Samit Shetty

Director - Chaitanya India Fin Credit Pvt. Ltd.

For many years, technology had been a barrier to our rapid expansion plans. With Finflux, technology is now our primary business accelerator.

Gold loan

Enhance every step of your gold loan journey with our customizable LOS and LMS, built to meet your business needs

Various schemes - bullet, interest only, step up, & regular

Appraiser module for gold valuation

RBI-compliant cash vs. bank disbursement splits

Packet allotment

Branch-led/agent-led origination channels

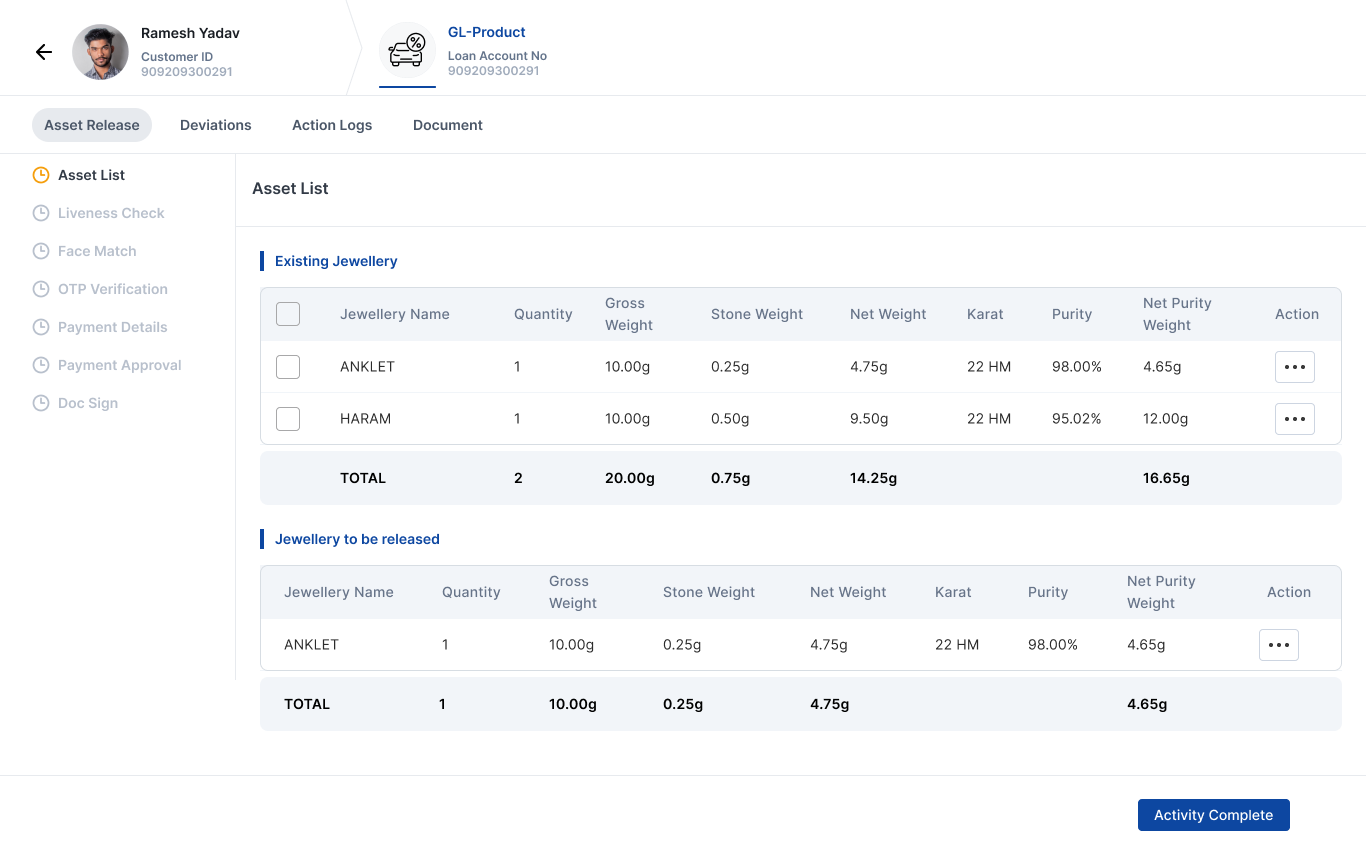

Partial release, auction release, & nominee release of pledged collaterals

We support multiple gold loan schemes, including: