M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

As MFIs expand, microfinance remains deeply human driven by group lending, social collateral, navigating weekly center meetings, collections, and RBI compliance in remote areas with limited connectivity. The challenge lies in scaling these human systems with speed, accuracy, and regulatory discipline. AI steps here, reengineering microfinance from the ground up.

AI-driven Microfinance

Enhanced automation, proactive risk management, and faster, transparent processes not only strengthen institutional performance but also deepen trust with borrowers. As technology and human insight work hand in hand, microfinance becomes more scalable, resilient, and responsive to the needs of underserved communities.

The future of microfinance is intelligent, inclusive, and deeply connected to grassroots.

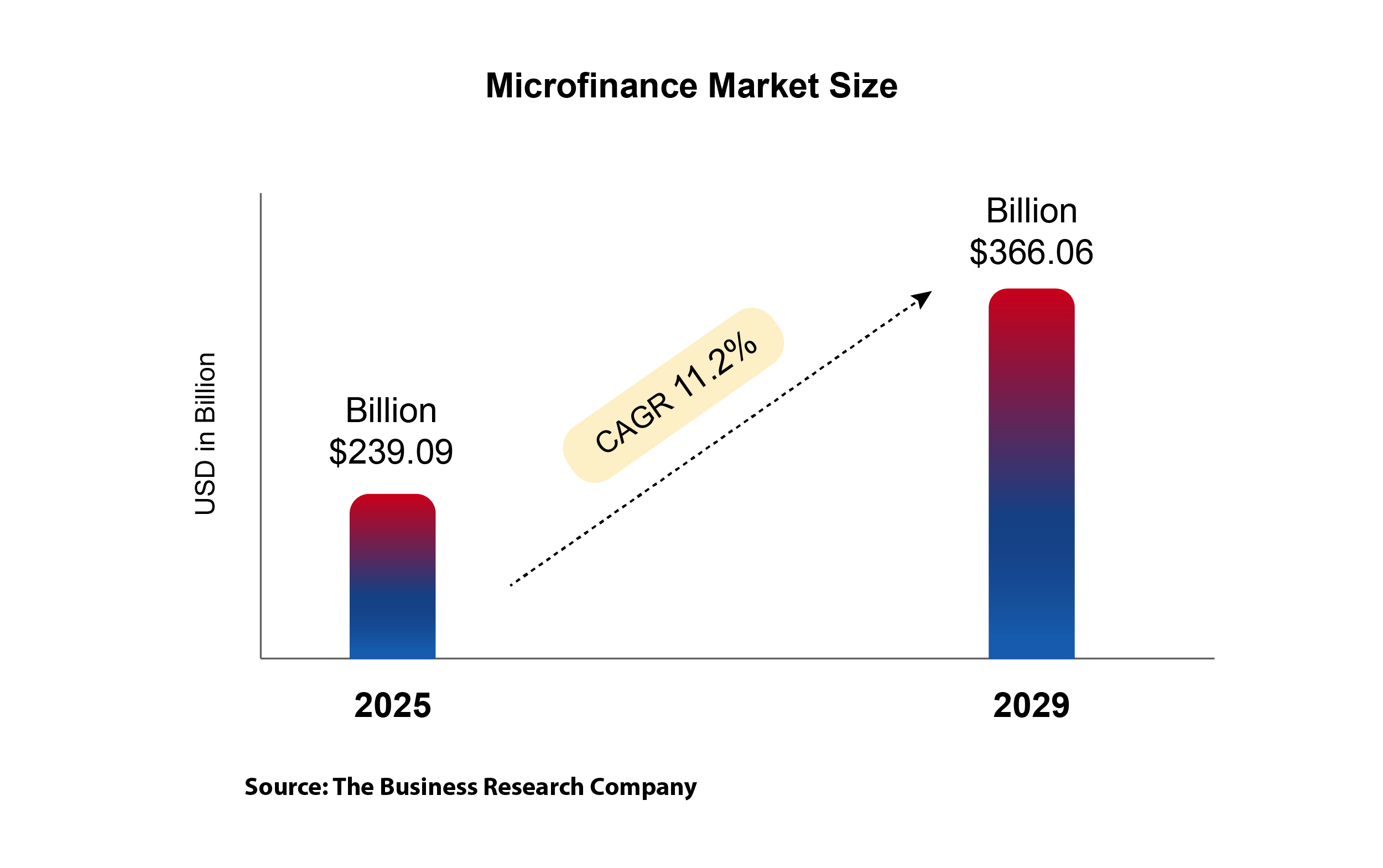

Microfinance Market on Uptrend!

At the 72nd Rural Bankers Association of the Philippines Convention we connected with rural banking leaders to discuss technology's role in streamlining operations, fueling sustainable growth, and strengthening trust across the ecosystem.

Prabhu Rangarajan, Co-founder, participated in the CEO Growth Dialogue at Nasscom Technology Confluence 2025 sharing his insights on synchronizing leadership vision with execution excellence to build resilient, future-proof organizations.

A keynote session was delivered by co-founder, Prabhu Rangarajan at the Magic Money TN Summit 2025, highlighting how founders develop financial judgment, assess opportunities, and prioritize long-term value in their decision-making.

Co-founder, Prabhu Rangarajan shared his professional journey in The Half Brick Raw Stories – Chennai Edition 2025, highlighting the leadership decisions, disciplined practices, and strategic insights that have guided his growth as a founder.