M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

APIs have been foundational to banking technology for well over a decade, enabling seamless communication between systems and powering financial services. What’s new is the unprecedented scale and sophistication with which modern banks use APIs, not just to comply with regulations like PSD2, but as engines of innovation that enable real-time finance.

In 2025, open banking APIs handle over 137 billion calls globally, a number projected to surpass 720 billion by 2029, supporting everything from instant payments to dynamic product bundling.

In traditional banking models, customers with accounts at multiple financial institutions found it difficult to quickly generate a picture of their overall financial situation; clients who wanted such an accounting lens for their personal finances were forced to combine transaction histories from individual sources themselves. Open banking, by contrast, allows applications to pull data from all the institutions where an end-user holds accounts, creating a more holistic financial view of—and for—a customer. And technology, once limited to specialized aggregators and other third parties, is now entering the mainstream.

API banking is now the backbone for next-generation financial experiences, powering both consumer convenience and operational efficiency across the sector. In 2025, banks and fintechs are leveraging APIs across a diverse set of high-impact use cases:

With this broadening application set, API banking is the critical infrastructure for delivering real-time, data-rich, and personalized financial services at scale.

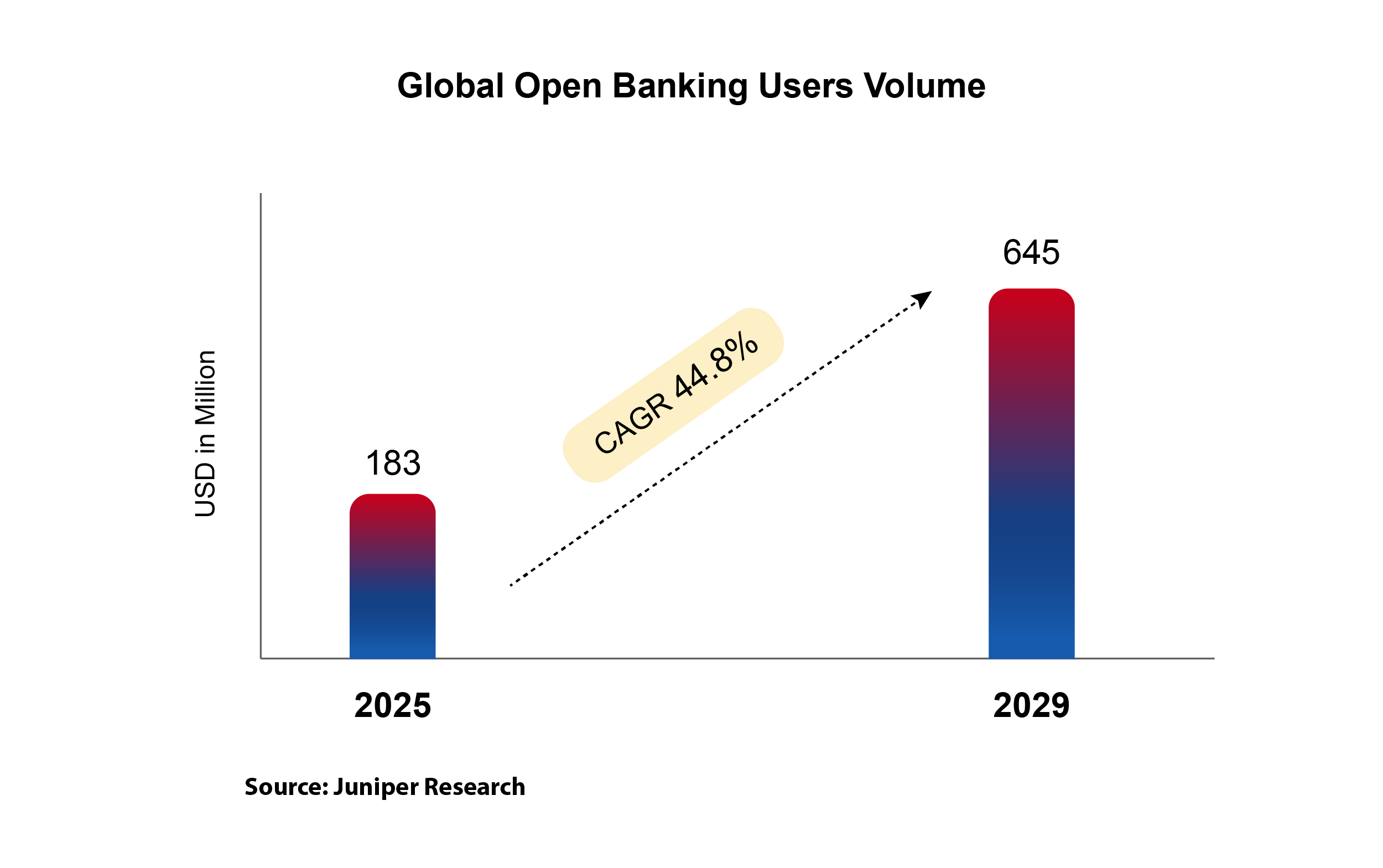

The total number of Open Banking users globally is set to reach over 645 million by 2029.

Co-founder Madhusudanan R was recently featured in Inc42 Media as part of a showcase of leading founders shaping Tamil Nadu’s vibrant, future-ready startup ecosystem.

At Global Fintech Fest 2025, Abhishek Arun, President – Platform Strategy & Commercialization, moderated a panel discussion on “Collections 2.0: Compliance-First Collections + Gamification, UPI-Pull, and Conversational AI,” where industry leaders explored how technology and regulation are reshaping collections into a more transparent, consumer-friendly framework.

M2P has partnered with Visa to simplify and accelerate debit card issuance for rural banks in the Philippines, combining M2P’s technology and operational support with Visa’s network and CTBC Bank’s BIN sponsorship to boost efficiency and better serve customers.