Samit Shetty

Director @ Chaitanya India Fin Credit Pvt. Ltd.

For many years, technology had been a barrier to our rapid expansion plans. With Finflux, technology is now our primary business accelerator.

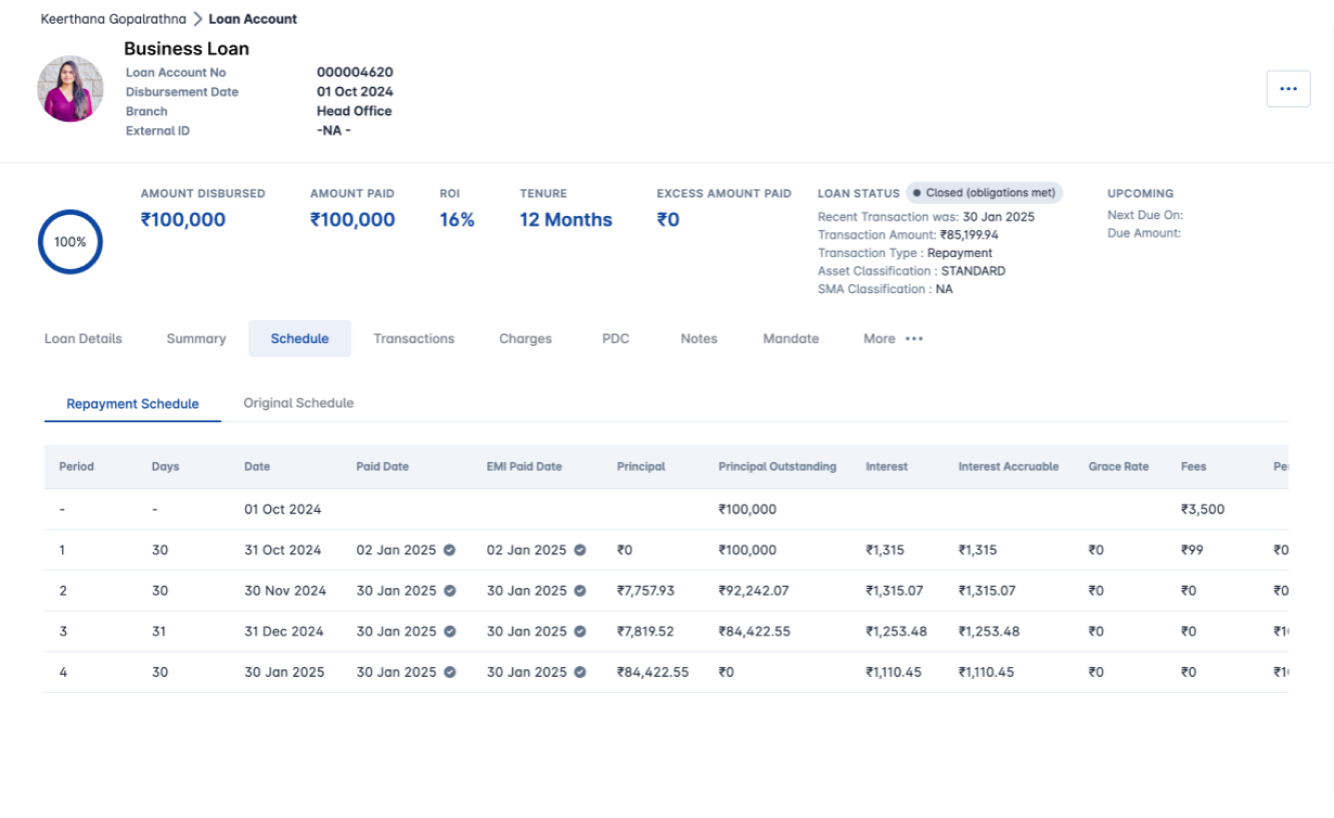

business loan

Boost your business loan operations with our customizable loan origination and management systems

Supports typical business loan structures: EMI, EDI

Fully Digital LOS with BRE Engine & DIY workflow setup

End-to-end support for onboarding: KYC, income validation, CB checks, & disbursement

Includes moratorium and asset classification features

Multi-lender support, automated reconciliation, and flexible lender selection