UPI transactions clock 1.61 billion transactions worth Rs 2.98 trillion in August

Digital payments up by 23% with transactions valuing at a record high of $113.4 Trillion

Source- Business Standard

India will provide approx. 2.2% of the world’s digital payment by 2023 — Pwc & PCI

Amazing right! In the race between digital payments vs. cash, the former is definitely taking the lead. Right from a cash-dependent economy to cashless transactions, we slowly see the shift. This trend is now fueled by the pandemic, COVID-19. Starting right from cards to UPI, digital payments have taken over in both online and offline methods. Nevertheless, UPI payments are setting up a record high as 1.61 billion transactions.

But this is not the first time that digital payments have seen a spike in our country. The history-defining move of Demonetization brought digital payments to the fore. Many opened bank accounts or started using their bank accounts for depositing their cash reserves. Incidentally, it also prompted many to dust their debit cards.

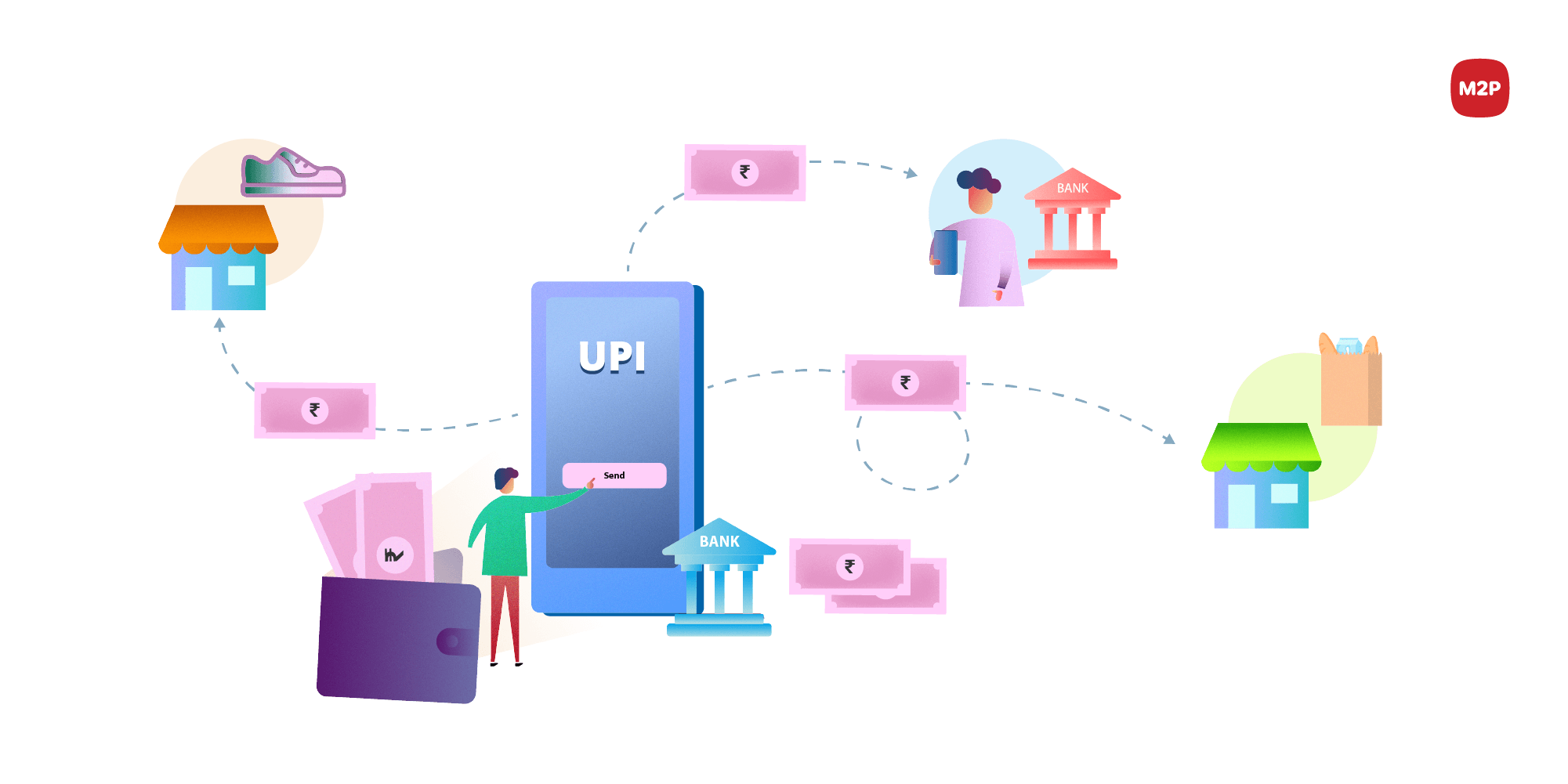

Soon, several incentives and schemes were introduced to encourage this transition. Also, the year 2016 saw a significant milestone with the introduction of UPI in August. Coupled with the availability of the internet, digital payments had the right boost. Starting from grocery stores to street vendors, UPI, and other modes of digital payments had taken root.

It was a great learning curve, with many technology players coming to the forefront. Innovating payments and user experience became a priority. But after a while, the spike plummeted as currency notes and coins rose in circulation.

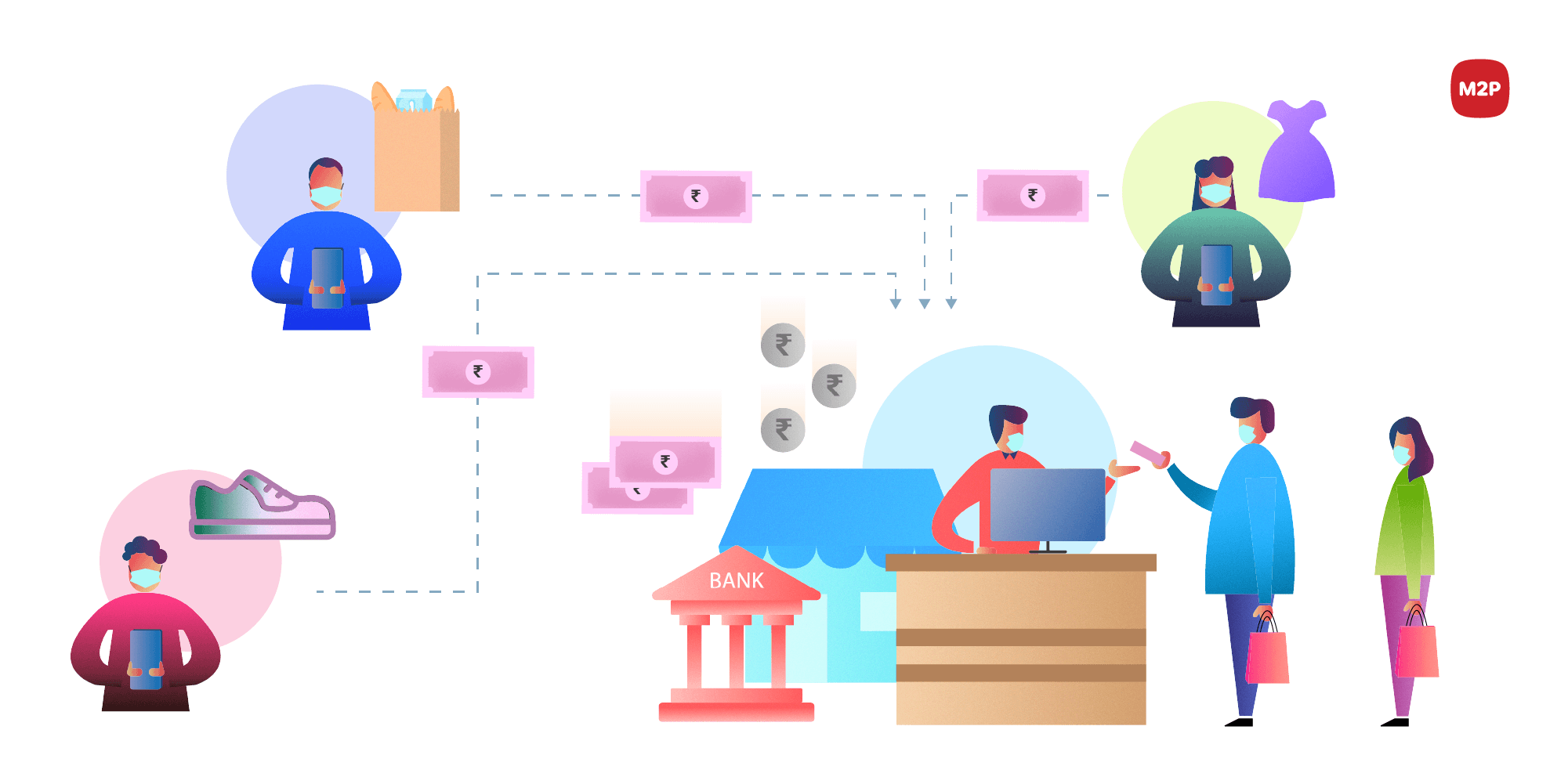

Now, the onset of the pandemic and nation-wide lockdown has made people embrace digital payments. The pandemic has also brought forth a two-pronged result where businesses are going digital, and some are losing their footing. But, the retail section seems to have stayed afloat by going digital. So, what took four years to adopt is now the norm within months of lockdown. With new customers on the rise, merchants are currently searching for tailored and localized payment solutions.

COVID has pushed people to adopt online shopping where digital payments rule and cash on delivery is frowned upon. Even those who are tactile by nature are now supporters of online shopping. Online grocery shopping is now on an all-time high with e-commerce spearheading the cause.

So, it puts forth the question of how digital payments got back their spotlight?

COVID has made people wary of physical contact, so digital payments were the only solution. Also, here are a few more points that answer the above question:

- It requires minimal or zero contact. Minimal contact if it is cards and zero contact if paying through UPI or mobile wallets.

- You don’t need to carry a loaded wallet as right from cab drivers to popular stores, digital payments are available.

- Forget rummaging around for change; your card or wallet will let you pay the exact amount.

- It is there 24/7, and you don’t need to spend long hours outside the ATM standing in those social distancing circles patiently waiting for your turn.

Recently, a study conducted by The Red Seer Consulting deduced that India’s digital payment will reach Rs.7,092 trillion by 2025. And that is not all; Digital payments are now the favored choice of the millennials. They have gone through a shift of reluctant usage to a must-have tool for every day.

To know more digital payments write to us at business@m2pfintech.com.

0 Comments