The advent of international payments has been long-standing in the financial world, facilitating commerce and trade. Be it sending money back home or international business contracts, today’s rising global commerce can be attributed to the growing volume of international digital payments.

It is a valuable ally for businesses and individuals who wish to enjoy commerce or transactions across borders. The surge in cross-border B2B payments is exponential since the penetration of the internet. With predictions of 30% growth in the next three years, cross-border e-commerce has taken off to exponential heights in these 2 years.

Also, the businesses that offer software as a Service (SaaS) heavily depend on cross-border payments as their demographic is spread across the globe. In recent years, these players have played a monumental part in increasing the volume of cross-border transactions.

The advancements in Fintech today empower many businesses and individuals to make instant payments. Businesses can experience stress-free invoicing, tax handling, and recurring billing in a few clicks. They also have access to top-notch support portals to handle any issues that arise out of a transaction.

Fintech companies experiment with technologies like Blockchain to bring more transparency and Artificial Intelligence for better regulatory compliance.

What are cross border payments?

Cross border payments happen when the payee and the recipient are in different countries. These transactions can be retail, wholesale or recurring in nature. Decades back, the electronic messaging system served as a crucial mode to enable cross border payments.

The cross border payments industry now utilizes many payment modes like credit cards, cross-border payment gateways, wire transfers, e-wallet, distributed ledger technology, APIs, etc., every day to facilitate international payments.

In fact, we can classify cross-border payment methods as Past, Present, and Near Future, where every advancement is an incremental leap in payment facilitation and user experience.

The Past

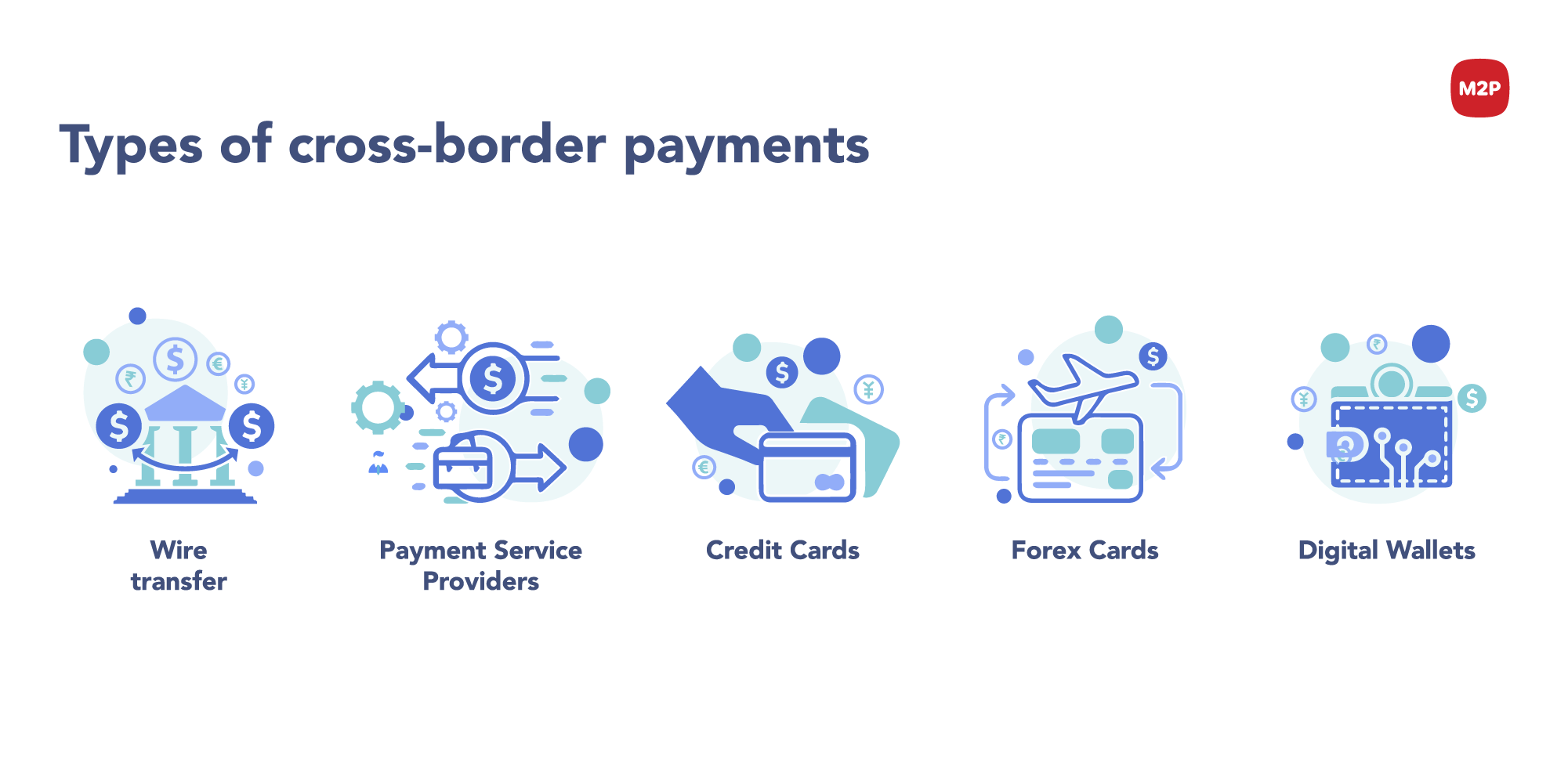

Wire transfer

It is an electronic transfer of money, where the money is ‘wired’ from one account to another. If you are initiating a domestic transfer, it is called a “Bank wire.” In the case of cross-border payment, wire transfer is interchangeably referred to as “Remittances.” It is the oldest method of initiating a cross-border payment.

How does it work?

Here the payee visits their designated branch and provides the details of the receiver. Those details include the bank account number, name, recipient country’s currency, SWIFT code, IBAN (International Bank Account Number), bank address, amount to be transferred, etc.

The currency rate is fixed before the transaction. The details are directly sent to the recipient branch or via an intermediary bank. That’s not all; the payee also has to pay certain charges like service tax, conversion charges, and other applicable charges. Based on the instructions, the recipient bank credits the amount to the recipient’s account within 5 working days or more at times.

Payment Service Providers (PSP)

A popular option for immigrants, Payment Service Providers (PSP), effect transactions either in the form of physical cash or online payments.

How does it work?

The sender visits the agency with the current nation’s currency and proper ID proof for physical cash. The recipient can visit the agency at his location and collect the money after dedicating transfer charges to completing the ID verification process. For online transactions, the sender visits the PSPs apps or websites. Within a few clicks, money flies over the nations and reaches the receiver’s bank account directly.

The Present

Credit cards

It is a reliable mode of payment while traveling abroad. A credit card eliminates the need to carry cash in hand. They also offer attractive benefits like interest-free loan periods (a month or more), reward points, gift coupons, shopping offers, easy EMI options, travel insurance perks, etc.

Forex cards

Many banks and financial institutions offer forex cards explicitly designed for globetrotters. They can make money transfers across multiple countries with a single card. It helps the users avoid currency exchange rate fluctuations by locking in the rates while getting the card.

Digital wallets, ewallets & mobile wallets

- These are virtual wallets that can store money and customer information (credit card/debit card number, date, bank details, etc.).

- eWallets are used like prepaid cards where we can store our money.

- Digital Wallets are used to store card numbers, account numbers, expiry dates, IFSC codes, etc. This confidential information resides in the cloud.

- Digital wallets can be used on desktops, whereas mobile wallets can be used on mobile devices.

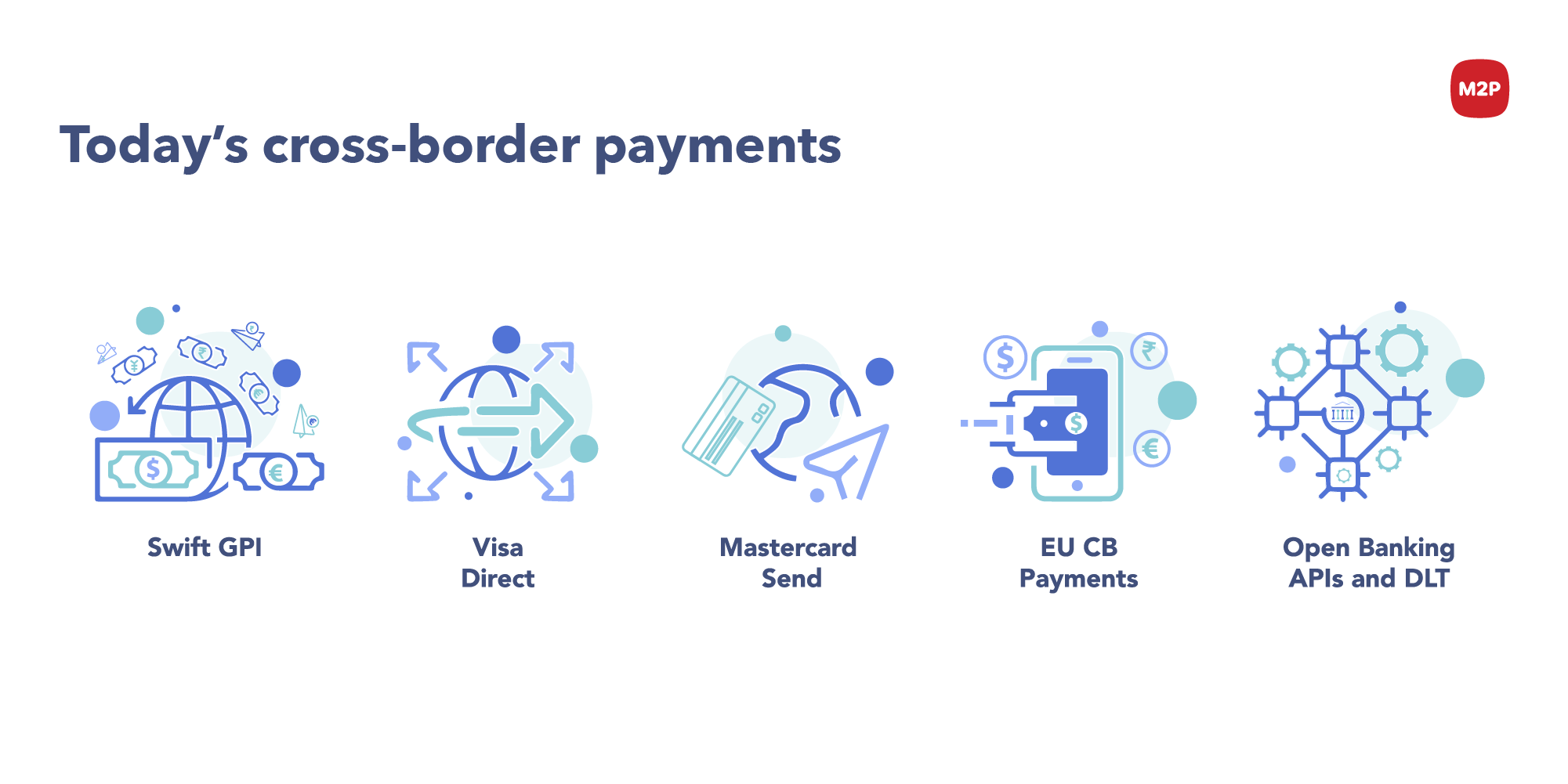

MasterCard Send

Initiated by the global network provider, MasterCard Send allows both businesses/ individuals to make real-time cross-border payments to the recipient’s debit card number. It does not rely on the bank’s ACH system, so there is no need for a routing or account number to send the money across.

Visa Direct

Visa Direct offers push payments to individuals/businesses across the globe. The business/user can tap into Visa’s global network and send payments in real-time or by a maximum time limit of 24 hours.

SWIFT GPI

SWIFT GPI or Global Payment Initiative aims for transparent and faster cross-border payments. It breaks down all the costs involved, and the payee can keep tabs on where the payment is at any given time. While the older methods of cross-border payments are traditionally mysterious, SWIFT GPI unveils the mystery and significantly increases the speed.

The Near Future

Open Banking APIs

Open Banking Application Programming Interface (APIs) aims to simplify the complicated procedures of cross-border payments. As it democratizes access to customer and their data, it becomes easier for fintechs and other financial institutions to build products that address their target demographic version of cross-border payment app.

Decentralized Ledger Technology (DLT)

A term made popular by Blockchain tech, DLT can be applied to cross-border payments’ three most challenging aspects. They are backend processes, compliance, and as a means of payment. DLT can speed up the backend process while offering transparency at every step of the transaction. It can also reduce compliance-related costs and can introduce an entirely new method of payment.

Cross-border payment is a complex mechanism that involves many players. It carries many fees right from currency conversion to the respective country’s tax and other service charges. Both domestic and overseas entities work together to accomplish the transfer.

For example, when a software purchase transaction is initiated, the “correspondent bank” requests the money from the “respondent bank.” Here both the correspondent and the respondent bank will have their colleague bank across the globe. So, the funds will leave the buyer’s bank and reach that bank’s counterpart present in the merchant country, ready for remittance. Then the remittance is transferred to the merchant’s bank for settlement. So, in short, banks work with other players like payment service providers; to transfer the money while navigating currency conversions, different tax regimes, transaction fees, etc. Further, slowing down the process.

One of the most popular banks for forex settlements is the CLS bank. Founded in 2002, explicitly for mitigating risk and settlement of Forex transactions, CLS works with 18 currencies in cross-border payments. Even though it has been instrumental in making forex payments easier, it does have some drawbacks. With new emerging currencies gaining global transaction volume, CLS is limited by 18 currencies and is yet to catch up with technological advancements of member countries’ payment infrastructure.

To create a seamless flow for the cross-border payments, some changes must be incorporated quickly to ensure better penetration across the value chains:

- Applications of Real-Time Payments will offer much-needed transparency. The parties involved can track the transaction status anytime. For example, this is what SWIFT GPI is trying to achieve. It has the potential to be replicated in other payment methods.

- The time factor taken to complete a cross-border payment should be brought to days from weeks. Small and Medium Businesses (SMBs) should have better access to these payments as cash flow is the backbone of their operations. Unpredictable delays and complex transactions will hamper its growth.

- Today’s customers, both retail and corporate, are looking forward to solutions that adapt to their evolving needs. They also favor the platforms where the solutions are embedded for all access.

- Customers today prefer a choice of methods and security when initiating transactions. A flexible ecosystem where transaction history, audit, and reconciliation can give valuable insight and a seamless experience.

- Integrations are a much-needed factor to bring about global interoperability and linking fragmented value chains. No matter the transaction origin, the experience of the transaction must be seamless for the merchant.

- Typically, the stakeholders in this transaction flow more often follow the same regulations. They can be bifurcated into ‘front end’ and ‘back end’ stakeholders. The Front-end players are the Tech companies who look at the ‘data’ aspect of the transaction and can have lighter compliance standards. The onus should lie in compliance with balance-sheet exposure, counterparty exposure, and liquidity for the backend players.

How is fintech disrupting cross-border payments?

With Blockchain taking the lead in the fintech space, digital currencies can be used in cross-border payments instead of national currencies limited by geography. As digital currencies are built with technology, it provides a bread crumb trail for the transaction trace and reduces the need for intermediaries. Also, the DLT applications of Blockchain can provide transparency and security at the core. Along with these innovations, Fintech also offers the following benefits:

- Constant enhancement: Fintech giants are leveraging the latest technologies like Blockchain to make cross-border payments completely transparent and tamper-proof. They concentrate more on the user experience and focus on making complex processes swift and convenient.

- Ease of use: Virtual wallets allow the users to stay free from making a note of all the passwords, account numbers and worry about their confidentiality. You can feed all your confidential information with a single tap and complete your purchase.

- Convenient: Forex cards are travel allies. It makes our wallets light when we are traveling to different countries handling different currencies. We can simply swipe on the retail outlets or wave it with a contactless card. Like an ATM card, it allows us to withdraw the local cash in any country (fed while receiving). The best part is few banks are waiving the ATM withdrawal fees, cross-currency charges, etc.

- User experience: Cross-border payment gateways help businesses to sell across borders. As they comply with PCI data security standards, customers feel secure while buying from a foreign website. Consumers can purchase by simply typing their email ids and enjoy rapid check-out.

- Marketing mate: Businesses can use the buying patterns of the consumers collected through their wallets and retarget them with attractive offers. Wallets offer rewards to buyers in the name of cashback. This money can be utilized only in their portal and increase the sales of the online platform.

Over the past decade, cross-border payments industry innovations are drastic and soaring high, with creative Fintech minds entering the space each day. Cross-border payments are no longer a daunting task consuming more time and effort. And we can expect many more innovations that make cross-border payments a secure and transparent exercise.

To know more about cross-border payments, write to us at business@m2pfintech.com

Thanks for every other excellent post. I’ve a presentation subsequent week, and I am on the search for such info.