Samit Shetty

Director - Chaitanya India Fin Credit Pvt. Ltd.

For many years, technology had been a barrier to our rapid expansion plans. With Finflux, technology is now our primary business accelerator.

Loan against mutual funds

Power your Loan Against Mutual Funds operations with our full-stack loan origination & loan management system

Interest-only billing on utilized principal

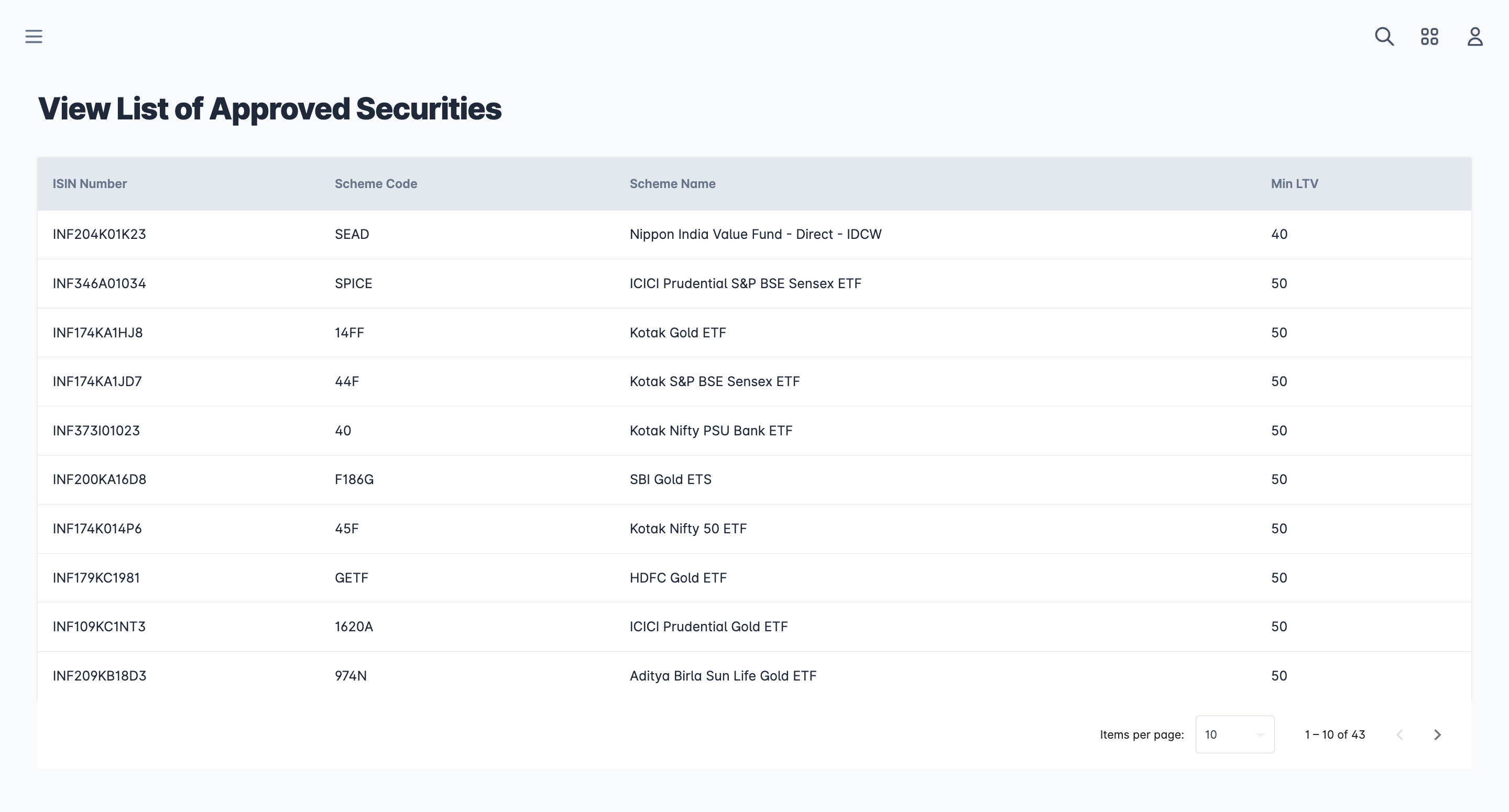

Manage approved securities with min and max LTV

Collateral holding reports with ISIN details

Real-time NAV updates and automated daily drawing power calculations

Automated notifications on shortfall for repayment/additional pledging/liquidation

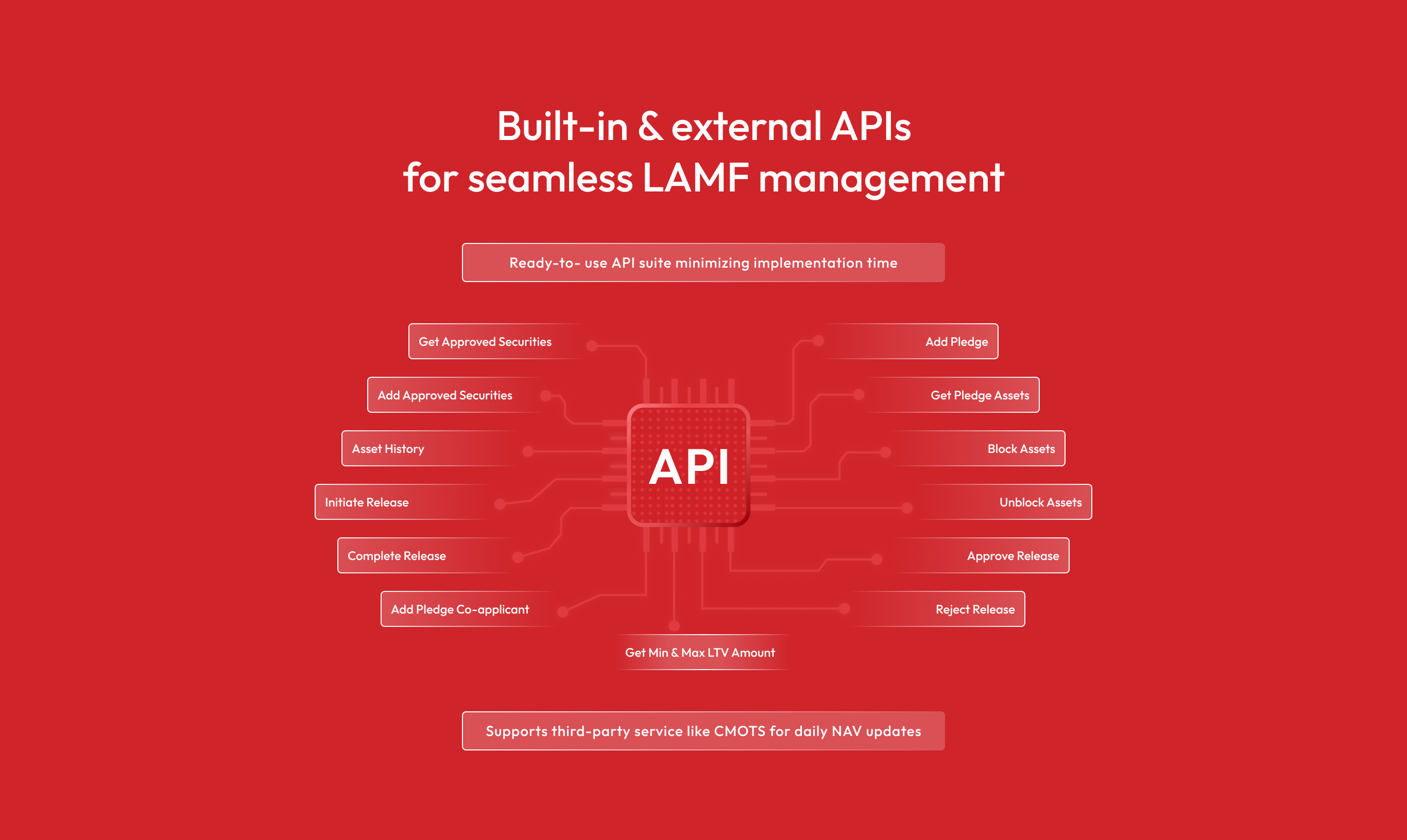

Pledging, invocation, & release management

Our LAMF product provides:

Our LAMF solution is ideal for: