M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

2025 is the year the ‘build vs buy’ debate in fintech finally ended.

Over the past decade, enterprises have grappled with the trade-offs between custom development and off-the-shelf platforms. But today the no-code and low-code platforms have become the new core system for speed, fundamentally changing the development calculus. According to a recent report, it is estimated that these tools cut feature delivery time by up to 70% and development costs by 50–60%.

Some leading platforms have rolled out fintech-native templates: pre-audited KYC/KYB flows, PSD2/Open Banking connectors, PCI-DSS-scoped payment widgets, and real-time fraud-rule engines that can be dragged into production in days, not quarters.

The biggest shift? Traditional development teams are freed to focus on what truly matters: security hardening, scale architecture, and proprietary algorithms.

No-code and low-code platforms have evolved from optional tools to essential strategic priorities for controlling costs and meeting customer expectations. M2P’s Connect platform is built precisely for this challenge. Connect empowers businesses to rapidly develop APIs, orchestrate complex workflows, build intuitive user interfaces, and apply sophisticated decision logic, all through seamless no-code configuration.

Its modular design includes,

This powerful combination helps CXOs accelerate go-to-market, reduce costs, and unlock new revenue streams, all with confidence and ease.

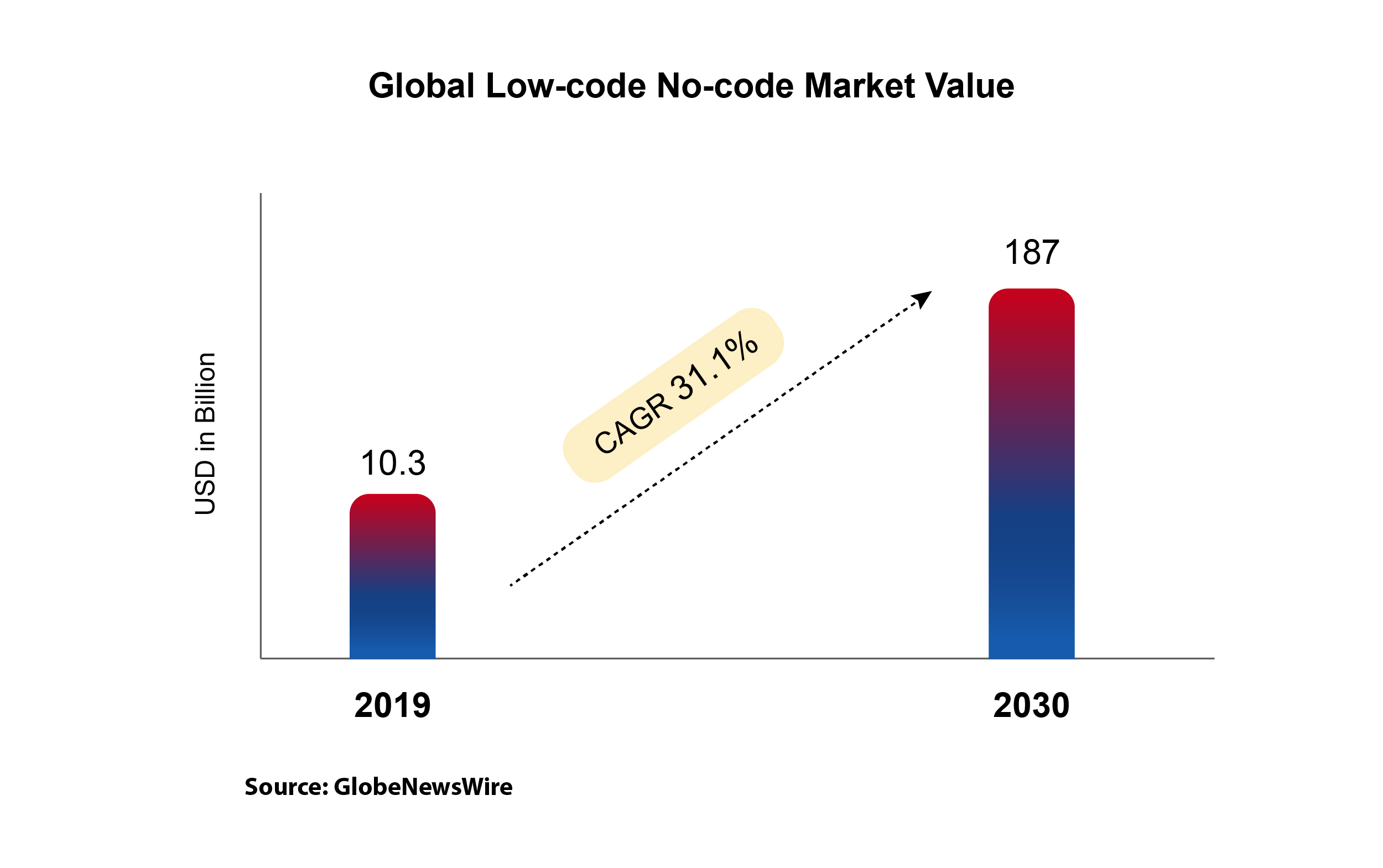

The global low-code no-code market is projected to grow to $187 billion by 2030.

At TechSparks 2025, Co-founder Prabhu Rangarajan joined a panel on “India’s deeptech decade: From jugaad to AI-first innovation,” moderated by Shradha Sharma with Arjun Rao and Vishesh Rajaram, to discuss how India can accelerate a deeptech ecosystem powered by conviction, patient capital, and sustained support for frontier technology.

Recognized among India’s Top AI Leaders, Co-founder Prabhu Rangarajan was honored by YourStory Media and Amazon Web Services (AWS) at TechSparks 2025 for driving meaningful, AI-led innovation in fintech.

Nikhil Bhat, Senior VP at M2P, joined the Groq x YourStory TechSparks 2025 leadership roundtable on real-time AI, ultra-low latency, and sustainable computing.

M2P co-hosted an executive roundtable on Smart Lending with Mobio Platform and GreenNode, focused on hyper-personalization and AI-driven decisioning.