No matter which investment vehicle hogs the limelight, nothing can break the charm of the good ol’ Fixed Deposit (FD). It is considered a perfect ‘coming-of-age’ gift for millions of first-time investors in India.

Factors contributing to the allure

Private Banks, Public Sector Banks (PSBs), and Non-Banking Financial Companies (NBFCs) issue fixed deposit plans for aspiring investors. The guarantee of assured returns, high-interest rates, zero risk exposure, and tax exemptions make FD a preferred savings instrument for people across socioeconomic strata.

Banks, fintech firms, and NBFCs offer secured credit cards, overdrafts, free insurance, and health cover to customers based on their fixed deposits. This adds to its greater appeal as a popular investment instrument.

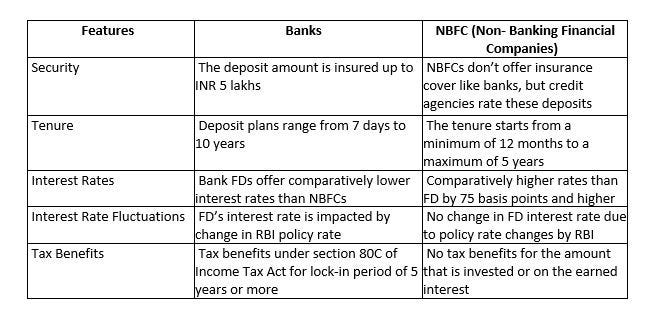

Difference between FDs offered by Banks and NBFCS

Digitization is critical

Physical FD booking demanded strict protocols like the creation of bank accounts, extensive background verification, and laborious paperwork. Customers were not too happy with the complex, time-consuming journey to invest in an FD.

Hence, digitization of deposits became the need of the hour to thrive in the evolving market. The convenience of product comparison, hassle-free onboarding, and digital payments/withdrawal attracted more consumers to choose online deposit plans.

PSUs, private banks, and NBFCs are actively deploying online FD platforms to reap the benefits listed below.

- Boost lending potential: Financial institutions can leverage online FDs to increase the aggregate deposit value, which will in turn boost lending opportunities.

- Access to New to Bank (NTB) customer base: Digital FDs offer new-age banks and NBFCs an efficient channel to onboard investors who do not have an existing bank account. NTB consumers can be incentivized with higher interest on deposits as compared to existing banks.

- Target new investor segment: Online FDs help Financial Institutions (FIs) target new consumer bases by leveraging diverse fintech platforms. For example, they can target wealthtech for investment and tech-savvy consumers, and digital banking/payment apps for zoomers and the millennials.

- Enhance customer experience: Digital FD platform offers instant hassle-free KYC processing, onboarding, settlement, and digital service request. It ensures personalized and enhanced customer experience and journey.

Challenges in digital FD deployment

Several FIs have already launched online FDs and upcoming players are looking to launch digitized deposit platforms. One commonality between them is the quantum of challenge they face during deployment and implementation. Here is a quick glimpse into the key challenges FIs face in digital FD deployment.

- Time to market- Launching FD solutions with end-to-end integrations and data security on 3rd party platforms is a time-consuming process. This delays the time taken for banks and NBFCs to go to market with digital fixed deposit plans.

- Unavailability of integration-friendly standard APIs- Bank and 3rd party integrations are critical for online FDs. To aid seamless operation, implementation and support, ready-to-integrate APIs are imperative.

- File-based batch files- Traditional banks have file-based batch files for handling service request changes. This makes API-based fintech integrations more challenging.

So, how can FIs overcome the challenges listed above?

Simple. Banks and NBFCs need to partner with digital FD solution providers for ready-to-use, end-to-end APIs that enable incredible go-to-market speed. Within a few weeks, the deposit product will hit the market and the FIs can enjoy the benefits listed below.

- Seamless & uniform API driven integrations

- Scalable platform supporting multiple FIs

- End-to-end functionalities and customer journey

- Customized fixed and recurring deposits issuance

- End-to-end digitized processes for KYC, account creation, account changes, maturity pay-out, account closure, and FD renewal

- Proactive compliance and security infrastructure

- Support for service requests (FD closure, account details changes, FD renewal, bank account changes) from both API-based as well as file-based integrations

Follow us on LinkedIn and Twitter for more insightful fintech tales curated for curious minds like you.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

0 Comments