A crowded building with people spending a lot of hours in a queue to get their service done– this is almost everyone’s idea about the term “Bank.” But now, it looks suave after an upgrade with a fresh look.

Gone are the days when people spent a day getting their banking service done. After the great technological innovation, traditional banking is no longer considered a troubling word. Several advancements acted as a trigger for the players like fintech companies and other third-party service providers (TPSP) to cause a paradigm shift that posed a challenge to traditional banks.

What does Banking as a Service mean?

Simply put, Banking as a Service (BaaS) is an end-to-end process that involves FinTechs and other third-party service providers(TPSP) to access the bank’s financial services through APIs for offering a different and personalized financial approach to their customers.

Banking as a Service – The Bonanza

Over the years, banks provided financial services to their customers using rudimentary infrastructure. But now, many tech-savvy banks evolving around have pushed every bank to upgrade their services to maintain their lifetime value. To meet this rising demand, FinTech comes into play by integrating their white-labeled services by accessing the bank’s APIs.

Looks like banks were on a ride of a lifetime to the technological planet with many advancements at fore. One such advancement is Banking as a Service. It is a business model which plays a crucial role in strengthening the customer base with the help of fintechs that provide innovative financial assistance to the bank. Banking as a Service pioneers a huge window of opportunities for digital banking and rockets the revenue.

As embedded finance is treasured and demanded by many NBFCs, software companies, and logistic firms, BaaS has gained popularity and is now ubiquitous for bringing promising financial features for their customers and even escalates their revenue growth.

Predominantly, fintech start-ups have come up in large numbers. They target banks to promote and promulgate their business by offering innovative products and services. The fintech sector collaborates with banks to gain rapid acceptance by the customers to provide loans, cards, deposits, insurance, make payments, and many trusted financial services.

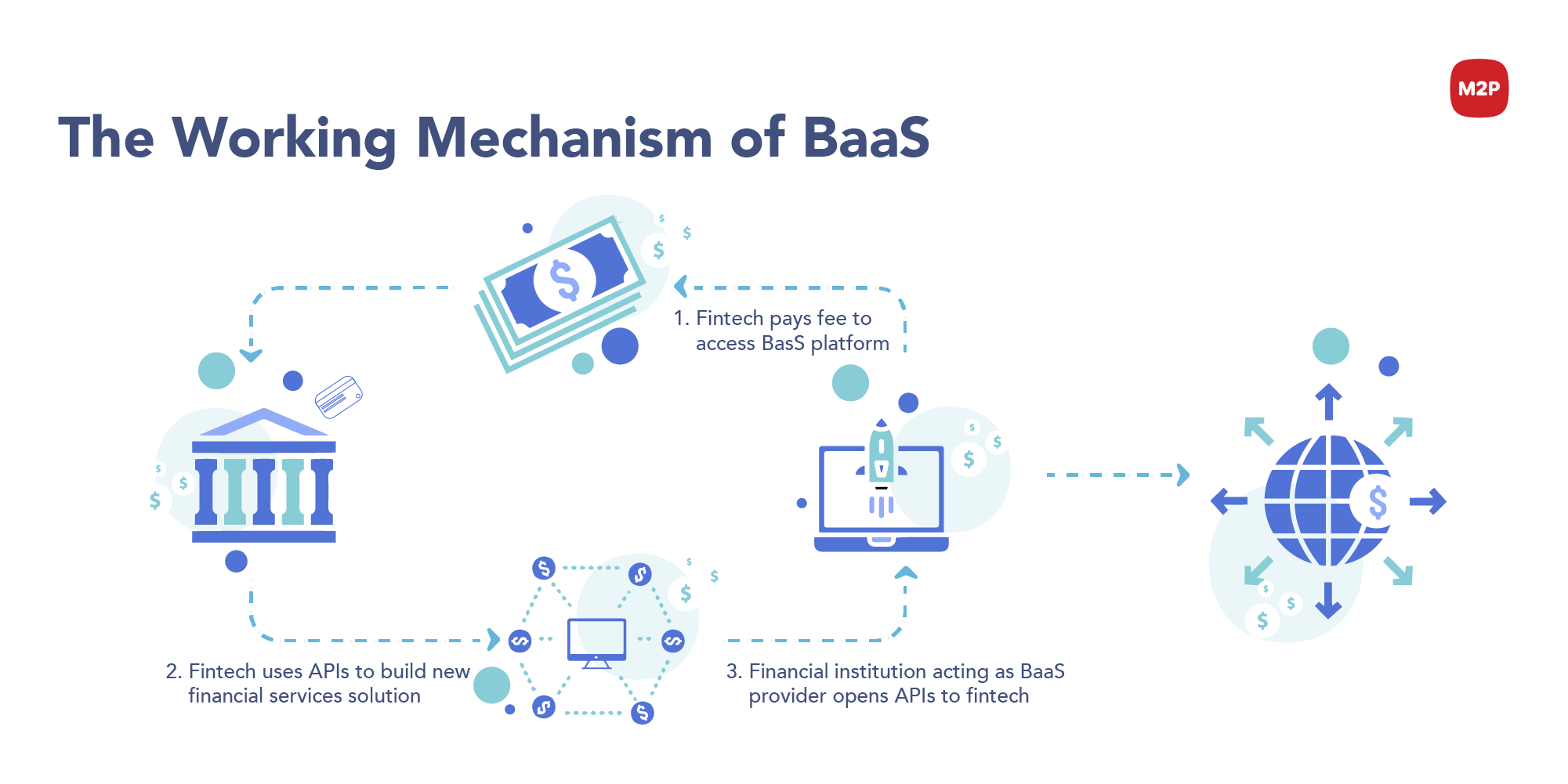

The Working Mechanism of BaaS

Banking as a Service works on providing trendier products than ever to customers with a more qualified user experience. The pandemic skyrocketed the demand for payment digital apps. Amidst the chaos, these contactless payments created a brighter picture by providing ease of use while staying indoors.

There are two ways to carry Banking as a Service seamlessly.

API- based stack

With API’s intervention, FinTechs and other third-party service providers (TPSP) can help banks offer customers a transparent, smooth, and customized financial service along with the existing banking services. Customers feel a better user experience when providers synchronize and connect with the bank’s tools and services. Simplified money flows are now possible with very few clicks for the customer.

The fintechs are given secured access to banking services followed by integrating bank’s APIs with the provider’s products to further execute seamless white-label banking services using upgraded technology. They strictly abide by the rules and regulations in carrying out the bank’s data safely using top-notch security systems like PCA.

Cloud-based stack

Here, the licensed tech companies operate as regulated banks to offer the services by pushing the traditional banks to the inoperative section in this play by redefining their stacks to cloud sections.

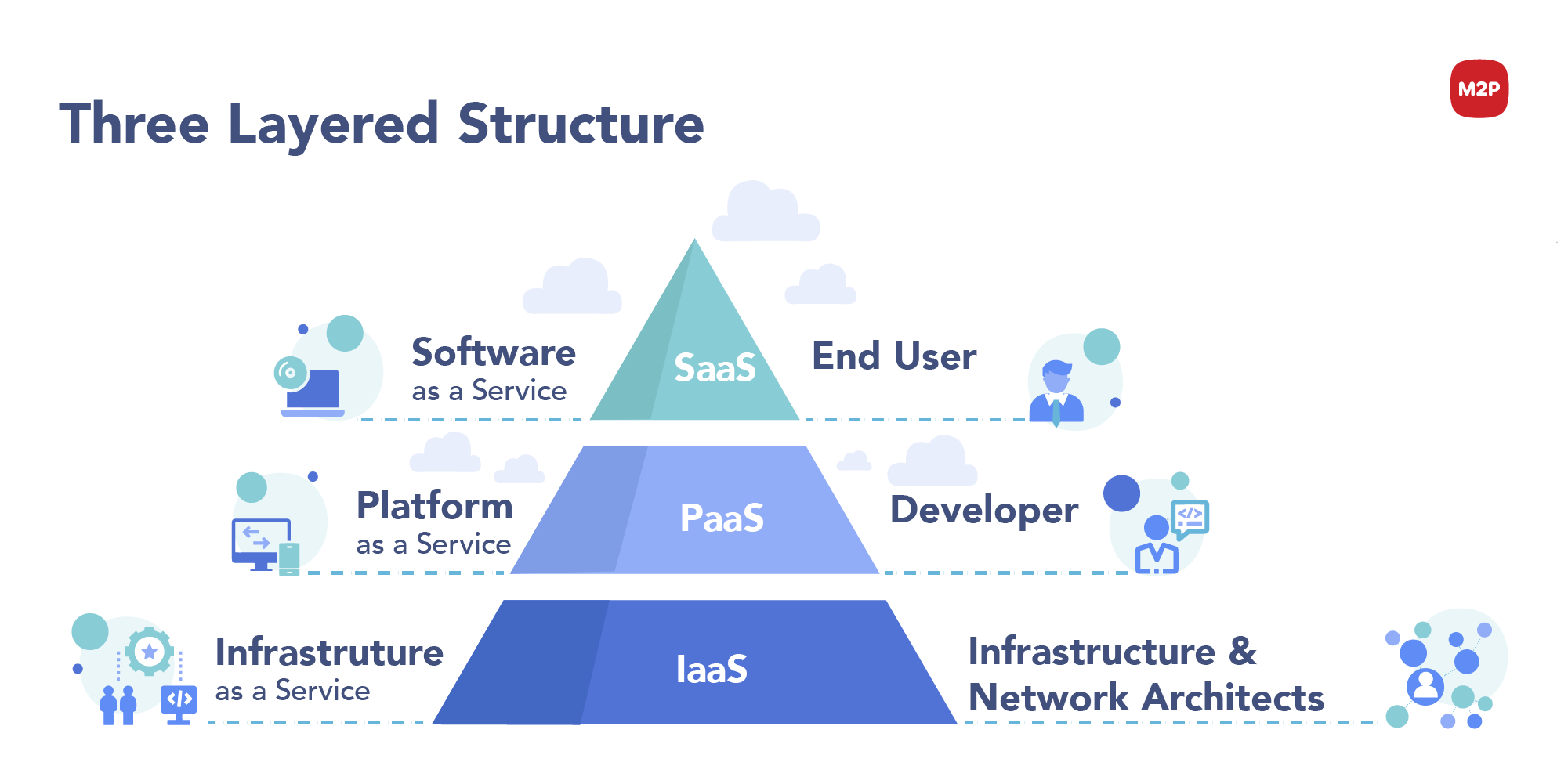

The Three-Layered Structure of BaaS

- Infrastructure as a Service (IaaS) includes the basic financial services provided by the traditional banks through an IaaS provider.

- Banking as a Platform (BaaP) is placed above IaaS, which includes the customized services offered for fintech start-ups and companies. The data carried out between the banks and fintechs are monitored securely as data security is concerned.

- FinTech SaaS — Here, the fintech companies which offer financial services interact with the end-users to carry out the data or requests and sends it back to BaaP securely.

Evolution of Banking

This era has witnessed the massive emergence of tech-savvy banks. One such popular emergence is the Neo Banks. They are digital banks that operate only online with the help of artificial intelligence, machine learning technologies, and APIs. Cost-efficient, convenient, and user-friendly interface are what makes them stand out. Neo banks partner with traditional banks to digitally offer services from opening a bank account to money transfers/bill payments 24×7.

FinTechs play a crucial role by building their innovative infrastructure on top of it, making the Neo Banks more popular. Banking as a Service is the backbone of Neo Banks as they are dependent on APIs and other crucial financial services they offer.

We take pride in the fact that M2P powers Finin, India’s first neo bank with our APIs that enables instant provision of user’s bank account and prepaid cards.

Types of BaaS Providers

BaaS providers can be classified into three models based on their purpose.

- API Stores — Traditional banks open their API for fintechs and other TPSPs to incorporate their innovative bank services for customers.

Services offered: eKYC, beneficiary validation, remittance, inquiry, etc.

- White-Label Platform — Companies that don’t carry a license can also approach fintechs and other TPSPs to offer their white-labeled service. But, in India, a license is a must to carry out this model.

Services offered: Digital banking & cards, lending, blockchain, payments, etc.

- BaaS as Co-branding — The fintechs or neo banks carry their appearance in the forefront for the traditional banks to offer their effective services.

Services offered: Banking & Cards, Integrated payment gateway, etc.

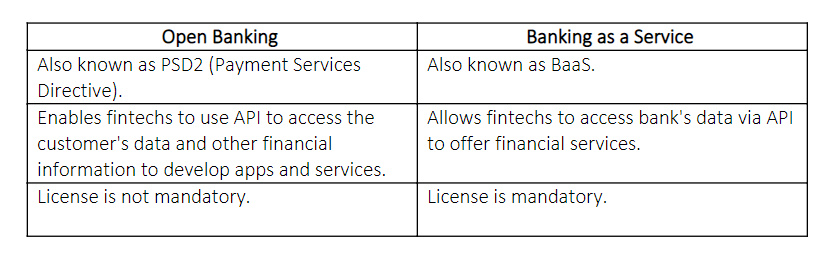

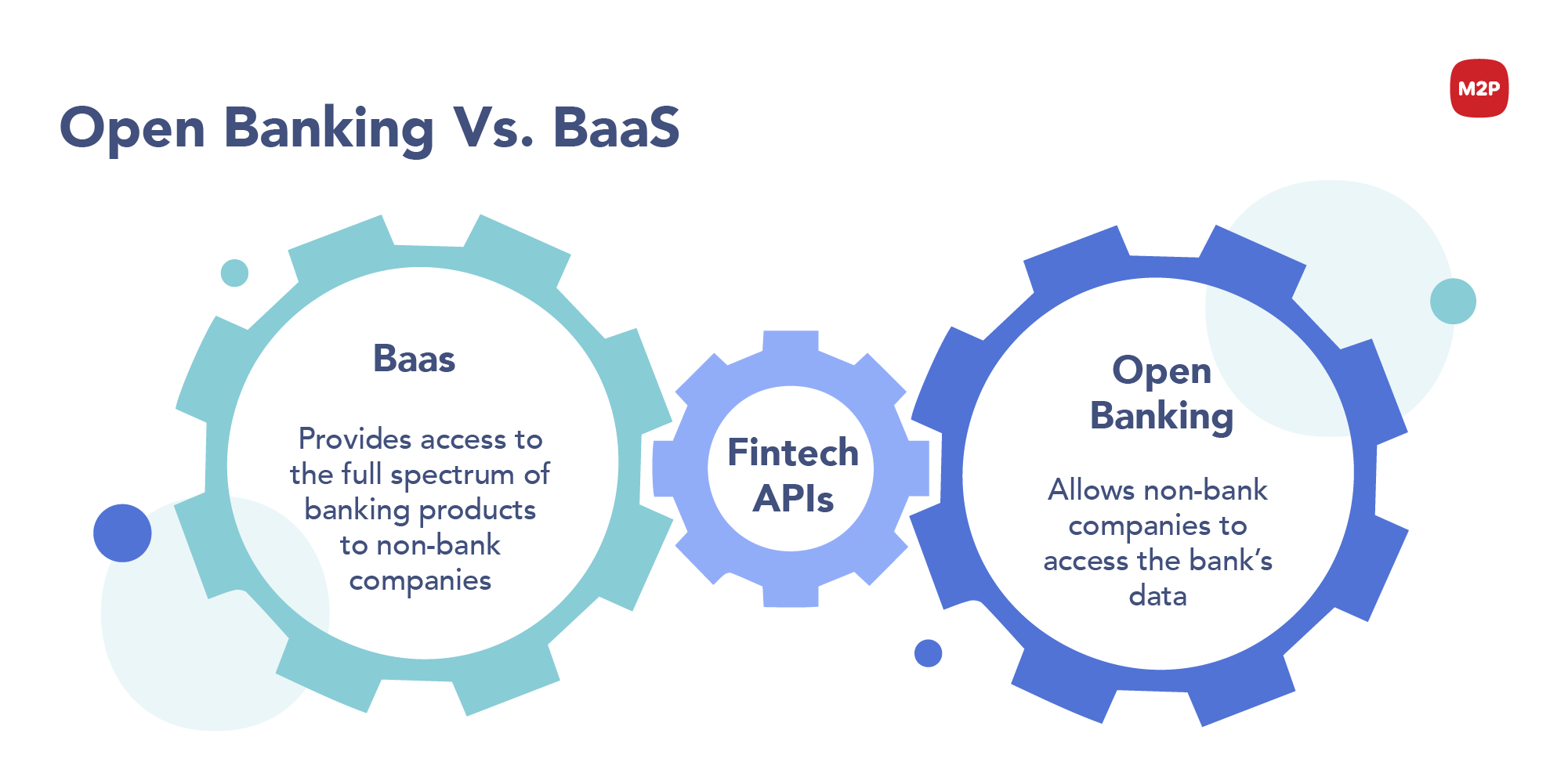

Open Banking vs. Banking as a Service

Let us elucidate the long-haul confusion between Open Banking and Banking as a Service. In a nutshell, the usage of APIs by fintechs determines the difference between these two.

Benefits of Banking as a Service

Nowadays, fintech start-ups shine with their innovative ideas and serve any financial need, making banks powerful. The mobile-first approach and everyday emerging digital advancements made Banking as a Platform a successful one in the industry. Also, the transparency and ease of use foster the growth of open banking by quickly nearing the go-to-market reach.

Banking as a Service is the new evolution for both traditional banks and fintech sectors. The traditional banks who are smarter enough in adapting to the digital era can attain profitable accomplishments. They are forced to attract more young clients with their newer technologies and methodologies in financial services. For instance, the traditional banks can now collaborate with third-party service providers to expand their services like vehicle insurance, lending, remittance, rewards, currency exchange, and many more.

Many banks’ go-to option is now BaaS since they cannot remodel their infrastructure for back-end, front-end development and give a more product-centric approach as fintechs do. Banks prefer it is better to approach fintechs and TPSPs rather than making a huge investment building in-house.

With banking service as a platform, it is simpler to launch and integrate banking features with the magic wand called API.

To make the long story short, BaaS is the savior for many banks, non-financial companies, and customers.

Yes! We all have the same thought. The future holds more for banking.

We can conclude that it will always be a money-spinning venture as fintechs and banks follow the collaborative way of doing business to produce more innovative services to their customers. Without a shadow of a doubt, the journey of Banking as a Service had just started, and we have a lot more to witness together.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments