M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Loan management system (Finflux)

Configure & launch multiple loan products in weeks

Borrowers Serviced

Active Loan Accounts

Total Loan Portfolio

Peak Capacity

At its core, our loan management system is highly configurable, enabling lenders to tailor nearly every aspect of the process, streamlining the entire loan lifecycle management

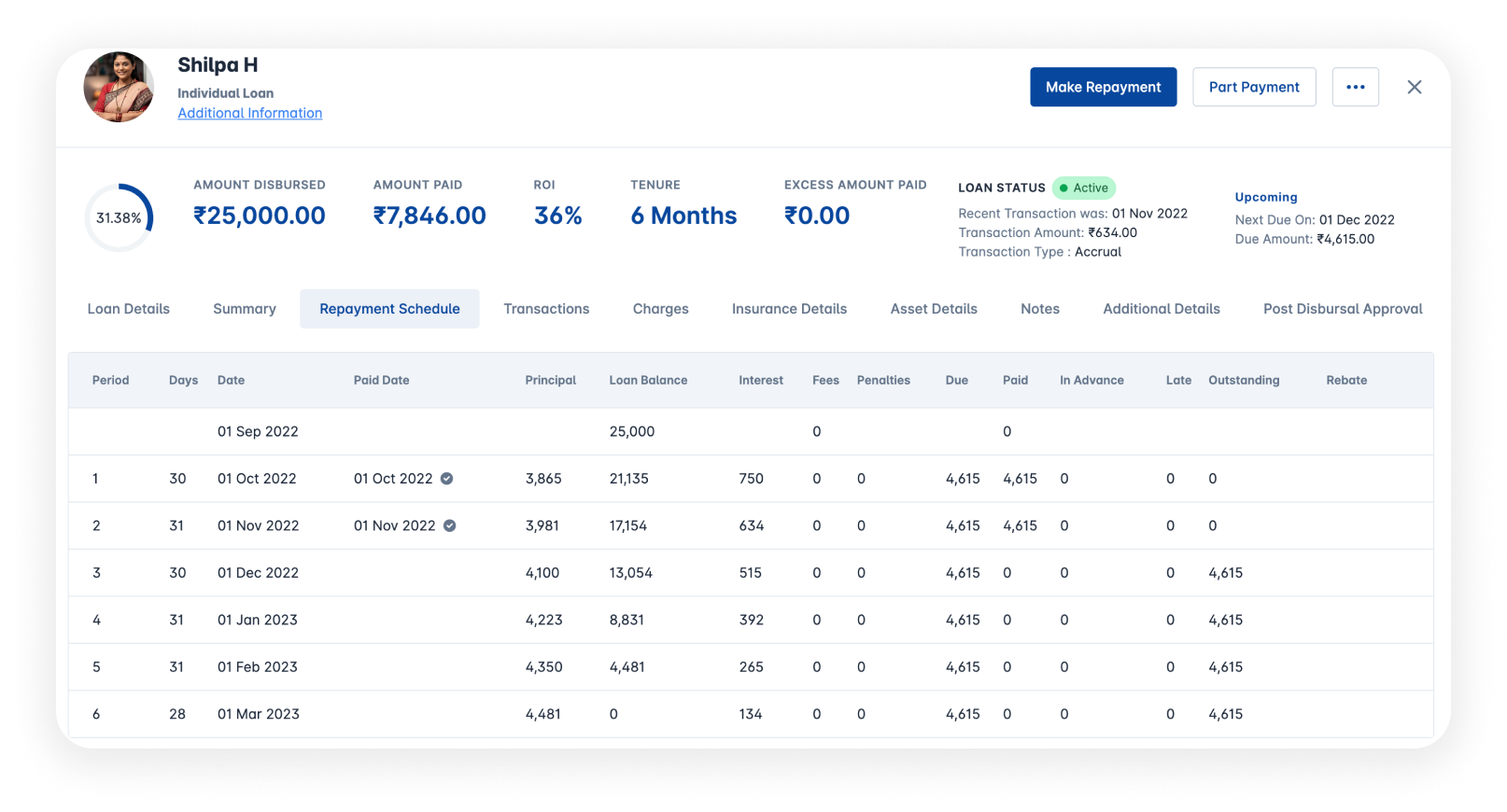

Flexible repayment options

Loan restructuring capability

Moratorium & subvention handling

DPD & NPA tracking

Integrated reports repository

Create 15+ unsecured & secured loan products from a single UI and scale your lending operations with ease

A loan management platform designed to enhance your lending operations while ensuring compliance throughout the process

Faster go-to-market

Supports varied repayment scenarios

Integration with different accounting tools

Custom reports for portfolio analysis

Fully compliant

Our loan management system is suitable for a range of financial institutions, including NBFCs, banks, credit unions, fintech companies, and microfinance institutions. These organizations benefit from our loan management system's ability to handle diverse lending needs efficiently.

Our loan management system caters to 15+ loan products with tailored configurations for loan types, such as personal loans, business loans, vehicle loans, gold loans, payday loans, microloans and other loan products.

Yes, lenders have the flexibility to configure all key components of the system to suit their specific requirements in our loan management system. This includes customizing loan terms, repayment schedules, charges and fees, repayment frequency, and more. Whether you need to adjust the interest rates, define grace periods, or set up specific payment plans, Finflux by M2P’s LMS provides the tools to tailor the system to your lending policies and business needs. This level of customization helps ensure that the system aligns with the unique processes and rules of each lender.

Lenders can easily restructure or reschedule loans based on their specific terms. Additionally, Finflux by M2P’s loan management system allows lenders to configure changes to loan terms, repayment schedules, interest rates, and other parameters to accommodate borrower needs, ensuring flexibility while maintaining compliance with the lending policies.

Yes, our loan management system supports bureau reporting. This includes integration with the major credit bureaus, allowing lenders to report borrower data to Experian, Equifax, TransUnion, and any additional required bureau. Loan management system ensures seamless and accurate reporting, helping to maintain compliance and provide comprehensive credit information to lenders and credit agencies.

Our loan management system can generate both standard and custom reports to meet specific lender needs. Standard reports include loan portfolio summaries, repayment schedules, arrear aging reports, disbursal reports, collection reports, etc. Additionally, Finflux by M2P’s loan management software allows for the creation of custom reports, enabling to tailor reports based on specific criteria such as loan type, borrower demographics, payment history, and more. This flexibility ensures lenders have the right insights to make informed decisions and manage loan operations effectively.

Yes, our loan management system supports loan loss provisioning at the product level. This feature allows lenders to set aside provisions for potential loan losses, helping them manage risk and comply with regulatory requirements. The system enables to track and adjust provisioning based on the performance of their loan portfolio, ensuring accurate financial reporting and more effective risk management.

Our loan management system supports SMA (Special Mention Account) classification in compliance with RBI (Reserve Bank of India) regulations. The system enables lenders to classify loans based on their payment status and risk profile, ensuring adherence to RBI guidelines for early identification of stressed assets. This helps in proactive management of non-performing loans and supports effective risk mitigation strategies.

Our loan management system include advanced reporting tools that provide insights into loan origination, repayment statuses, and compliance metrics, helping organizations make data-driven decisions.

Our loan management system is designed to integrate seamlessly with a variety of systems to ensure smooth data flow across your organization. Key systems that can be integrated with Finflux by M2P’s LMS include CRM, ERP, lead management tools, multiple LOS systems and reporting tools. These integrations help automate workflows, reduce manual data entry, and provide a unified view of operations, making loan management process more efficient and accurate.

Our loan management system aids in regulatory compliance by offering automated reporting, audit trails, and adherence to global standards. These features help financial institutions meet compliance requirements and pass audits smoothly.

Our loan management system provides robust security features such as data encryption and access restrictions to safeguard sensitive borrower information. Ensuring data security is a top priority in our loan management software.