BNPL, the acronym for Buy Now Pay Later, though a relatively new concept, is slowly becoming the talk of the town. The new-age shopper is now drawn to BNPL products and is ditching the traditional payment options like Credit Cards. The article below explores the “why” of this paradigm shift.

Starting from the ease of checkout to personalized offers, BNPL has masked the word and feeling of a “Loan.” It is simply viewed as Buy Now and Pay Later minus the paperwork and as a different IOU avatar. Along with the single-click checkout, BNPL also gets your merchant to bear the cost of No Cost EMIs. The factors and psychology behind the allure of BNPL will sure make this the next big thing in consumer finance.

Are credit cards getting left behind?

Traditional credit cards were once a great choice for credit lines, but they are also perceived as a debt trap. Often, the lack of transparency and complex interest calculations attract heavy penalties and bad credit scores for the customer, leading to difficulties when securing a loan in the future.

This is where BNPL holds a massive advantage over traditional credit cards. They offer a clear and transparent checkout option where the consumer is presented with all the factors of applicable charges and due dates upfront.

Some BNPL players have even gone a step further and adopted time-tested business models and have appended penalties for specific time frames. So, in the end, the new-age shopper not only gets flexible repayment options, but they are also empowered to understand financial nuances in case of late or missed repayment.

BNPL in India

After creating ripples in the US, Canada, Australia, and Europe, BNPL has now started its journey in the Indian fintech ecosystem. And in a country where loans are generally frowned upon, BNPL has captivated customers with ease of payment, right at the checkout page.

What is its premise ?

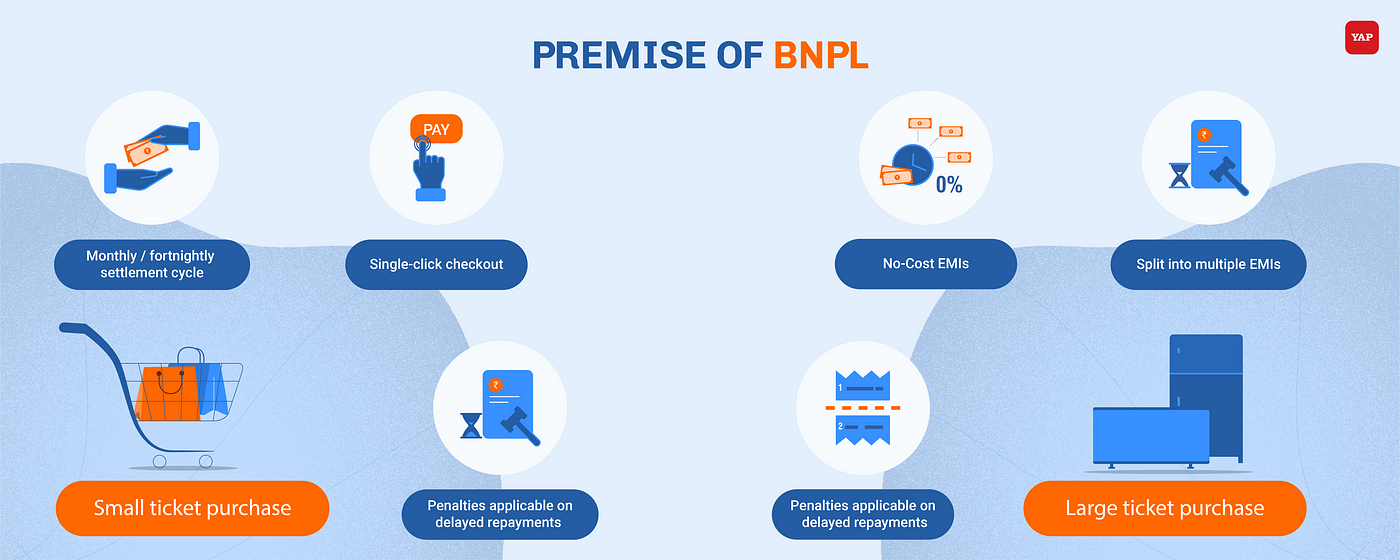

Even though BNPL applications have adopted different means to facilitate checkout, they center around the issuance of “credit.” It also increases the shopper’s purchase power while completing the transaction with minimum hassle.

Moreover, like Credit cards — BNPL applications are powering users for:

- Consolidating many small expenses in one bill

- Splitting a major expense in multiple repayments

Let’s assess the BNPL options here in India!

For example, Anuj has a list of standard expenses made at different e-commerce and hyperlocal players. He pays them all via a debit/credit card, which means entering card details, OTP, and finally paying the credit bill. With a single BNPL application where there is no need of OTP or card details, Anuj gets to shop without the hassle and gets to settle the bill through his preferred settlement option.

So this option of BNPL has and offers the following features:

- · Suited for small ticket sized purchases

- · Monthly or fortnightly settlement cycle

- · Single-click checkout

- · Late payment charges and penalties applicable on delayed repayments

So, next comes the question of big ticket purchases:

Let’s assume Anuj wants a new TV that is top of the line in the market and quite expensive. While using a credit card to make a purchase is a traditional method, BNPL offers a much easier way. The TV’s cost will be split into 4 EMIs, while the TV seller/merchant bears the EMI’s interest charge. So, in the end, the merchant gains a loyal customer, and Anuj gets a better way to manage his finance with manageable repayments.

In this method, BNPL works this way:

- · Suited for higher ticket sized purchases

- · Bill split into multiple EMIs as provided by the seller

- · Seller funded no-cost EMIs up to a time frame

- · Late payments penalties accrue if a due date is missed

Who are the users of BNPL?

Millennials, Bridge Millenials and Generation Z, are the early adopters of BNPL.

Source: Pymnts- Buy Now Pay Later Report-2020

It is worthwhile noting that the youngest millennial is turning 25 this year, and he can be assumed not to be the ‘reckless spender.’

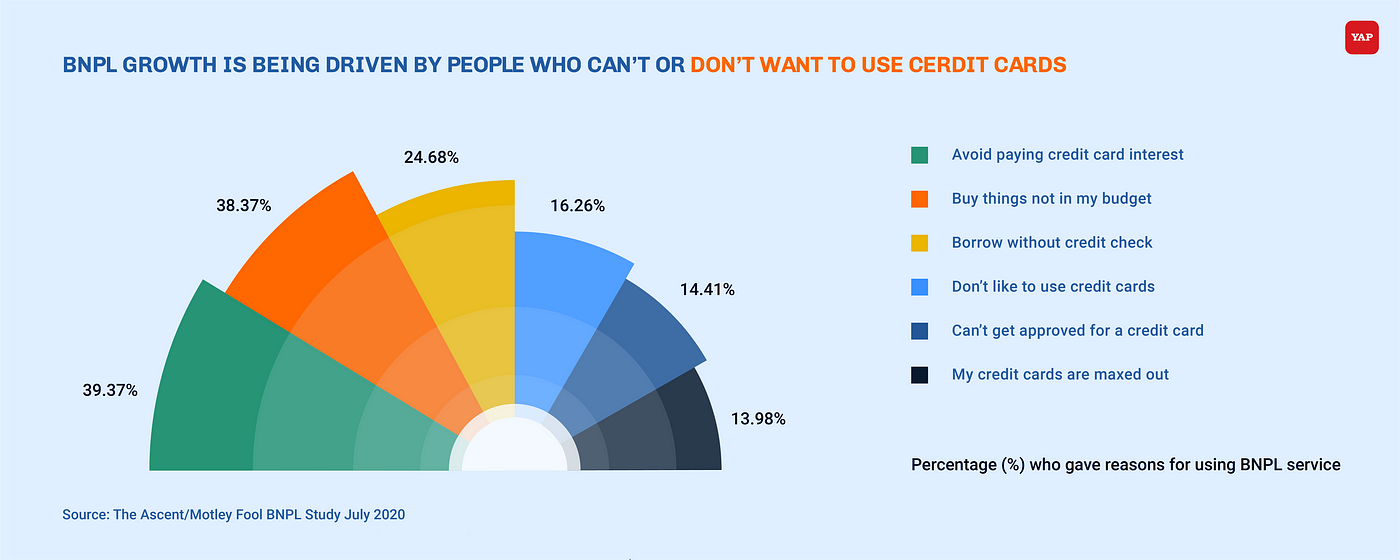

Alternatively, cash transactions are in the lead, followed closely by debit and credit cards. However, with BNPL and digital wallets, this dynamic is slowly shifting, and it is an exciting wait to see who tops the chart. Many users who have never used or have limited exposure to credit cards rely on BNPL applications for credit needs.

Well, now the fundamental question arises about the user without a good credit history.

BNPL lenders give credit lines to shoppers based on secondary data. For example:

· They analyze the data points like shopper’s history with the merchant

- · Average order size, time of association

- · Order behavior like the number of prepaid, canceled, or COD orders.

- · Order history and other available digital footprints of the shopper.

Based on this data, BNPL lending business models enable credit to a user, and it gets enhanced as he/she makes timely repayments of the offered credit.

Connection between COVID and BNPL

The ongoing pandemic has certainly accelerated BNPL adoption across the globe. With employees being laid off, being furloughed, and the uncertainty about their income, consumers are inclined towards budget-friendly payment options in which BNPL certainly takes the lead. Merchants are also more receptive to BNPL applications than they have ever been as it increases their consumers’ purchase power.

How does the future look for BNPL?

BNPL, in a decade, has taken the lead even though banks have been lending for hundreds of years. Today, banks are trying to keep up and switch to a digital-centric approach, such as providing their BNPL offerings and partnering with a Fintech to co-create solutions for consumers. BNPL, for banks, is an excellent medium for portfolio diversification.

In India, BNPL has been scratching the surface, and it has a long way to go. Internet penetration has created the market where BNPL could fly in the coming years with FinTech’s, Banks, and Merchants’ necessary push.

We can expect regulators also to fence BNPL offerings in the coming years. One thing is for sure, BNPL is here to stay, and it’ll keep on luring consumers. We are yet to watch its full potential and need to wait to see how BNPL shapes commerce in the future.

To know more about BNPL, write to business@m2pfintech.com.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments