M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Blockchain is familiar to most of us in the fintech space, and for a good reason.

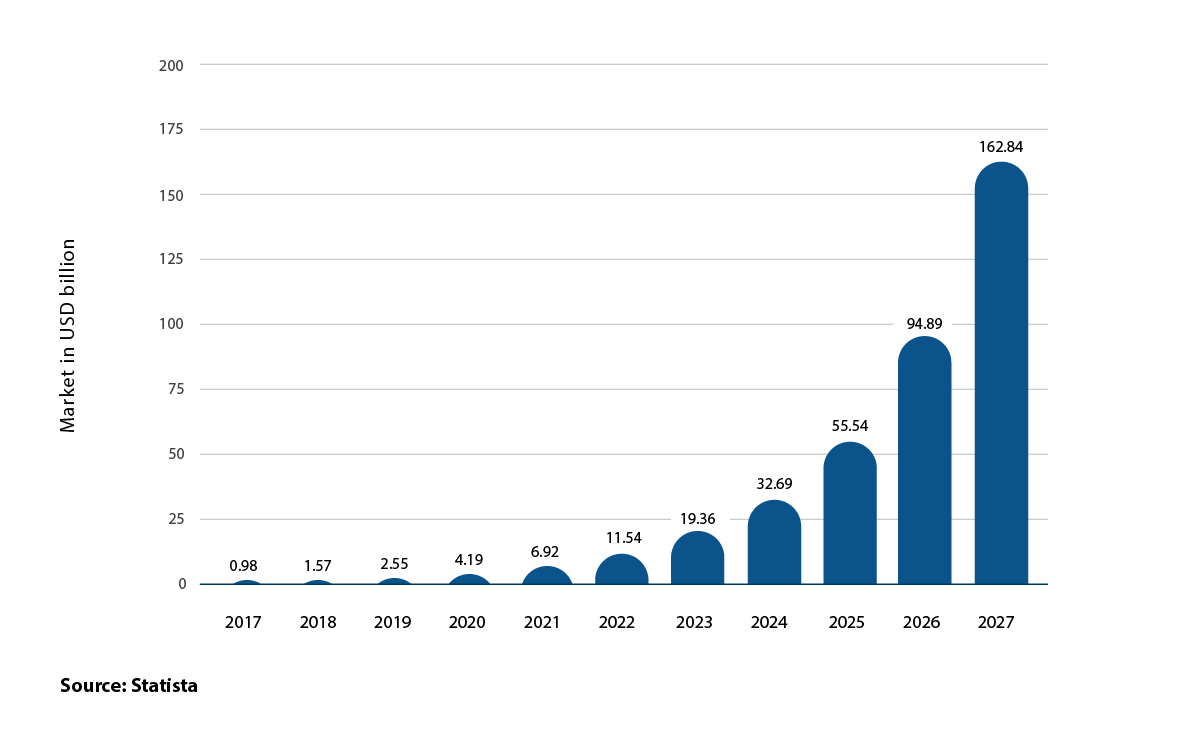

Blockchain is a $17.21 billion industry in 2023 with the potential to revolutionize the financial sector with its secure, transparent, and tamper-proof infrastructure. For the banking & investment sector, blockchain relieves operational and functional challenges and ensures authenticity, data integrity, process efficiency, and cost control.

Here are the top 3 blockchain trends in banking and investments to look out for.

It is expected that 2023 will witness significant advancements in the blockchain. From the rise of Metaverse to booming Decentralized Finance (DeFi) and green initiatives, the industry will experience unprecedented breakthroughs with huge ramifications for the banking and investment ecosystems.

If you want to know more about blockchain and its use cases, click here.

Nordek is the latest rising layer 1 blockchain ecosystem used for Web3 payments. By offering faster and cost-effective transactions, this revolutionary technology is driving the mainstream adoption of blockchain payments.

Stellar (cryptocurrency payments) connects Polkadot and Kusama blockchain ecosystems via the Spacewalk bridge to access their fiat on-ramp globally.

Coinbase introduced the Base (Layer 2 network) on top of the Ethereum chain, offering a secure, low-cost, and developer-friendly platform for building decentralized applications on Ethereum from anywhere.

Solana is positioned as a Layer 1 protocol to challenge Ethereum’s dominance in the smart contract space.

Our co-founder, Madhusudanan Rangarajan, moderated a panel discussion on 'Fintech and Lending: Going Beyond Distribution' at the India Fintech Conclave - a brand new initiative from Moneycontrol and Network18 group.

M2P secured 11th rank in Financial Times' High Growth Companies in Asia and 5th spot in 'The Economic Times and Statista India's Growth Companies 2023', which features the top 125 Indian companies that have reached the highest percentage growth in revenues between 2019 and 2022.

Our co-founder, Prabhu Rangarajan, participated in an engaging discussion at Umagine Chennai's Technology, Entrepreneurship, and Skill Summit, where they deep dived on ‘Navigating the Fintech Frontier: Trends, Challenges, and Opportunities Ahead’.

Prabhu Rangarajan participated in a panel discussion at ‘The Makers Summit 2023 presented by Inc 42 on the topic, ‘Seizing The $2 Tn Crossborder Payments Opportunity.’