M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The funding winter has propelled the startup ecosystem to diversify its capital sources. Adaptable, alternative financing without significant equity dilution and cost of capital is reigning in a new funding paradigm.

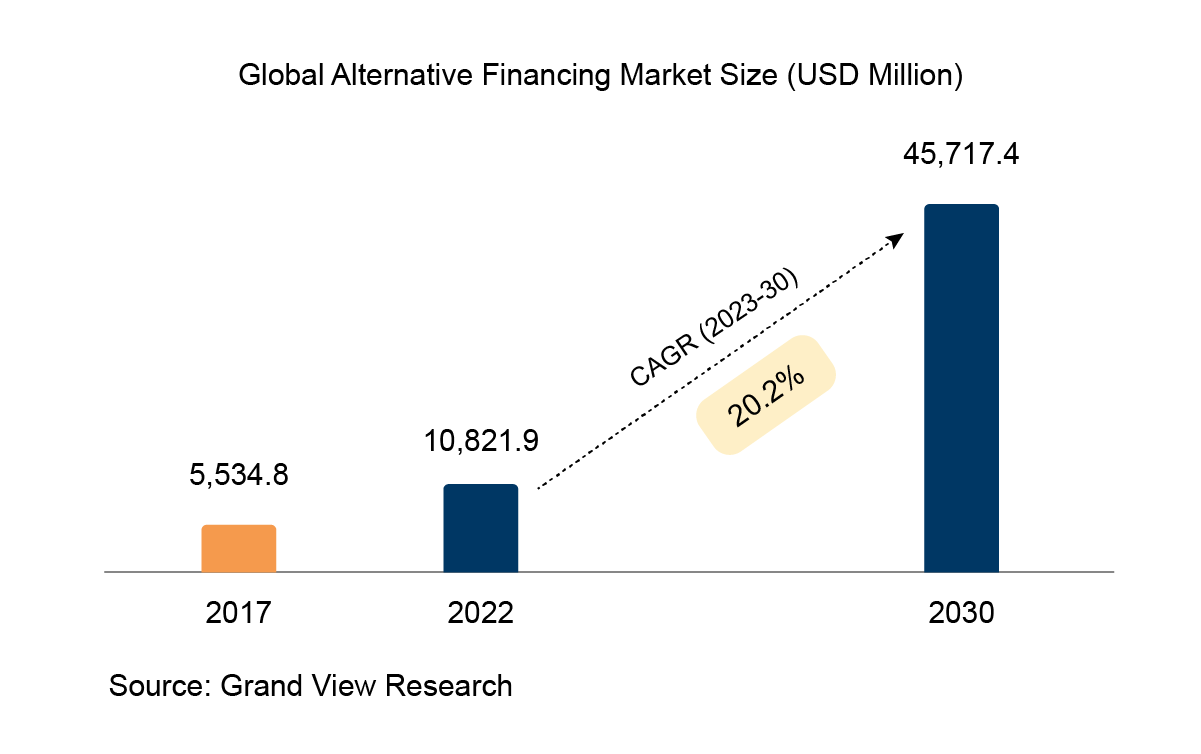

There has been a significant upswing in the alternative finance market, recently.

This is due to the demand for flexible financing options, technological innovations, and greater acceptance of alternative finance by the general investing public.

Alternative finance platforms are increasingly relying on AI and ML technologies to evaluate credit risk accurately, make lending decisions more efficiently, and serve a wider audience through online platforms. The integration of AI and ML is considered a key driver of growth in the alternative finance industry.

In India, alternative finance platforms are regulated with different guidelines. RBI guidelines focus on registration, capital requirements, and transparency, while SEBI guidelines focus on disclosure requirements, investor protection, and mandatory escrow accounts. Escrow is a secure financial arrangement where a third party holds and regulates payment until all agreement terms are met.

Alternative finance platforms benefit a wide range of industries, including housing and real estate project funding. Startups and SMEs also benefit from alternative finance platforms, as they often struggle to obtain financing through traditional channels.

SaaS platforms are a major growth area for software businesses, and alternative finance companies may adopt a similar approach with an all-in-one platform for various alternative finance offerings.

Distributed ledgers, or blockchains, have a wide range of uses in the finance sector, and many embryonic companies are emerging with innovative and creative blockchain-based alternative finance products.

While technology and automation are important in the finance sector, the personal touch is still highly valued, and alternative finance companies have an advantage in their ability to provide flexible, customer-focused service.