The fintech industry is a big ocean where one gets easily lost if unaware of the operational standpoint of digital solutions. It has so many entities built with innovative ideas, frameworks, and processes that offer high scope to elevate the business to different levels.

The fintech industry is a big ocean where one gets easily lost if unaware of the operational standpoint of digital solutions. It has so many entities built with innovative ideas, frameworks, and processes that offer high scope to elevate the business to different levels.

Among the pool of technology offered by the fintech world, payment solution is the essential competitive niche with robust ideologies already in action.

The statement Payments are happening in the air is surreal because of the customized payment solutions popping out from every nook. These customized payment solutions are powered by two little, but mighty players called the Payment Gateway and Payment Switch. Though invisible to the human eyes, this duo is at the center of every scalable payment method that today’s banks and businesses are trying to deploy for a niche customer experience.

What is a Payment Gateway?

A payment gateway is a tool that potentially takes care of the transaction process end-to-end, covering security to settlement. Payment gateway, also known as the facilitator of the payment, is an online digital cashier who charges, verifies, collects cash, and hands over the deliverables.

Payment Gateway is developed and launched by fintech’s to allow the merchants (businesses) to accept the payments in their selling platform, online or offline.

They are third-party software sitting between businesses (merchant selling platform) and issuing bank account. This software creates a pathway in which the user (customer) can submit his/her sensitive information (card details, passwords, PINs) to the merchant in exchange for the promised goods.

The payment gateway validates the submitted information, checks for the fund availability, deducts the fund. When the products are shipped or handed over, the fund is moved to the merchant account in 1–2 business days.

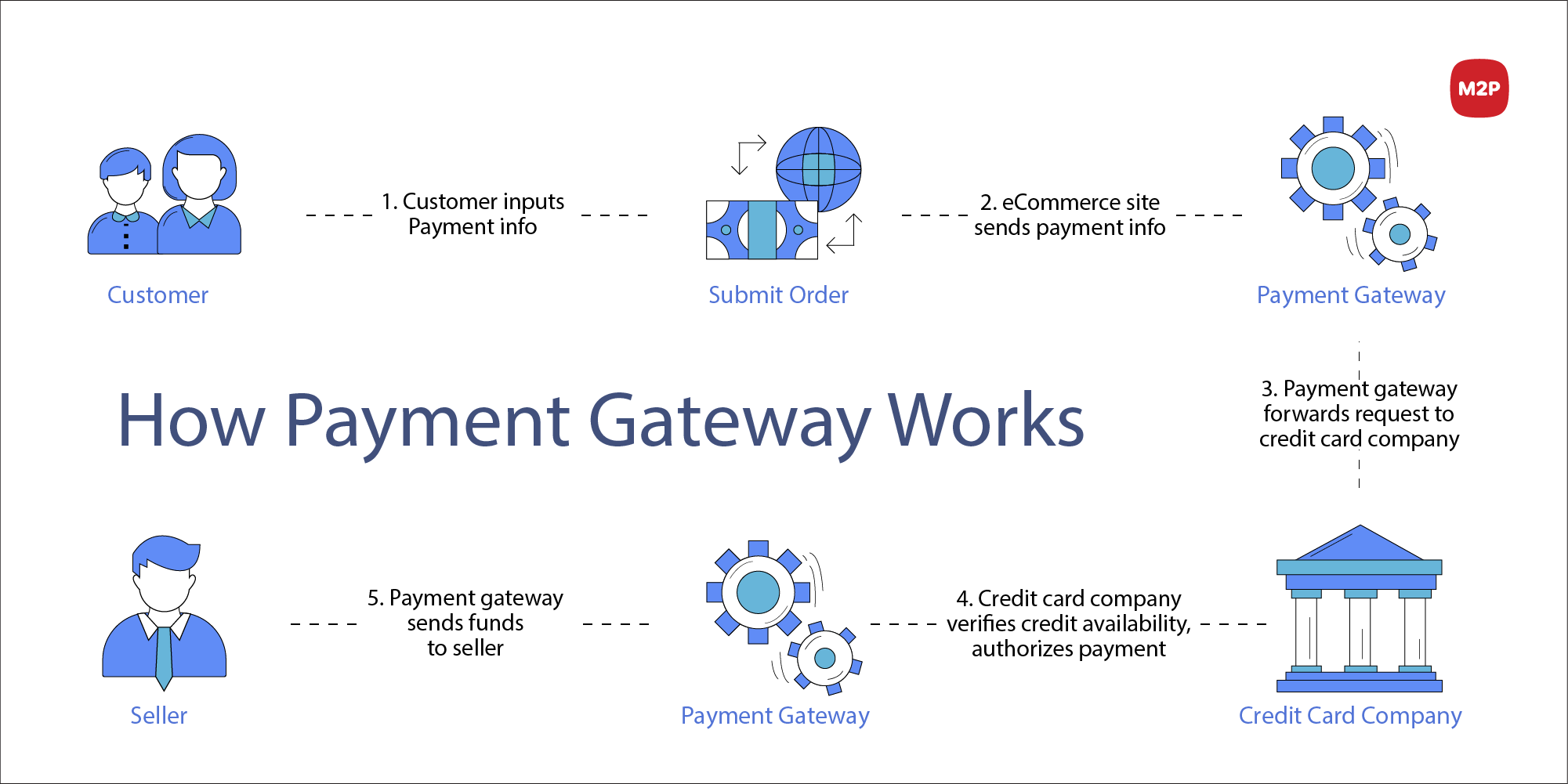

The powerful coding lines in the payment gateway enable the user to request a payment transaction within the seller platform. It assists the transaction process by executing the following steps,

- Accepts the payment request

- Verifies the user card details or submitted account details

- Check for the fund availability

- Processes the transaction

- Transfers the fund to the acquirer bank account (merchant bank account)

In simple terms, the software allows the smooth transaction between the issuing bank account and the acquirer’s bank account.

Benefits of a Payment Gateway

- Allows millions of users to perform a transaction with the merchants

- Reduces the fraudulent services in online payments with various authentication steps like OTP, CVV, or CCV

- Allows multiple payment options like a credit card, net banking, mobile wallet, or digital transactions.

- Easy report generation, reconciliation, and settlement for accounting frameworks.

What is a Payment Switch?

Payment switch is also a technology but embedded into the payment gateways. It is an independent entity that conveniently sits inside the payment gateways to assist the payment processing.

Being an OLTP (online transaction process tasks) a payment switch takes care of all the nuances inside a transaction. Suppose the payment gateway is a founder who oversees the transaction. In that case, the switch is the executive who does the actual payment processing tasks.

In a payment gateway, there are multiple merchant accounts boarded with their bank (acquirer bank). So, when a payment request comes from a merchant selling platform, switch dynamically identifies the acquirer bank (associated with that merchant) and the issuing bank of that specific request through BIN allotment and then permits the transaction to happen securely.

BIN allotment is one among many ways for the payment switch to route the transaction. It also supports routing by amount, routing by the time of the day. Once it receives the message from the issuing bank, it formats and sends back the response to the acquirer.

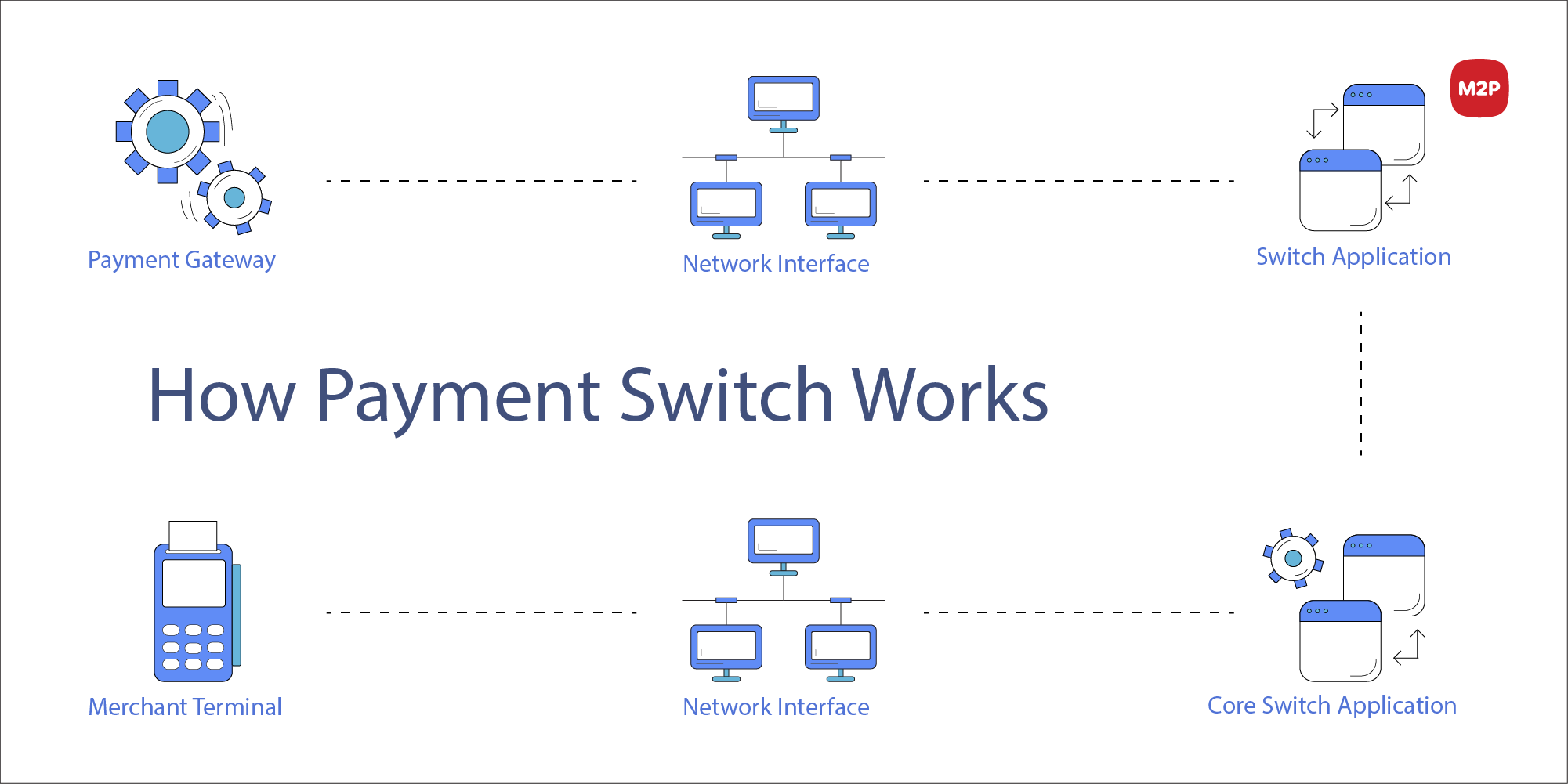

The payment switch is a flexible entity accepting the payment request from the payment gateway and beginning the transaction steps.

- Accepts the validated payment request from the PG

- Reads the merchant rules for the transaction process

- Identifies the PSP for that particular payment request

- Routes (switches) the transaction based on a BIN allotment for a specific PSP associated with that payment request

- Processes the transaction based on failure or success

Benefits of a Payment Switch

- Highly Scalable

- Dynamic Routing

- Fewer outages’ issues

- No more connectivity time out

- Secure and eliminates the fraud risks because of the encrypted BIN allotment

- Allows extension of payment networks

Payment Gateway vs. Payment Switch

In the whole payment ecosystem, payment gateway and payment switch are the two variables that have become the atom to all the online and offline businesses appending banks. The two entities are not different but not the same too. They are embedded onto each other to reduce downtime and outages.

It is easy to confuse both and interpret them as one, but it is not. Although on a bird’s view, the operations of both are alike, the underlying subtlety in the payment processing tasks differentiates payment gateway from payment switch.

How do they work together in sync?

Payment gateway and Payment switch work together in a fashionable way enabling faster, safer, and dynamic transactions. At a fraction of a second, the payment gateway can process more than a million transactions because of the flexible switch.

You can imagine a payment gateway as the train track, and the payment switch is the railroad switch to change train routes. Just like the railroad switch guides the train to their proper destinations, the payment switch guides the transaction process to the right acquirer’s place.

One platform, multiples payment requests, no mishaps, no outages, and no time outs — all possible because of payment switch.

What is the future of both?

Payment switches will not go away because banks face intense competition to bring the topmost secure and faster payment methods. Payment initiatives will take the revolution road only till the switch exists.

However, the future remains unpredictable (after what 2020 has taught). So, maybe the end might eliminate the switch and bring in a more robust payment gateway technology.

In retrospect…

The switch will be the payment gateway and grow as a monopoly in the payment ecosystem.

Since owning a switch needs BIN allotment, the regulations charges are heavy; also, the technology requires a fast server with 24*7 hours access.

But the real question for our thought here is, what if AI intelligence operations are allowed into payment technology. Then the game changes — switches will get a complete upgrade. But the future is yet to be witnessed.

Subscribe to our newsletter and get the latest fintech news, views, and insights, directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech tales curated for curious minds like you.

0 Comments