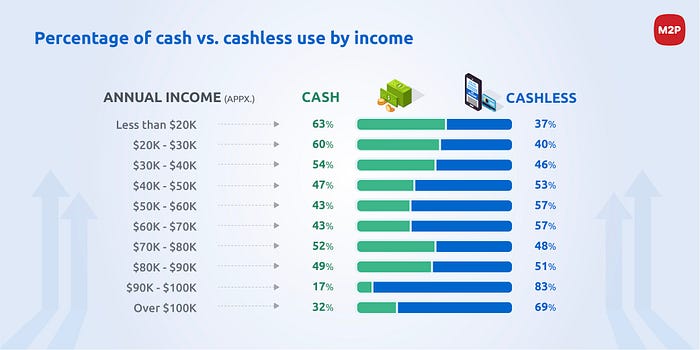

Though traditionally a cash-loving society, Japan is not a laggard in embracing digital payments via credit cards, contactless, and e-money. Over 64.5% of consumers use cashless payments both online and offline. And 54% of them claim they like going cashless as it earns them redeemable points. Here’s interesting research that correlates Japanese consumer income with cash-based and cashless transactions.

When it comes to Asia, South Korea is a forerunner in cashless payment adoption. With 50% of bank branches no longer accepting cash deposits or withdrawals, only 14% of payments are cash-based. With 100% smartphone usage and the e-commerce boom, mobile wallets and contactless payments are gaining much traction.

With 49% unbanked population, Indonesians make just 13% cash-based payments. The rest are usually card-based payments. The value of digital transactions grew at 38.62%, from $10.07 billion in 2019 to $13.95 billion in 2020. The increasing financial literacy and acceptance of e-commerce and fintech will drive the cashless society in Indonesia.

Geared to become fully cashless by 2025, the Philippines is making headways in building a trust-based digital system for payments. The Filipino central bank reports a 5000% surge in digital payments in 2020 due to contactless QR payments and e-money wallets. The government has taken several initiatives to capitalize on the swell and create a cashless society in the Philippines.

Other South East Asian countries like Vietnam, Thailand, Taiwan, Hong Kong are embracing digital payments and are making advances towards orchestrating cashless societies.

A leading fintech hub in the MENA region, the UAE ranks 8th among cashless societies worldwide. With over 63% of the population optimistic about adopting a cashless society in the UAE, this nation is most likely to become the 1st cashless country in the MENA region.

The shift from cash began between 2006 to 2011, when debit card usage grew in the country. Today over 83% of the UAE people use debit cards. Gradually macroeconomic barriers were taken down by the UAE government and the regulators to drive digital payments. Initiatives like the Wage Protection System (WPS), innovative e-wallet plans, microcredit pushes like Buy Now, Pay Later, and the Covid pandemic provided further impetus to the cashless drive in the UAE.

It’s not just the UAE, countries like Bahrain, Qatar, Oman, Kuwait, and Saudi Arabia are making strides to ride big on the cashless bandwagon.

Home to 57% unbanked populace where over 95 million people do not have access to bank accounts or income sources, Africa is a gold mine for financial inclusion enthusiasts supporting cashless societies.

Wonder why?

It’s because the mobile phone and internet penetration rate in Africa is very high. Smartphone sales in Africa alone constitutes 6.6% of the global market. Neobanks and challenger banks help residents with digital payments, lending, and banking solutions. In Sub-Saharan Africa, the mobile money transaction volumes grew by 23% to $490 billion last year, which was greater than the Nigerian GDP, the largest economy in the region.

Now let’s check out few budding cashless societies in Africa.

With 16.3 million mobile wallets and 81 million wallet-based e-transactions recorded in the first half of 2021, Egypt embraces the cashless way of transacting beautifully. The Egyptian government aims to develop the New Administrative Capital in East Cairo as the world’s first cashless city and a regional hub for e-commerce and fintech.

With a 71% unbanked population and 62% avid internet users, Morocco holds a conducive environment for a financially inclusive cashless society. Accordingly, the government is taking significant measures to boost mobile and contactless payments in Morocco.

With a modernized digital payments infrastructure, South Africa is well poised to become a cashless society. The government and regulatory bodies are streamlining their CBDCs, e-money/ mobile money, remittance-receiving infrastructure, and cross-border payments to enable secure digitization as much as possible.

With countries like Kenya, Tanzania, Uganda, Rwanda, Côte d’Ivoire, Egypt, Nigeria, and Zimbabwe leading the cashless marathon in Africa, the creation of cashless societies is not far behind.

Europe is quickly progressing towards becoming a cashless continent, with Finland, Sweden, UK, Spain, Germany, The Netherlands, Poland, and Italy in the lead. The European Payments Initiative (EPI) serves as an enabling force by facilitating a unified payment solution for the European Union (EU) countries (the UK is not part of the EU as of 31 December 2020).

Let’s explore the rise of cashless societies in Europe, starting with the UK.

5 in 6 payments involve no physical cash in the UK today. Since 2010, there has been a gradual decline in cash transactions by 70%. And the pandemic further accelerated the idea of a cashless society in the UK.

The number of people who used no cash or coin for payments rose from 2.9 million in 2016 to 13.7 million in 2020. Cash transactions fell by 35% in 2020 alone, as several businesses like Ikea, Brew Dog, Itsu, etc., refused to accept cash due to contagion transmission fears. Most of the transactions in the UK today are through cards, contactless and mobile payments.

According to the Paragon Bank stats, 71% of Brits feel that they are progressing towards a cashless society. However, the UK Government feels the need to protect the future of cash by taking initiatives to assure free access of coins and notes to non-tech-savvy people.

In 1661, Sweden was the first nation in Europe to embrace the concept of currency notes. And now, 362 years later, Sweden aims to be the world’s first cashless economy in 2023. That’s quite a phenomenal stride.

Sweden has given wings to its digital dreams by doing everything it needs to become 100% cashless by 2023. Today over 99% of the Swedish population have mobile coverage, and only 9% of transactions are cash-based. Almost all purchases are made through Chip and PIN debit/credit cards, contactless technology, and mobile payments. So, becoming cashless in a couple of years will not be an arduous task for Sweden.

Recognized as the happiest country in the world, Finland is sailing smoothly to become cashless by 2023. Even in 2019, only 20% of Finnish payments were cash-based. Its all-encompassing welfare benefits, liberal taxation, wealth distribution, non-existent corruption levels, vibrant democracy, and flourishing health care have positioned Finland as the best place to go cashless.

Being part of the high-trust Nordic society, Finns are more open to using non-cash payment modes such as credit cards and online wallets.

Denmark is among the first progressive countries to lift all Covid curbs. The Danes have been open to the concept of a cashless society in Denmark, even as early as 2015. The Denmark national bank ceased printing currency notes and outsourced the task to a French supplier.

Today the Danish government encourages online and in-store businesses to accept credit cards, mobile payments, contactless payments, and peer-to-peer payments. A Nationalbanken report suggests that only 17% of all supermarket payments were cash-based in mid-April 2020, which was a rapid dip from 28% in the pre-covid 2020. However, Denmark is also considerate of the non-tech-savvy population who need some time, training, and space to adapt to the concept of a cashless society.

With 3% to 4% physical currency-based transactions, Norway records the lowest level of cash transactions in the world. With contactless and PIN-less payments dominating the market, 3 out of 4 card payments are contactless payments. And several initiatives are underway to launch the central bank digital currency in the next couple of years.

Equipped with a rich fintech ecosystem, the Nordic countries are well placed to embrace a cashless society very soon.

Russia has made several strides in recent years when it comes to cashless payments. In the first quarter of 2021 alone, non-cash payments hit an all-time high, surging up to 59.4%. And the Russian Central Bank vows to further boost non-cash transactions to 75% by 2023.

71% of Russians believe credit cards and debit cards are the safest cashless payment modes, while 48% rely on mobile payments, and 21% on smart watch-based payments.

While it is a well-known fact that the French love their physical currencies and notes, the cashless trend is catching up in France too. There is a steady increase in digitized transactions.

80% of Polish consumers say they are most likely to purchase only from retailers who offer contactless payment services. And 70% of them have already gone completely cashless since 2020.

With digitally enthusiastic citizens taking the lead, Poland is taking the highway to become an early adopter of the cashless society concept in Europe. The Polish government has taken several innovative initiatives to boost digitized transactions. Increasing contactless spending limits is sure to have an accelerating effect on the development of a cashless society in Poland.

Comprising a contrasting mix of demographics, North America and South America is a fascinating financial ecosystem to explore.

With 83% of the population owning a credit card, Canada is the most cashless country globally. With the highest contactless payment limit in the world at C$250, Canadians expect their nation to be the first cashless country in the world. Consumers and businesses prefer contactless mobile payments, P2P transfers, and card payments for frictionless, secure transactions.

Over 47% of American consumers opine that they would not shop at a store that does not offer contactless payments. Tap and Pay transactions, QR code payments, mobile wallets, and cards are the most prominent digital payment modes in the US.

However, as custodian of the world’s most used currency, the US Federal Reserve looks to move cautiously when it comes to going cashless. Traditional banking structures, hesitant CBDC entry, and uneven socioeconomic dynamics may delay the implementation of a cashless society in America.

According to the Reserve Bank of Australia, cash today constitutes less than 25% of payments in Australia. And in 2024, it is expected to nosedive to 2% of total transactions. With digital wallets overtaking contactless card payments by 90% for day-to-day expenses such as groceries, transport, fuel, etc., consumers are racing towards a cashless society in Australia.

Maintaining an optimal mix of digital payment modes will enable the efficient sustenance of this high-gear shift toward a digitized economy.

Now, this is a billion-dollar question.

When everybody goes cashless, how do you facilitate digital payments for your customers?

This is where you need fintech enablers and accelerators like M2P, who specialize in building digital financial ecosystems for omnichannel commerce.

We help banks, businesses, and other financial institutions capitalize on the cashless revolution by migrating traditional legacy systems to high-tech infrastructure. We expedite card issuance, program management, and digital banking solutions along with debit and credit card payments and digital/mobile wallet payments. In addition, our microcredit aggregator service helps businesses facilitate instant consumer lending (Buy Now, Pay later) that boosts top-line and bottom-line growth. Our modular APIs and solutions are compliant and customizable with unprecedented speed and efficiency.

Eager to know more? Or want to kickstart your fintech journey?

Get in touch with us at business@m2pfintech.com

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.