M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

AI and ML are revolutionizing fraud detection in financial services by analyzing vast volumes of transactional and behavioral data in real time, recognizing subtle anomalies, complex fraud patterns, and emerging risks that traditional rule-based systems often miss.

While real-time analysis, pattern recognition, and self-learning are the foundational elements of modern fraud detection, the true revolution of AI in fintech extends into highly specific and sophisticated domains.

Traditional methods look at a single user or transaction in isolation. GNNs are designed to identify fraud rings and complex networks.

GNNs map out relationships between entities like users, devices, accounts, and IPs. The model can identify a hidden connection, such as a group of seemingly unrelated accounts that all logged in from the same device in a fraudulent cluster. This allows institutions to find and shut down entire fraud networks at once, rather than catching them one transaction at a time.

In a highly regulated industry like fintech, trust requires transparency; institutions and regulators must know precisely the rationale behind an AI model’s suggestion.

XAI provides a clear audit trail for every decision. If a loan application is flagged for fraud, the system can provide a transparent report detailing which specific data points (e.g., location history, application inconsistencies) led to the high-risk score. This builds trust in the AI system and is crucial for regulatory compliance, ensuring that decisions are fair, auditable, and not biased.

The rise of sophisticated scams, with fraudsters now using Generative AI, has forced a definitive industry response. According to Feedzai’s 2025 AI Trends Report, nearly nine in ten leading financial institutions surveyed have adopted AI solutions, with two-thirds doing so in just the past two years. By actively deploying AI-powered defenses, these institutions are “fighting fire with fire.”

Financial institutions are rapidly adopting AI/ML-driven fraud prevention to counter the rise in sophisticated digital scams, phishing, synthetic identities, and coordinated attacks. Solutions like entity risk scoring, adaptive authentication, and predictive fraud models are now central to industry strategies.

These innovations allow financial services to protect customers, reduce operating costs, and comply with stringent regulations, turning AI and ML into a competitive edge in the fight against financial crime.

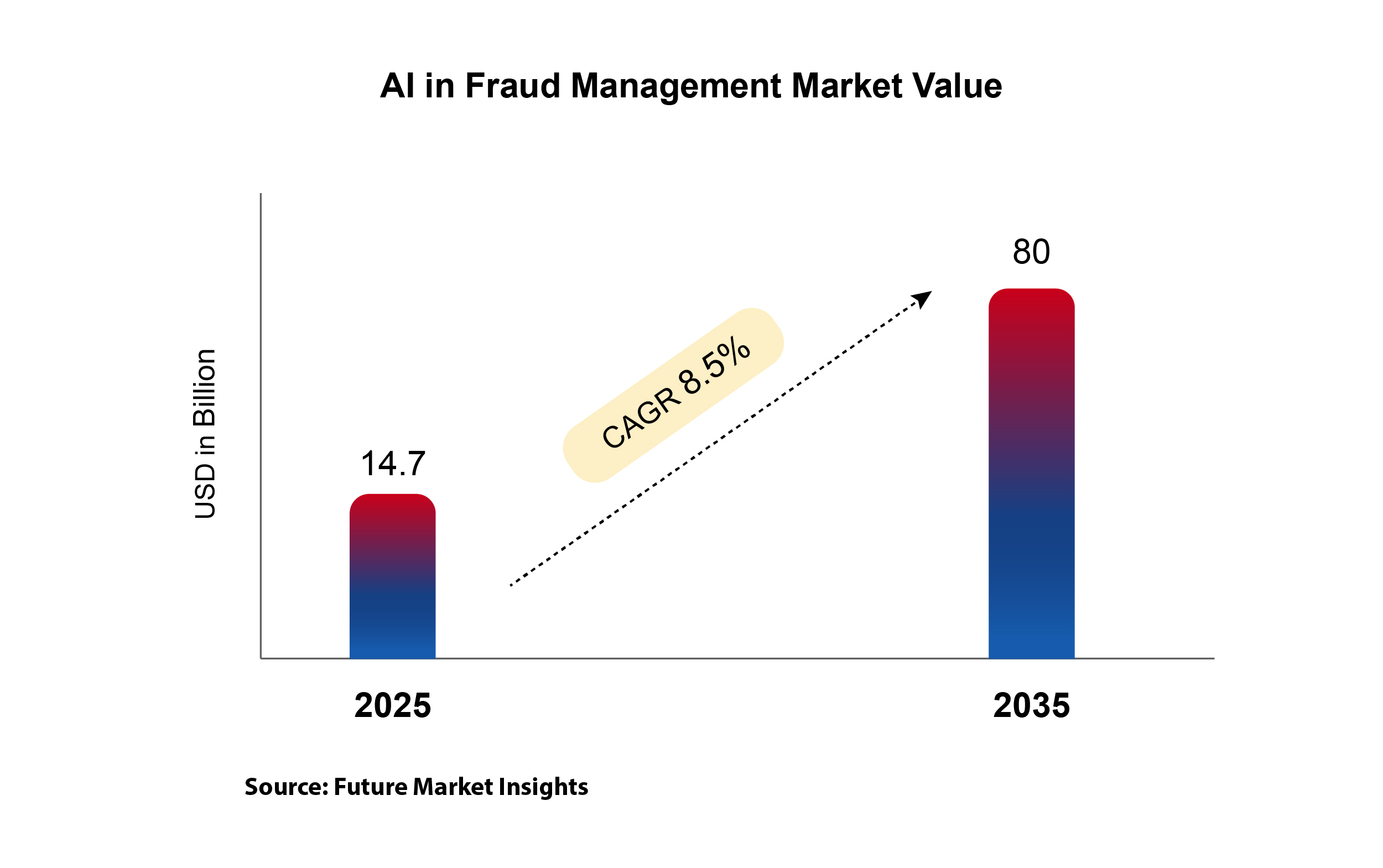

The AI-driven fraud management market is set to hit $22.1 billion by 2030.

Introducing The Leader Series! This edition features Aarti Ramakrishnan, whose success is rooted in her belief that “Mission is the Boss.” This principle strengthens M2P’s foundation by driving team unity, accountability, and bold new directions.

Kannan Murali, Head of Products, joined global industry leaders in an exclusive panel discussion at the Global Fintech Fest 2025 to explore transformative fintech innovations that are redefining the financial ecosystem.

Co-founder Madhusudanan R hosted a closed-door session at the Global SME Finance Forum 2025 in Johannesburg on AI-Driven Lending and Payments, exploring how AI-led innovation is essential for bridging the SME credit gap, powering real-time payments, and achieving financial inclusion at scale across emerging markets.