Samit Shetty

Director @ Chaitanya India Fin Credit Pvt. Ltd.

For many years, technology had been a barrier to our rapid expansion plans. With Finflux, technology is now our primary business accelerator.

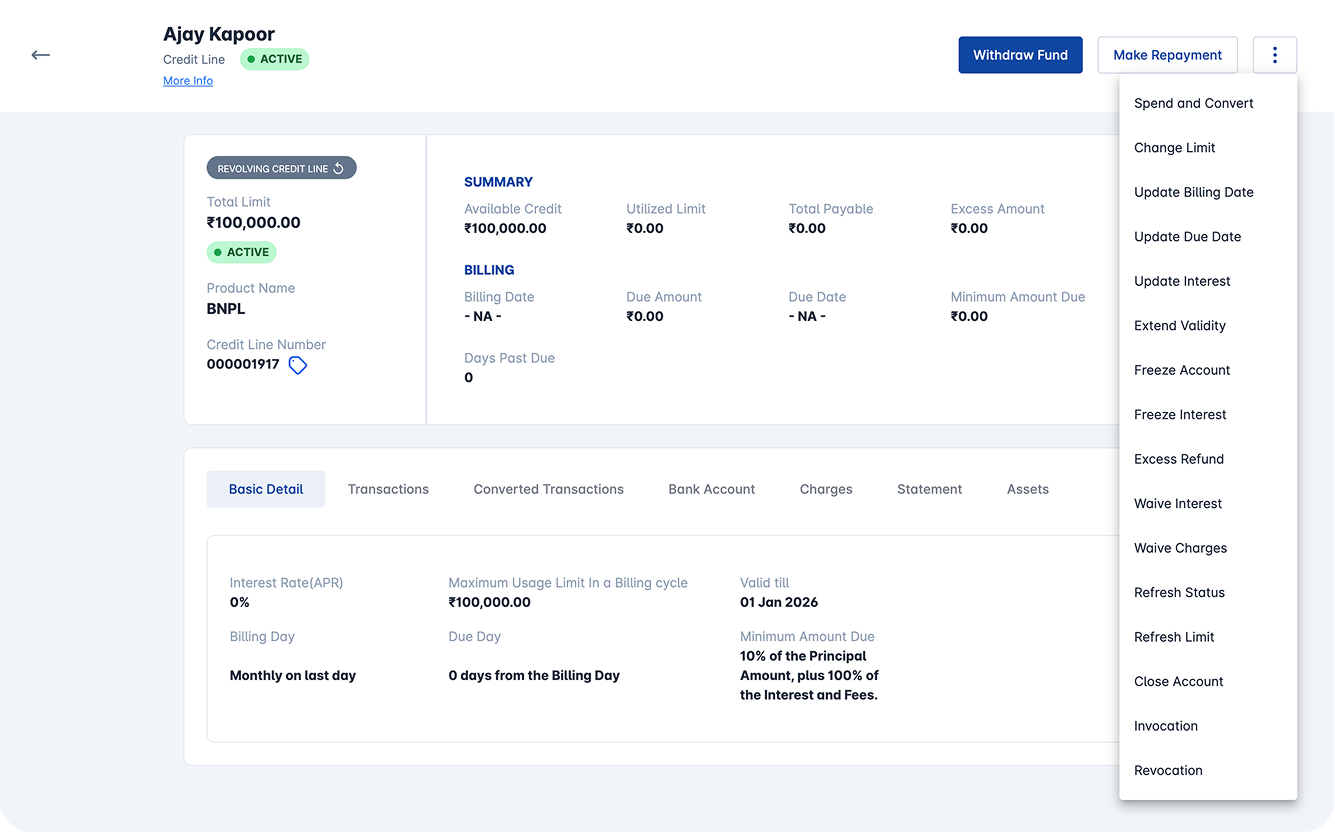

BUY NOW, PAY LATER

Optimize your lending process with customizable loan origination and loan management solutions

Merchant onboarding & dashboards

Daily/Weekly/Monthly billing setup

Dynamic bill and due date setup

Automate cancelation requests based on return policies or merchant integrations

Enable auto-debit to streamline repayments

Auto soft and hard freeze on NPAs

Bill aggregation for consolidating multiple dues into a single bill