Samit Shetty

Director @ Chaitanya India Fin Credit Pvt. Ltd.

For many years, technology had been a barrier to our rapid expansion plans. With Finflux, technology is now our primary business accelerator.

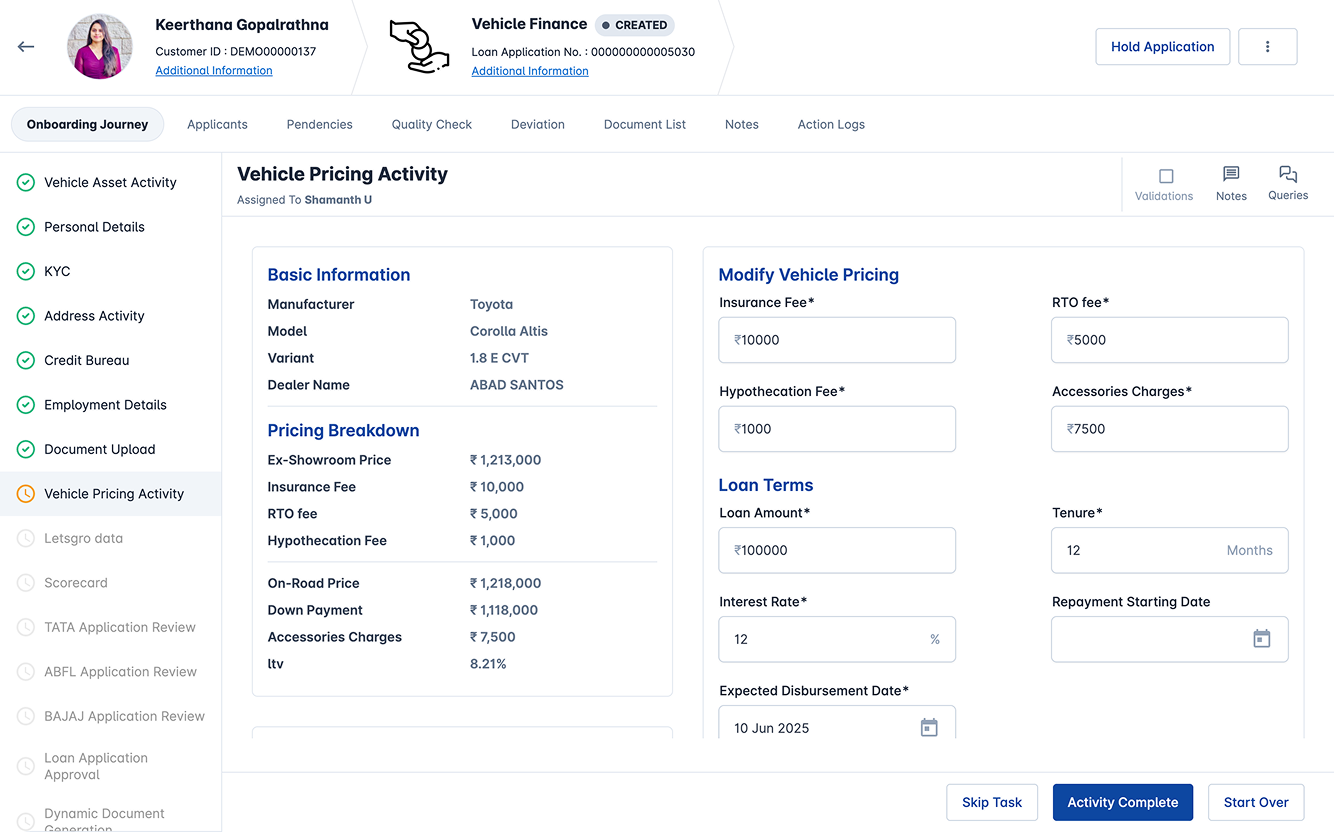

Vehicle loan

Amplify your vehicle loan operations with our comprehensive loan origination and loan management systems.

Masters management (Dealer, Location, Vehicle, Price)

Agent/Dealer app for assisted onboarding

Hybrid sourcing with assisted and customer driven options

Pricing engine for all components

Customizable workflows and full-service LMS

Supports EV, used/new vehicle, commercial vehicle loan journeys