What is the Loan Against Property (LAP) module in M2P Loan Management System?

How does the LAP module streamline the loan lifecycle for lenders?

Can the LAP module be configured for different property types and borrower profiles?

Does it support integration with credit bureaus and property valuation APIs?

Can lenders set custom LTV, interest rates, and risk grading logic?

Is there a provision to manage co-applicants and guarantors?

How does the system manage overdue accounts and NPAs?

Does M2P’s LAP module support both fixed and floating interest rates?

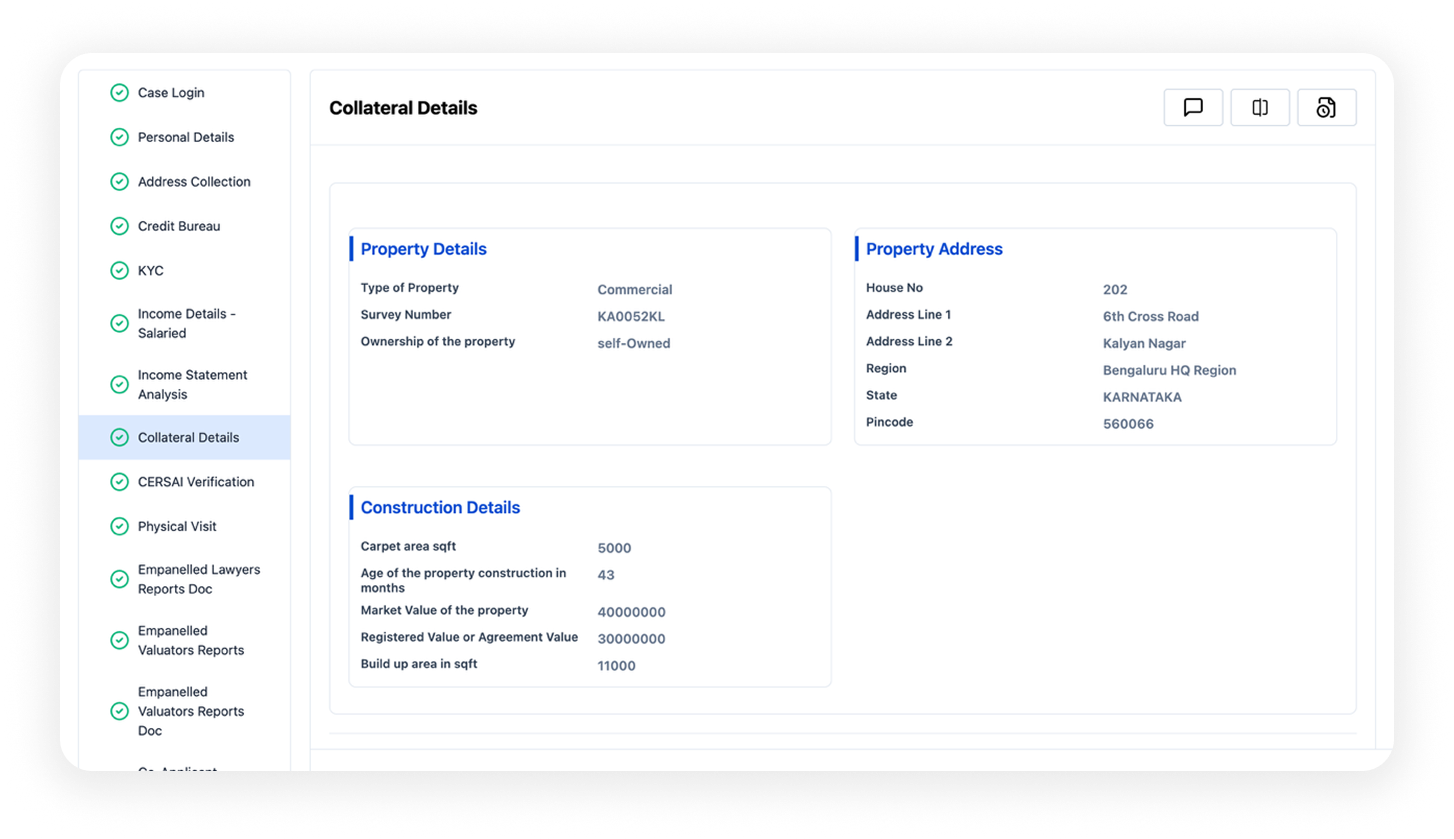

Can we track collateral details and property documents within the system?

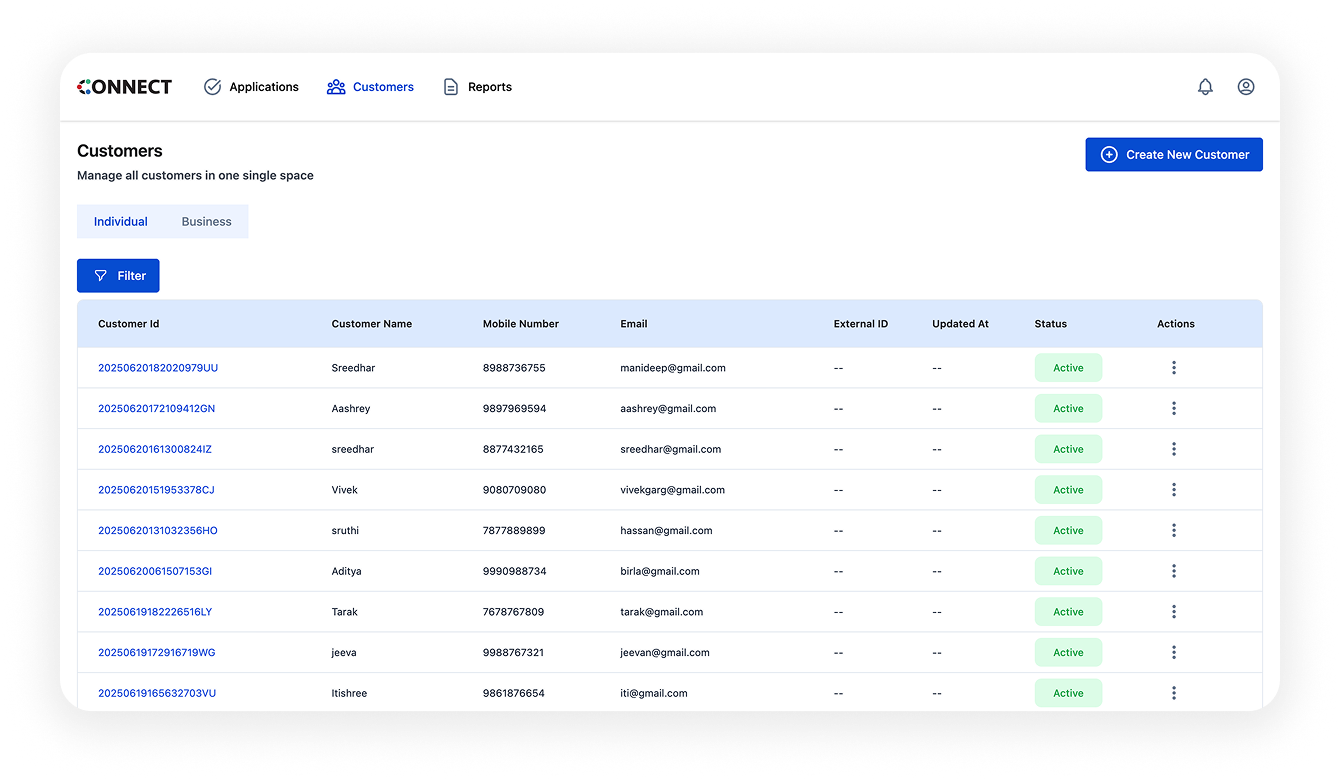

Is the LAP system scalable across branches and digital lending channels?