M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Does banking impact the environment?

Oh yes, it does.

Copper ore depletion in coin production, plastic pollution in payment cards, power consumption at ATMs, and carbon emissions from cash transportation are legitimate concerns.

But all's not gloomy.

Banks and fintechs are driving several sustainability initiatives to curtail the aftermath. Let’s check out some of them.

Digital and paperless payments are key drivers for green fintech, as they can facilitate eco-friendly transactions. Enabling customers to access financial services anytime, anywhere, mobile-first banking reduces the need for paper-based transactions and physical branch visits, leading to lower carbon footprints. Furthermore, sustainable financial products, such as green bonds and impact investments, also promote eco-friendly banking.

Companies worldwide are prioritizing sustainability and taking innovative steps towards building a greener future amidst growing climate change concerns.

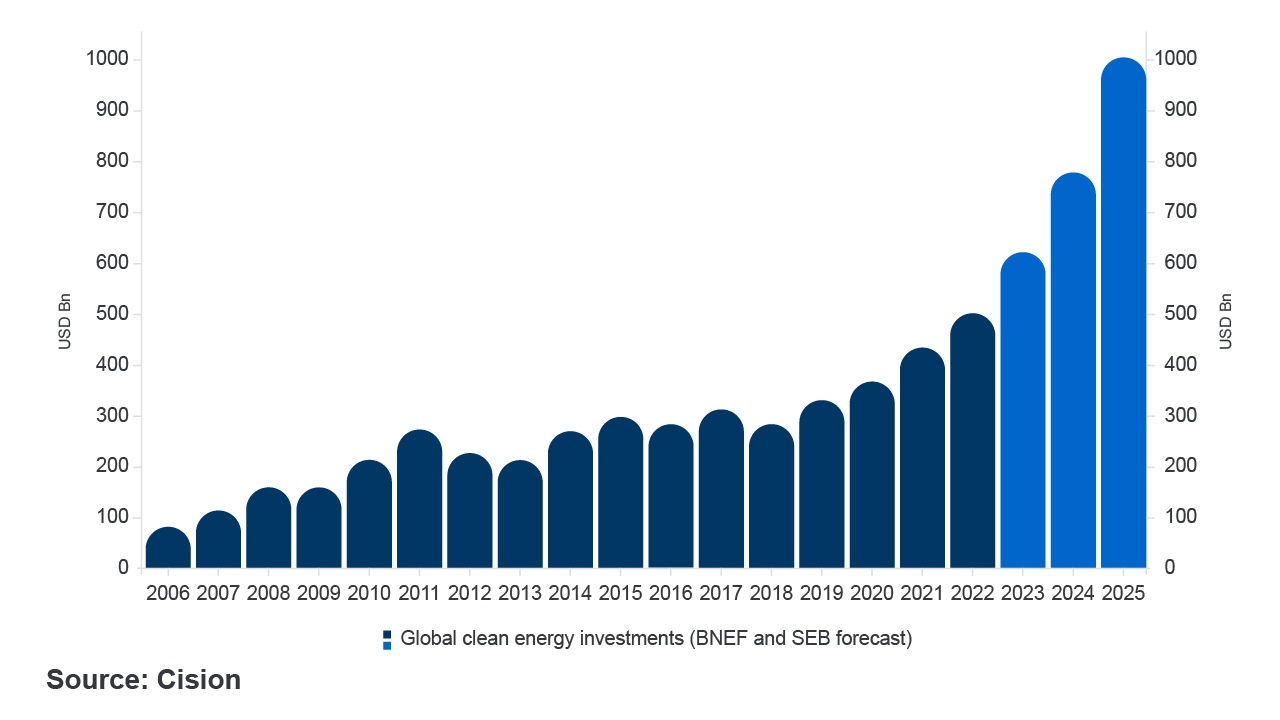

Banks are feeling the pressure to balance financing both fossil fuels and clean energy industries. Recent developments show that the shift towards renewable energy is gaining momentum.

Fossil fuel divestment is gathering pace, with more than 1,000 institutions pledging to divest over $9 trillion from banks that finance fossil fuels. Banks like JPMorgan and Barclays are among those limiting their financing of fossil fuels and increasing their support for clean energy.

As the world becomes more aware of the urgent need to address climate change, the role of green fintech in facilitating the transition towards a more sustainable future cannot be overstated. By supporting innovative solutions and investing in renewable energy, we can pave the way for a greener, more prosperous future for generations to come.

The global green bond market is set to grow significantly.

Our co-founder, Prabhu Rangarajan, was featured in an interview with Entrepreneur India, where he talks about M2P's organic and inorganic growth, acquisition spree, and global expansion plans. Read here.

Sriram KS, Head of Engineering, M2P Fintech, was featured in a podcast interview with Azure Developer Community, where he talks about how open-source software can be leveraged to secure privacy in the fintech industry. Listen here.