M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Today’s consumers expect banking to be as intuitive as speaking aloud.

“Hey Siri, what’s my account balance?”

This simple phrase reflects a seismic shift in how we interact with money. As of 2025, over 20% of the global population are actively engaging with voice search, with a staggering 8.4 billion voice assistants in use globally. Over 153 million people in the United States use voice assistants, with Siri being the most popular, serving approximately 86.5 million users. Voice technology is fast becoming the go-to interface for financial services.

Voice assistants have evolved far beyond weather updates and playlists. Today, they’re helping users

This transition from screen-based to voice-first banking is streamlining customer experiences and reducing friction in everyday financial tasks. In fact, over 50% of smartphone users now rely on voice assistants for everyday searches, prioritizing speed and convenience.

Security is a top concern, and voice tech is rising to meet it. The voice biometrics market, valued at $2.63 billion in 2025, is expected to reach USD 5.70 billion by 2030. By analyzing vocal patterns, tone, and cadence, voice biometrics offer a secure alternative to passwords and PINs. However, with the rise of deepfake threats, banks are pairing voice authentication with multi-factor verification and anti-spoofing analytics to stay ahead.

Voice interfaces are breaking barriers for underserved communities. In regions with low literacy or limited access to digital infrastructure, voice banking in local languages is enabling more people to manage their finances independently. This is especially impactful in rural areas, where traditional banking infrastructure is scarce.

Powered by AI and Large Language Models (LLMs), voice assistants are now capable of understanding context, intent, and even emotion. This allows banks to deliver tailored financial advice, proactive alerts, and real-time support, all through natural conversation.

Imagine asking, “Can I afford this purchase?” and getting a smart, data-backed answer instantly.

As voice tech seamlessly integrates with wearables, smart homes, and vehicles, it promises true omnichannel banking. The next big leap in financial services will begin with something as simple as saying, “Hello, bank.” The shift is subtle, but the impact could be profound, let’s see where voice takes us next.

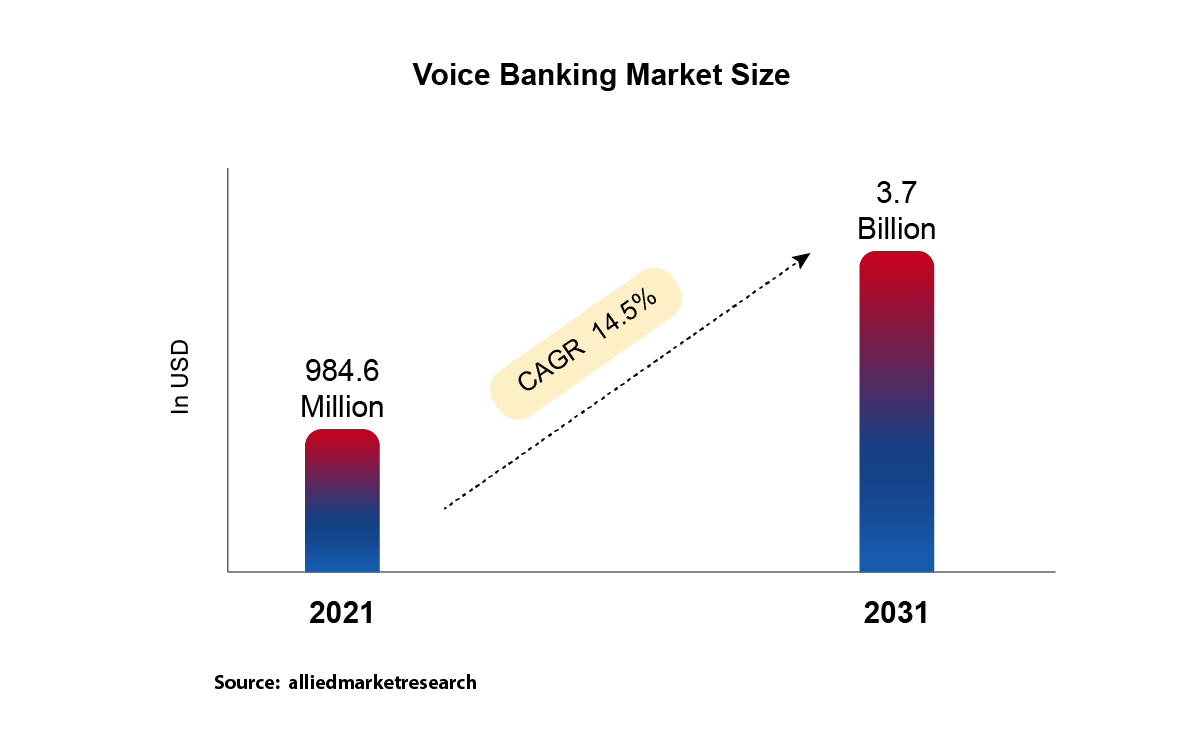

Voice banking adoption on surge!

Madhusudanan R, Co-founder, participated in a roundtable discussion on ‘De-Risking SME Finance’ at the Global SME Finance Forum 2025. The session highlighted scalable guarantee models, data-driven strategies, and tech-led collaboration to unlock SME growth in emerging markets.

M2P made its mark at Global Fintech Fest 2025—three days of innovation, launches, and meaningful conversations. We unveiled new products and strengthened fintech partnerships, all while reaffirming our commitment to building future-ready solutions.