The international prepaid cards market is set to reach a whopping $ 4.1 trillion by 2027, at 10.7% CAGR from 2020. And the Indian prepaid cards market, in particular, is expected to grow by an enormous 35.2% CAGR from 2021 to 2026.

Wonder why the growth projections are massive for prepaid cards?

You can owe it all to the immense benefits that prepaid cards offer to consumers and businesses alike. Prepaid cards are one of the most cost-efficient, safe and convenient digital payment modes in the market today. Moreover, the demonetization and Covid-19 pandemic accelerated prepaid card adoption by ushering in the need for secure and cashless digital payments.

New to the world of prepaid cards? Here’s our 101, where we guide you through the basics of prepaid cards and how you can benefit from their immense potential.

What are prepaid cards?

Also known as stored-value cards, prepaid cards are the perfect alternative to carrying cash around. They can take the form of a physical or virtual card with an underlying digital wallet that is not linked to your bank account.

Government entities, banks, and businesses use prepaid cards extensively to cut costs, reach more beneficiaries/customers, increase revenue and enhance loyalty and lifetime value. In addition, prepaid cards foster financial inclusion by enabling monetary disbursements and economic access to the unbanked and underbanked populace.

The card issuer can set the spending limit and load money accordingly in the associated wallet. The cardholder is free to spend the loaded amount under the direct control of the issuer.

Classification of prepaid cards

All prepaid cards fall under the broad classifications listed below

1. Open-Loop Prepaid Card

2. Closed-Loop Prepaid Card

3. Reloadable Prepaid Card

4. Non-Reloadable Prepaid Card

Open-Loop Prepaid Card

The open-loop prepaid cards are the most popular payment instruments that can be used anywhere, anytime. Also known as network branded cards, the open-loop prepaid cards come with card network logos (such as Visa) embedded on them. They are reloadable and can be used at any online and offline store approved by the bank or card network printed on the card.

Closed-Loop Prepaid Card

Usually designated for single store use, the closed-loop prepaid cards can be in the form of gift cards or transit cards. The closed-loop cards do not have any network logo on them. Depending on the issuer and usage, they may fall under the reloadable or non-reloadable category.

Reloadable Prepaid Card

Prepaid cards that can be reloaded with money online are reloadable prepaid cards. The card issuer or cardholder can reload most prepaid cards such as payroll, travel, and student cards.

Non-reloadable Prepaid Card

In the non-reloadable prepaid cards, the value is fixed. The cardholders cannot reload money for further use. A good example is a gift card that can be used for purchase and discarded when the amount is exhausted.

But where and when did it all start? Let’s check out the history of prepaid cards now.

History of prepaid cards

Have you noticed how sci-fi novels and movies have been accurate in predicting inventions much before their times?

It is no different in the case of transactional cards.

The first mention of transactional cards dates back to the good old 1890s. Edward Bellamy mentioned credit cards over eleven times in his novel ‘Looking Backward’ as a tool to use government dividends. In the real world, charga-plates from 1928 laid the foundation for modern-day prepaid cards.

Though not prepaid cards per se, these were the closest ancestors to prepaid cards.

Prepaid cards came into existence in the 1970s as paper gift cards/certificates in the USA. After the ’90s, Europe, Asia and Australia joined the prepaid card bandwagon, thanks to the efforts of VISA and MasterCard.

Evolution of prepaid cards in India

In India, prepaid payment instruments existed way before the introduction of the Payment and Settlement Systems Act 2007. In the early 90s, companies offered simple paper vouchers such as food coupons to their employees and gift certificates to their customers.

Meanwhile, banks and some non-bank entities were also trying their hands at semi-closed prepaid cards as alternative payment systems that required stringent regulatory compliance. Therefore, to ensure orderly development and operations, RBI shared an ‘Approach Paper’ on issuance and operation of ‘prepaid payment instruments in India’ on November 07, 2008.

Based on feedback received from relevant stakeholders, RBI finalized the ‘guidelines for prepaid payment instruments in India’ effective from April 07, 2009 (according to section 18 of the Payment and Settlement Systems Act, 2007). The subsequent launch of Rupay, digital India strategy, demonetization, and pandemic-driven safety concerns contributed a significant impetus to the growth of prepaid cards in India.

As consumer preferences evolve today, safe, green, and touchless payments are preferred over physical modes. Hence businesses are quickly adopting plastic-free virtual cards for internal expense management, purchase and reward disbursement. Employees can create their own virtual cards instantly to make online purchases. The prepaid virtual cards can be embedded into the Buy Now, Pay Later (BNPL) space and Internet of Things (IoT) payments to make contactless in-store transactions, send money, recharge mobiles, and pay bills.

What is the difference between prepaid card and debit card?

Prepaid cards and debit cards may feel similar in terms of acceptance and credit free usability. But there is a huge difference that makes consumers and businesses prefer prepaid cards over debit cards.

Debit cards are linked to your bank account, which provides the cardholder access to all the money in your account. On the other hand, prepaid cards give users limited access to only the amount loaded on the card. Unlike debit cards, you can control and manage prepaid card usage through just-in-time funding and dynamic spend control.

Some prepaid cards come with multicurrency wallet features that make them ideal for employees on foreign tours. Foreign exchange conversions will be competitive and hassle-free, and businesses can keep a tab on employee spending. There are no monthly fees or minimum balance requirements for prepaid cards, unlike debit cards.

Are prepaid cards safe?

Prepaid cards are much safer than credit cards, debit cards, and cash. They do not bear credit risks or the threat of cash loss or overspending. As prepaid cards come with stringent Payment Card Industry Data Security Standard (PCI-DSS) compliance and fraud control features, you can avoid data breaches and identity theft issues easily.

Even offline, prepaid cards eliminate the risk factors involved in carrying stacks of cash while travelling. In the unfortunate event of card theft or loss, you can immediately contact customer care to block card usage and instantly apply for new card issuance. As prepaid cards are not linked to bank accounts or social security numbers, the incidences of identity breaches and security issues are close to none.

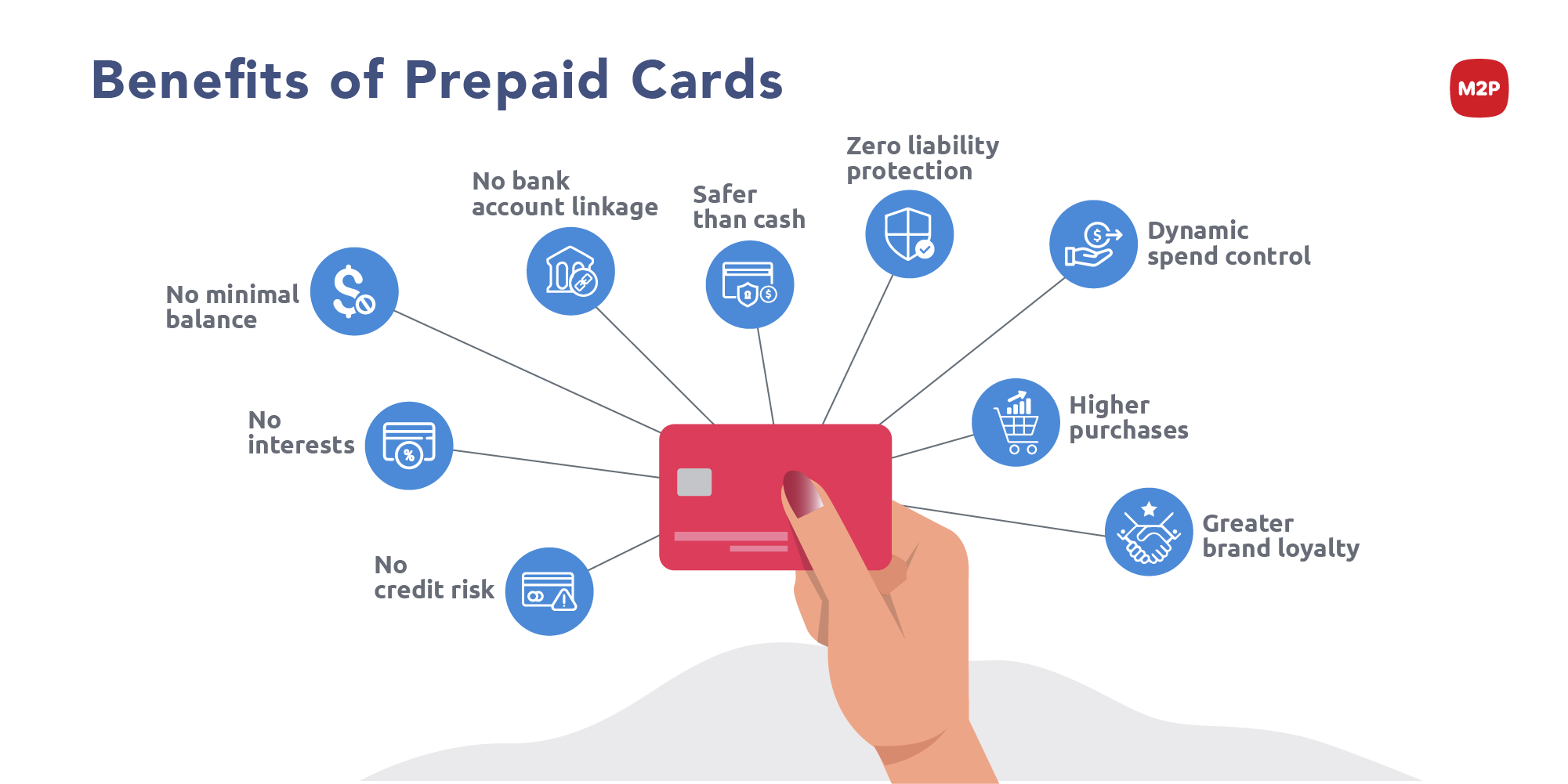

Benefits of prepaid cards

If you want to grow and sustain profitability in today’s age, you need to incorporate prepaid cards into your payment ecosystem. Check out the key benefits you can realize by issuing your prepaid cards.

1. Controls overspending

Corporate credit/ debit cards and cash can tempt employees to overspend while travelling or purchasing supplies. Prepaid cards will help businesses control and track expenses in real-time. You can set the credit limit and load the prepaid card without linking your business bank account.

2. Zero minimal balance, no credit risk

Prepaid cards do not attract interest rates, credits or charges. Some cards also offer zero minimal balance facility. So there is absolutely no risk of running into credits.

3. Safer than cash

Prepaid cards are way safer than cash. When your employee loses the cash you provided for a business purchase or bill payment, the money is lost forever. But if the prepaid card is lost, you can block it immediately and apply for a new card.

4. Zero liability protection

This is an excellent security feature that lets you rest assured that you won’t be charged or held responsible for unauthorized transactions.

5. Drives purchases and customer loyalty

Prepaid cards can expedite customer/employee loyalty by taking the form of loyalty cards, reward programs, gift cards etc. It motivates and rewards customers for spending more and bonding better with your brand.

6. Enhances brand awareness and recall

Fully customized prepaid cards with respective corporate logos, colors, and branding helps improve your business’s marketability and raises brand awareness among your cardholders and customers.

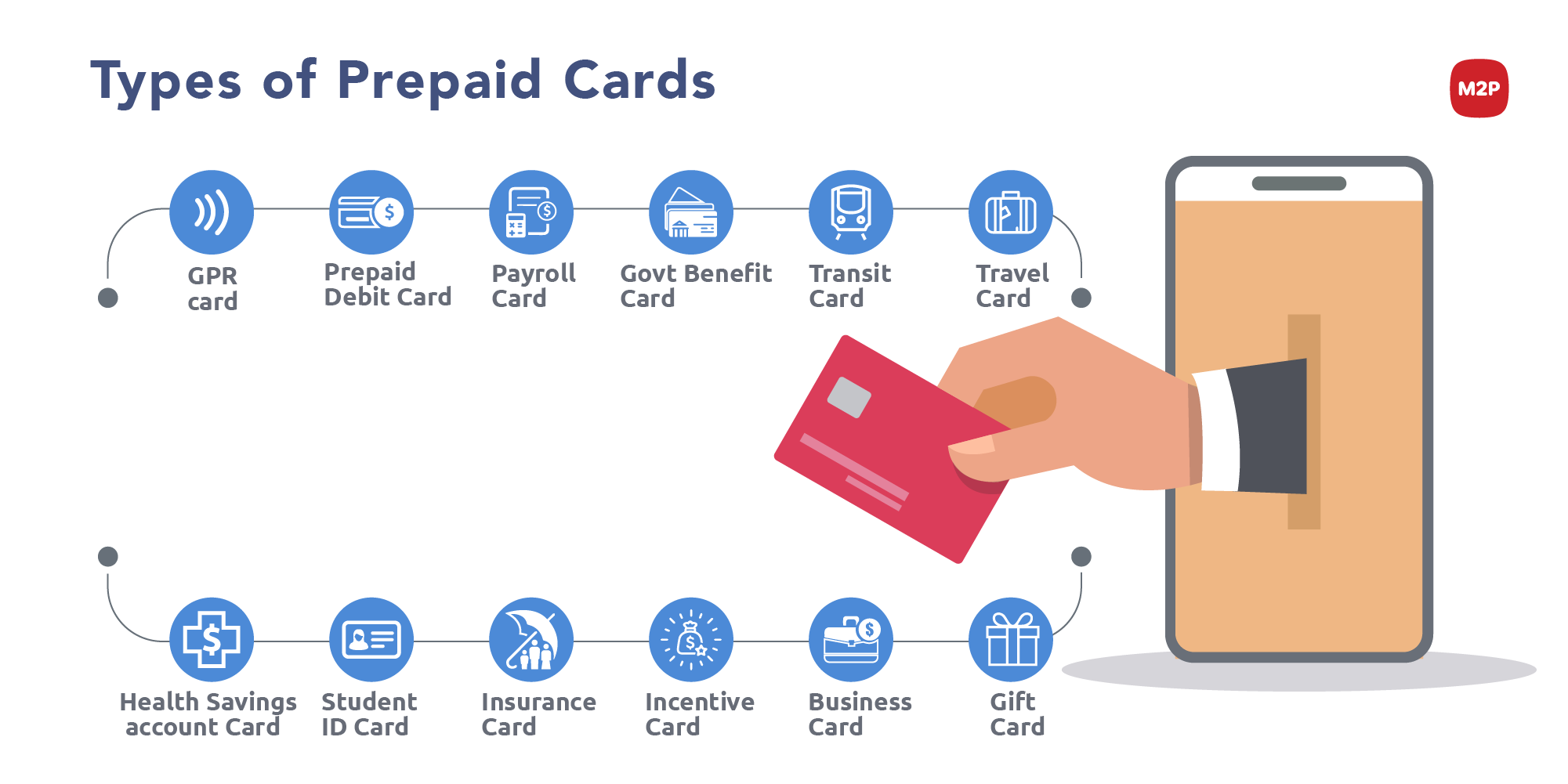

Industry-wide applications of prepaid cards

Prepaid cards cater to a wide range of industries, consumer segments and business processes. They are used for gifting, payroll processing, business expense management, benefit disbursement, intra-city transit, travel expenditure management, foreign exchange facilitation, healthcare reimbursements, student expense management, insurance disbursement, and employee incentives schemes.

To help you understand the industry-wide applications of prepaid cards, let us classify prepaid cards into types based on usage.

General Purpose Reloadable (GPR) prepaid cards

The GPR card is a boon to consumers who do not qualify for conventional credit or debit cards. GPR prepaid cards help people shop anywhere, pay bills online, and have paychecks directly deposited onto them.

Prepaid Debit Card

These stored-value cards also double as debit cards, but without direct bank account linkage. You can use these prepaid debit cards at a larger cluster of businesses. They work with both closed and open-loop networks.

Payroll Card

Introduced for the benefit of unbanked employees, the payroll card is a true lifesaver. It enables employers to transfer salaries safely to their employee’s cards without any hassles. As a result, employees can access and spend their hard-earned money flexibly.

Government Benefit Card

These cards are used by some government sectors to deliver assistance programs such as food coupons, pension, child support, and veteran benefits to its citizens. The disbursements are hassle-free, and their usage is entirely trackable.

Transit Card

Issued by public transportation operators, the prepaid transit cards are reloadable cards with restricted usability value. They are usually used for ticketing and occasionally come with shopping benefits too. Transit cardholders in metros can tap the card at entry and exit points for automatic fare deduction.

Travel Card

Also knows as prepaid multipurpose, multicurrency cards, the travel cards are ideal for executives who travel within the country or abroad. These cards are loaded when the employee starts his travel. The foreign exchange rates are locked for competitive pricing, and the holders can use the card extensively for all purposes. Some cards also come with inbuilt travel insurance features.

Health Saving Account Card

This prepaid card type is usually offered by the employer who loads the card for medical expenses. Employees can use the health savings account card in pharmacies, hospitals, and even ATMs for cash withdrawal.

Student ID Card

Some colleges and universities provide students with ID cards that double as prepaid cards. Parents can load these cards for ward’s purchases and fee payments inside the college campus. When linked with bank accounts, students can also make cash withdrawals at ATMs.

Insurance Card

Issued by insurance companies, these insurance cards boost the speed and efficiency of claim disbursements. People get paid quickly, and insurers save on administrative costs.

Incentive Card

When businesses reward or incentivize their employees, they provide prepaid incentive cards like gift cards or vouchers. This kind of incentivization is an excellent motivator for employee productivity.

Prepaid Business Card

Businesses that want to control and track their expenses issue prepaid business cards to their employees instead of credit or debit cards. These cards are highly effective in cutting costs and reducing overspending, credit risks and fraudulent transactions.

Gift Cards

Gift cards are non-reloadable cards usually issued by banks or retailers to their customers. They can be used as an alternative to cash for purchases at a selected store.

How can a business issue prepaid cards?

Issuing and operating prepaid cards and digital wallets is not a child’s play. First, businesses need to be authorized and approved by the respective Central Banks to issue prepaid cards. Then they must create and maintain in-house teams to develop the infrastructure for card issuance, adhering to regulatory compliances.

Maintenance, support and upgrades post-deployment is another issue altogether. This process is highly tedious and can drain your resources and focus, taking several aeons for the prepaid card to reach the market.

The best way for businesses to issue their own prepaid card is by partnering with a card issuance service provider like M2P. Our cutting-edge APIs facilitate modern and agile card issuance at an unprecedented go-to-market speed and Zero CapEX. We cut across complexities to empower enterprises of all sizes and scales to grow by issuing customized prepaid cards within days.

Even if you are not PCI-DSS certified, you can use our widgets and extensive libraries for compliance. Leveraging our strategic partnerships with banks and PPI license holders, we instantly enable physical, virtual, and tokenized payments.

Ten Point checklist to remember while issuing prepaid cards

If you are a business looking to issue prepaid cards, don’t proceed without consulting the checklist below.

- Ensure your prepaid cards are flexible (physical and virtual) with multipurpose and multicurrency functions

- The overall card ecosystem must be robust and scalable so that you can layer and build allied financial products around it

- You must be able to drive interoperability through mobile apps

- Deploy security compliance and tokenization to prevent cyber threats and fraudulent transactions

- Optimize cash flow and mitigate fraud through dynamic spend control and just-in-time funding

- Leverage sound business logic to allow or decline transactions for just-in-time funding

- Gain access to real-time analytics and reports for card monitoring

- Offer reward programs to drive loyalty and reduce churn

- Customize with respective branding elements to enhance brand equity and recall

- Make sure that you partner with a great prepaid card program manager for hassle-free onboarding, maintenance and support

Last but not least, don’t waste your time and effort on building prepaid card applications from scratch. Focus on customer acquisition and product development instead. Partner with card issuance API providers to simplify and humanize world-class card issuance, management, and support. Remember, go-to-market speed, quick onboarding, and hassle-free program management are paramount parameters in card issuance.

How to choose the best prepaid card program manager for your business?

Running a prepaid card program without a program manager is like a circus without a ring master. You can’t even imagine the consequences.

Partnering with the best prepaid card program manager is critical if you want profitability and efficiency in your card ecosystem.

For a successful prepaid cards ecosystem, program managers should technically be the owners and facilitators of your cards program. They should serve as intermediaries between the issuing bank and card network and be responsible for security, technology integration, migration, customer engagement, reward strategies, and banking relationships.

Hence choosing a program manager for your prepaid cards program is a critical decision for your business.

Before narrowing down your prepaid cards program manager, ensure they have extensive experience in the following functions.

- Quick deployment of prepaid card APIs across verticals

- Layering cross-functional applications and solutions

- Generating analytics and reports that drive data-driven decision making

- Maintaining card efficiency and security

- Offering transparent, upfront pricing

- Delivering streamlined, hassle-free and quick customer onboarding

- Provide 24/7 support to any issues that may arise

Challenges in issuing prepaid cards

All said and done, the world of prepaid cards is not a bed of roses. It is fraught with challenges in legal and regulatory requirements, market infrastructure, competitive pricing, and security on a macro-level. And on a micro-level, enterprises face crucial challenges below while issuing prepaid cards.

Here are a few of them.

- Core business focus and key resources get diverted into building in-house prepaid card applications, compliance, and support systems

- CAPEX increases multifold, straining company’s finances

- Efforts are misdirected in application building and forming bank and PPI partnerships

- Go-to-market speed and onboarding is delayed

- Customer churn increases as sales and product development initiatives slump

On the whole, the entire operation may turn downhill if not managed well.

Here is good news.

You can overcome all these challenges by partnering with the right card issuance API provider and prepaid card program manager with deep domain expertise, experience, and network strength.

How M2P enable businesses override challenges to issue prepaid cards?

With in-depth domain knowledge and an empathetic mindset, we help businesses overcome micro and macro challenges effectively.

We ensure Zero CAPEX by collaborating as OPEX partners to deploy and manage prepaid card programs at an incredible go-to-market speed. Businesses can leverage our PCI-DSS compliant stacks and Software Development Kits (SDKs) to prevent customer data theft and card frauds.

Our cutting-edge APIs have enabled several businesses like Ola and Muthoot Finance to control expenses cost and achieve growth by issuing multipurpose, multicurrency, physical, or virtual wallet-enabled prepaid cards to their employees and customers.

Using your own branding style, we deliver user-friendly mobile apps and wallets with quick onboarding, excellent rewards, and stringent spend control, security, and fraud detection features. Our real-time reconciliation of card transactions, data-rich dashboards, and accounting process simplifies program management and spend monitoring for businesses. In addition to issuing new cards, we also deactivate redundant cards and block cards in case of thefts or misplacements.

Our customized solutions help enhance and expedite the following platforms for your business.

- Corporate and retail gifting

- Just-in-Time funding

- Prepaid card-based Lending

- Fleet Expense Management

- Cross-border payments through forex cards

- General Purpose Reloadable cards for employees

- Prepaid cards for teenagers and millennials

Want to issue your own prepaid card? Write to us at business@m2pfintech.com.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments

Trackbacks/Pingbacks