M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

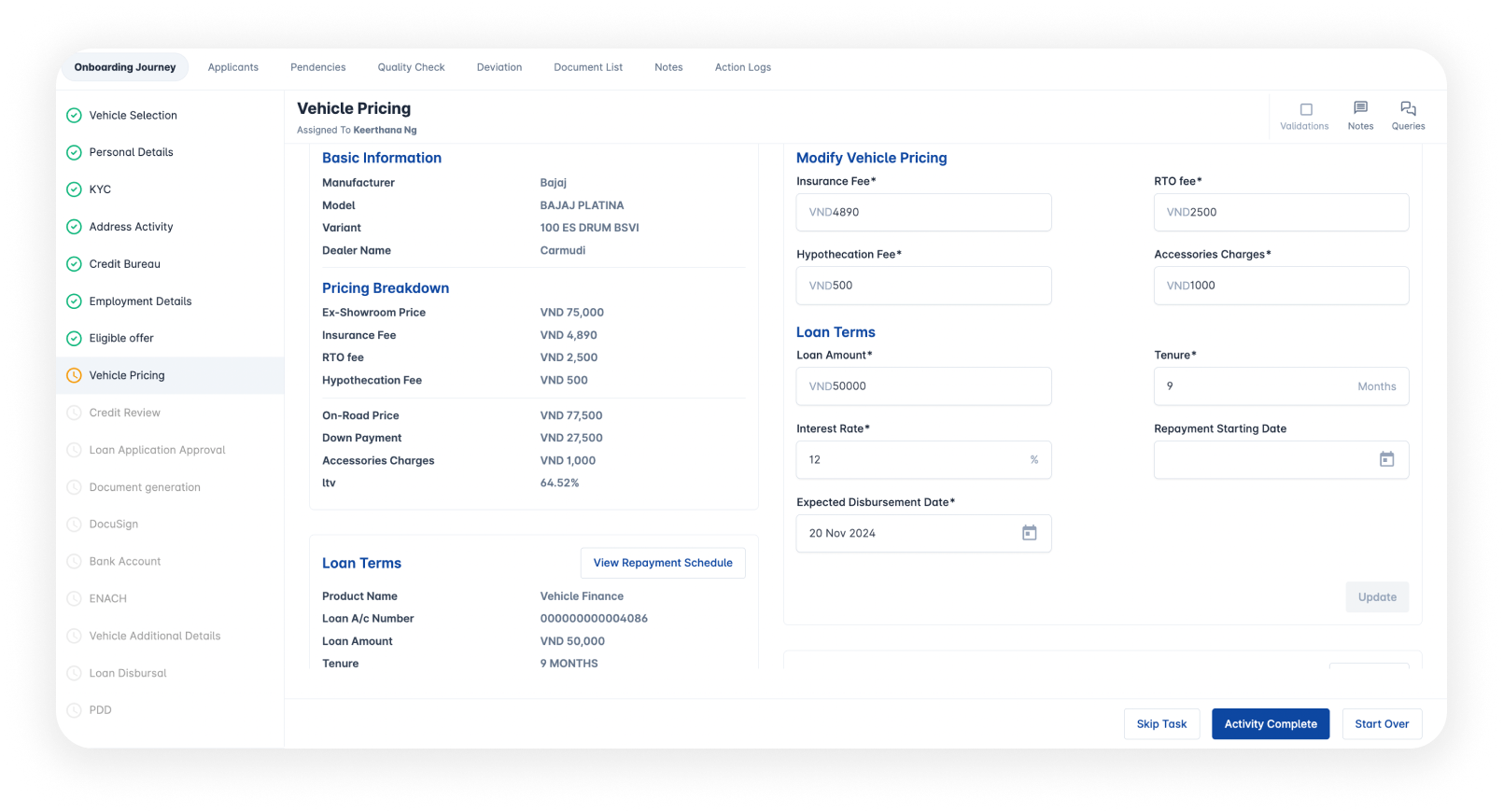

Loan origination system (finflux)

Create custom digital journeys within minutes

Borrowers Serviced

Active Loan Accounts

Total Loan Portfolio

Peak Capacity

Create workflow-driven custom onboarding journeys with our low-code loan origination system for quick qualification and loan approvals

Full API stack

Workflow builder for onboarding journeys

Customer notification engine

Automatic and manual deviation handling

Document generation and e-sign

Leverage 100+ parameters to craft personalised journeys on a drag-and-drop interface for effortless omni-channel sourcing

Drive customer conversions and streamline the complete onboarding journey from sourcing to disbursement

Faster to configure and deploy

Create personalised loan journeys

50+ pre-built third party integrations

BRE for automated underwriting

Reduced customer drop-offs

Our workflow-based loan origination system offers key features like low-code form builders that automate the entire customer onboarding process, from application processing and credit assessment to document management, automated underwriting, compliance tracking, till disbursement.

Our loan origination software accelerates the loan application process by digitising the entire customer onboarding journey. It automates repetitive tasks, minimizes manual errors, and centralizes lead sourcing from various channels, including branch, assisted, and DIY methods.

Yes, our loan origination software includes credit assessment features like BRE for automated decisioning and multiple scoring models, allowing lenders to evaluate borrowers’ creditworthiness and minimize risk during the loan origination process.

Lenders can create customer onboarding journeys for 15+ loan product types with our loan origination system, including personal, gold, education, business, auto loans, etc. This versatility allows our loan origination system to cater to diverse borrower needs.

Our loan origination system simplifies document management by allowing digital document uploads, storage, and retrieval, making it easier for lenders to track and verify documentation digitally.

Yes, our loan origination system is fully compatible with major CRM and core banking systems. It has 50+ in-built third-party integrations in place, ensuring a seamless workflow. These improve data flow across systems to enhance operational efficiency of the loan origination process.

Our loan origination software includes built-in compliance checks, audit trails, and automated reporting to help lenders meet regulatory standards.