M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Every second, millions of dollars move across borders. What’s changing isn’t just the volume it’s the speed, intelligence, and autonomy behind those transactions. Global money movement is no longer defined by delays, manual handoffs, and high costs. Instead, it is being reshaped by AI-driven intelligence and digital-first payment rails, unlocking real-time, secure, and scalable cross-border experiences.

Here’s what’s powering this transformation.

Blockchain is quietly redefining the base of cross-border payments.

Stablecoins are emerging as a compelling alternative to traditional correspondent banking, enabling near-instant settlement with significantly lower fees. Their ability to reduce currency volatility exposure makes them especially valuable for remittances and B2B payments in emerging markets.

Taking this further are tokenized deposits. These deliver the efficiency and transparency of blockchain while remaining fully backed by bank-held reserves. For financial institutions, this means faster settlement and improved traceability without overhauling core banking systems striking a balance between innovation and regulatory alignment.

Agentic AI transforms cross-border workflows by autonomously handling Foreign Exchange booking, intelligent payment routing, invoice reconciliation, and exception management. Payments are increasingly becoming self-directing, reducing operational friction, and dependency on manual intervention.

Beyond execution, AI strengthens the operational backbone:

Leading payment networks are already processing AI-initiated cross-border tasks at scale signaling a shift from assisted automation to true autonomy.

Remittances are rapidly evolving from cash-heavy to mobile-first digital ecosystems. Nowadays customers expect faster settlement, lower fees, and transparent FX rates. Modern remittance platforms are responding by layering in value-added services such as financial memberships, savings features, and stablecoin-based apps turning one-time transfers into long-term financial relationships.

Digital wallets are evolving from domestic tools into globally connected networks. Interlinking initiatives are enabling billions of users to transact seamlessly across regions often without relying on traditional bank rails. As interoperability improves, wallets are poised to become a dominant interface for cross-border payments, particularly for retail and SME use

Cross-border payments are evolving rapidly becoming faster through blockchain rails, smarter with AI-driven decisioning, and more interoperable via connected wallets and APIs, enabling a seamless payments ecosystem.

For financial institutions, the opportunity lies in adopting next-generation digital architectures that combine automation, real-time settlement, and embedded compliance to deliver secure, scalable, and future-ready global financial services.

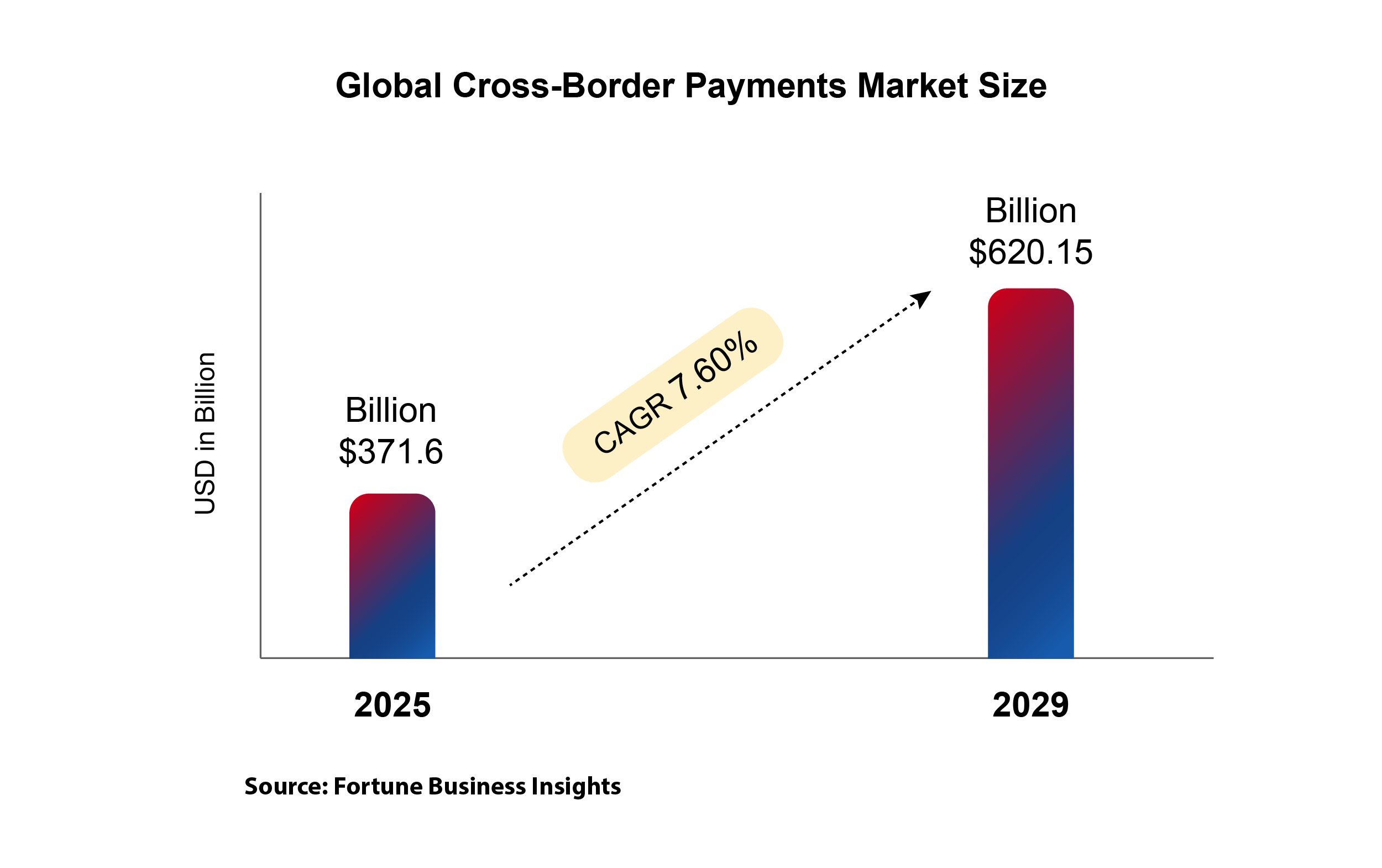

Cross-Border Payments on the Rise!

M2P’s DevOps team was recognized at the 9th India DevOps Show 2025 for Innovative Use of Open-Source Tools in FinTech, underscoring our commitment to engineering excellence, automation, and reliability at scale. At the event, Parani Raja, Vice President – Engineering, also participated in an expert panel on Culture, Scale, and Operations in DevOps, sharing insights on balancing speed, quality, and operational resilience in modern engineering teams.