The size of the Fintech market via Embedded Finance — embedded insurance, embedded lending, and embedded payments is going to be 400 lakh crores in the next 10 years.”- The Economic Times

Lending has existed since civilization started. Mankind has borrowed for various reasons: seeds, animals, currencies, jewels, mortgages, credit cards, and digital.

Embedded Lending or embedded credit is the latest in the line receiving the spotlight. Being an active subject of debate, many businesses believe embedded lending can increase their revenue by 5x. This article summarizes the story of Embedded Lending and its potential to bridge the gap between businesses, lenders, and the end customer.

What is Embedded Lending?

When lending (a financial service) is offered through non-financial products/services (retail or food delivery app), it is called Embedded Lending.

As the name suggests, a financial service is embedded into a non-financial service, thereby removing the need for using third parties. The embedding is invisible and offers a seamless lending experience to the users in a few clicks. It saves the costly infrastructure as it happens at the backend with simple API calls.

The entire lending ecosystem now becomes light as the reliability of many participants like a lender, banking institutions are reduced. Credit risks are almost zero as the lender has access to the customer’s credit history and spending pattern. Based on these analytics, the lender can set the amount to be disbursed as a loan. They can further use these analytics to offer attractive rewards as an incentive. It also narrows down the gap between businesses and consumers.

Furthermore, legacy lending processes slow down the business cycle in many ways such as:

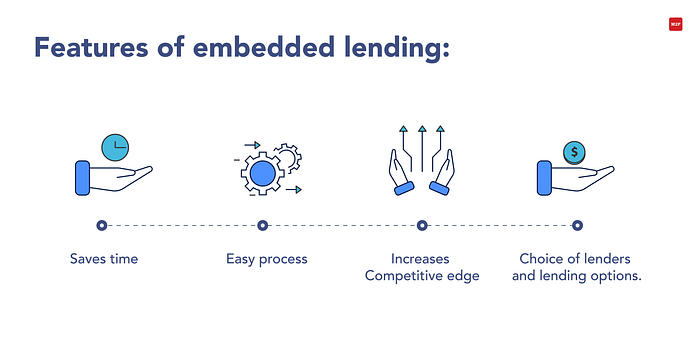

Time-consuming — Businesses borrow for starting a new branch, upscaling, delivering bulk orders, etc. At times, they need loans to fulfill their unexpected short-term revenue shortcomings and to improve their credit score for troubled-free future loan processing. Businesses cannot hold their orders for a long time till they are approved of the loan. By the time they are credited, the deal would be in the air.

Lengthy processing — The concept of lending is believed to be forbidden or rather daunting as it involves complex and lengthy processes. Documentation, verification, underwriting, sanction, payment management consumes huge manual labor and time.

“Consumers prefer to accomplish their financial tasks through their digital channels.” -Forrester

Change in customer preferences- The emergence of mobile devices changed the consumer’s buying and transaction channels. While the businesses want their customers to stick to their platform till they buy the product, consumers prefer to complete their payments, lending, or availing no-cost EMI options in the same platform digitally.

Competitive advantage — It’s vital for businesses to stay abreast in the market. Any business that adopts the latest innovative features are deemed to be the top-rated services/products.

Physical verification needs– Traditional lending requires the applicant to walking to the investor’s office or a banking institution with physical proofs and certificates. Each bank has its set of procedures. It takes substantial manual efforts and energy. A small error, say a spelling mistake can take another month for the applicant to prove genuine.

Pandemic constraints — The government’s curfew measures to contain the pandemic or face any unprecedented challenges fostered the businesses to navigate their operations indoors.

Embedded Lending alleviates these shortcomings, and it is an incremental leap on digital lending.

A practical example of Embedded Lending

Geeth is an aspiring fashion designer. She started selling handcrafted sarees online with Flipper. As an effect of her hard work and unique designs, more customers began buying her products. Geeth realized it’s time for her to replenish her inventory but her cashflow was not sufficient. One day, she received an invitation to the Flipper Lending program.

Geeth grabbed the opportunity without any second thoughts. She logged into the Flipper seller central to know her available loan limit. She applied for a $20,000 loan, which she can repay within 12 months at an interest rate minimum than the banks. Within 5 business days, her account is credited with the money. Geeth’s brand flashed in the top seller’s list.

Thanks to Embedded Lending.

Why this process is much easier than the traditional route of lending?

● Geeth never has to run to a banking institution, check her credit scores, search for a liability, wait for the underwriting process completion or leverage her assets.

● The entire process — loan application, verification and approval, credit, repayment is digital. Geeth can get her loan with a few clicks.

● Interest rates are comparatively minimal than banks.

● Flipper Lending is an invitation-only program. It verifies the seller’s eligibility criteria like Geeths’s annual selling history, customer complaints and copyrights infringement history of 6 months, etc., before inviting. This ensures Flipper the seller’s ability to repay.

● Repayments are automatically deducted at fixed rates every month from Geeth’s account while Geeth can focus on her designs and sales

● Geeth never has to postpone her dreams for the sake of money.

● Both Flipper and Geeth can enjoy increased revenue, and steady stream of customers.

How Embedded Lending helps businesses?

“Credit card penetrations in India remains 59% although 800 million have a bank account.”

-Economic Times

Embedded Loans aims to facilitate the end-user (consumer or business) to avail of financial service as and when required. It can be applied to many fields, such as

E-commerce Website challenges:

Shopping cart abandonment, where the customers leave the site before buying products in the cart, is a headache for eCommerce businesses. Although there are many reasons, insufficient cash at the moment stands on top. Embedded lending alleviates this with Point of Sale credit providers. This increases the consumer buying rates, which in turn increases the profits.

Tackling cash flow of Small Businesses:

One of the biggest challenges small businesses struggle to tackle is their cash flow. They can harness this credit method to drive their business. With Embedded Lending, SMBs can utilize every opportunity they come across, like buying raw materials required for a large manufacturing order without worrying about the capital.

Simplifying loan processes:

Embedded Lending can also assist in processing education loans. A student can apply for a loan with a few clicks while taking his online certification courses. He can easily link his bank account, fetching his registered details from RBI (Reserve Bank of India)/ or a respected country’s regulatory body. He/she can pay her loans at once they are placed.

Non-financial service providers incorporate Embedded Lending on top of their core services. The application process is simple, and the daily rewards are attractive. Technologies like Face ID and Touch ID ensure the end consumers’ security and privacy who avail themselves of the credits.

Further, Embedded Loans can make businesses go cashless in the near future, provided all the cybersecurity and regulatory needs are satisfied.

Financial services are no longer seen as a standalone domain. It has now become the kith and kin of all the businesses that focus on sales. The synergy between financial services and non-financial services is phenomenal, helping every stakeholder enjoy the benefits. With the facts discussed above, Embedded Lending is indeed a noteworthy Fintech innovation every business should leverage.

To know more about embedded credit write to us at business@m2pfintech.com.

0 Comments