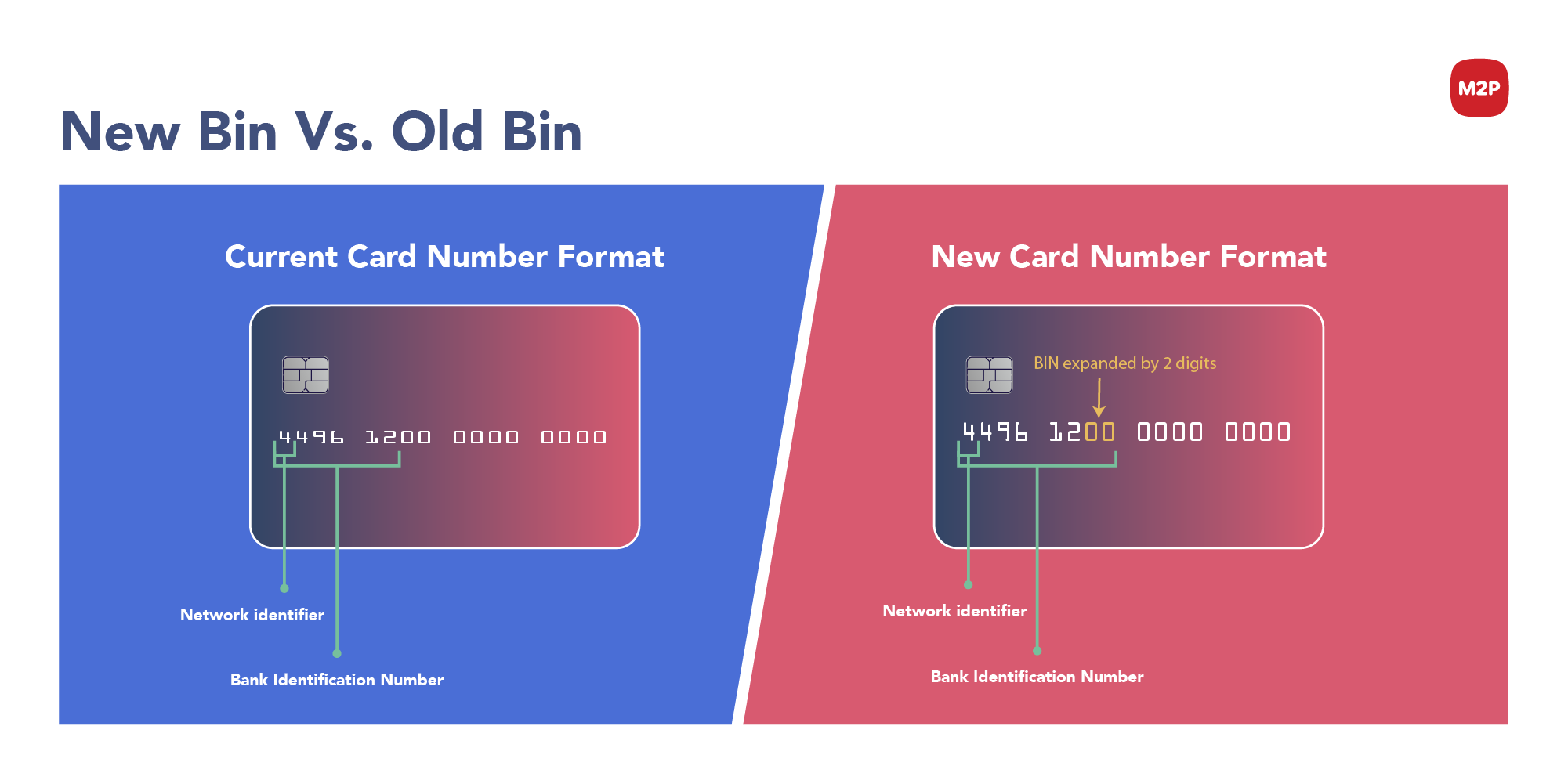

Have you ever noticed the numbers on your credit/debit/prepaid card? They have a string of numbers out of which the first six digits are called Bank Identification Number (BIN). The BIN number helps the merchant processor identify the card type, network, and the issuing bank for the transaction’s approval/decline. For instance, a Visa card starts with the number “4.” Master card starts with the number “5” and “2”, Diners starts with the number “3” and so on.

They also enable merchants to accept different types of payments like digital and mobile payments.

Now with the explosion of payment electronification and many becoming savvy financially, there has been a drastic increase in the number of card users. This, in turn, has led to a shortage of BINs; if we take a rather dim view, it can be observed as depletion of BINs.

To stop this from happening, the International Standards Organization (ISO) amended the existing standard of (ISO/IEC 7812–1) Part 1: Numbering system from Six-digit to Eight-digit BIN in 2017. So, card networks such as MasterCard, Discover, American Express, Visa and others have started prepping for the change.

Visa has been quite active with this change and regularly issuing updates and ready reference guides for this migration. Visa adopted this standard in 2017 and has urged its partners to migrate to the Eight-digit BIN by the end of April 2022.

Who will be affected by this migration?

- Acquirers

- Issuers

- Processors

Merchants

On completion of April 2022, the card network’s 100,000 BINs will migrate to 10,000,000 BINs. The first Six-Digits will remain the same in this change, and the following two numbers (00,01,02…) will become part of the Eight-Digit BIN. Also, there will be no need to reissue replacement cards to the customers.

Here are the key points that sum up this initiative:

- After April 2022, the existing 6-Digit BINs will continue to function, and requests for new BINs will be assigned in 8-Digits.

- 6-Digit BINs will be supported, but they won’t be forced to convert to 8-Digit BINs

- PCI guidance and Visa clearly outline that organizations storing the full 8-digit BINs require additional controls may include expanded scope.

Why the sudden urgency about this migration?

While the standard is out for migrating to Eight-Digit BINs, ISO did say that they are maintaining the other issuing BINs in the six-digit sequence until the deadline of April 2022. The mandate also doesn’t require the removal of Six-Digit BINs. Therefore, the concerned parties must continue supporting both Six and Eight Digit BINs.

The time taken for the adoption will significantly vary by the stakeholder. So, even though the deadline is still 10 months away, there is a concern regarding the impact of updating the backend systems. Especially those involved with issuer processing, routing, and other activities need to assess the impact and get ready for the changes.

Industry watchers were almost sure that this initiative will call for a longer PAN. Still, Visa has decided to implement the same on the existing 16-digit- PAN structure. It has become quite clear that the decision will affect the PCI compliance of the existing truncation and masking rules. Any organization that stores the full BIN and the last four digits of the card will become non-compliant unless the rules are not modified.

The decision did not specify any modification, and it requires organizations to handle 8-digit BIN as cardholder data. But organizations that spent massive efforts over the years to lower their PCI compliance load will face an explosion of responsibilities and remediation efforts. It will probably result in actions, expense, and their own timeline of non-compliance.

So, card networks have been encouraging its vendors, agents, partners, and other stakeholders to actively assess the impact they would be experiencing across their systems. This assessment would help them to increase their efficacy and avoid any hurdles when handling transactions.

How does this change impact?

As six-digit BINs are on the decline, it will be challenging to rely on them for authorization, routing, and transaction clearing. The effect might not be immediate but will slowly and surely escalate when Eight-Digit BINs become the norm. Both Merchant and Service providers might face issues in the following scenarios:

- Prepaid card’s identity

- Chargeback and Fraud

- Transaction processing

- Merchant services and disputes

- Reporting

How to prepare for the change?

Visa has issued directives for both merchants and service providers on how to handle this change. They have explicitly said that the changes are specific and may need to require a timeline extension. So, organizations, service providers, and other stakeholders are encouraged to initiate and pool the resources necessary to prepare for Eight-Digit BINs.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments

Trackbacks/Pingbacks