M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Digital banking is not a new phenomenon.

It started out in the 1960s in the form of ATMs and cards. As technology, innovation, broadband, and smartphone connectivity grew, the sector advanced into online and mobile formats. Today, the digital banking market thrives and is expected to grow at a 15% CAGR and to reach a valuation of USD 19.2 billion by 2028.

One-size-fits-all experiences will not do any good for banks. AI-driven systems, omnichannel super apps, and data analytics must be adopted to provide hyper-personalized experiences to customers.

Virtual cards, wearables, and mobile wallets will be preferred transaction modes as they are secure, quick, and convenient. Banks need to adapt and scale.

Intense competition, regulatory pressure, and customer expectations will accelerate the need for fintech collaborations. The partnership will improve the speed and scale of innovation and compliance in banks.

Banks must leverage AI, ML, and data analytics for anti-money laundering and fraud detection, advanced personalization, investments, and improved decision-making.

Legacy core is a thing of the past. Banks need to modernize their core banking infrastructure to be future-ready, scale innovation, and achieve optimal cost and operational efficiency.

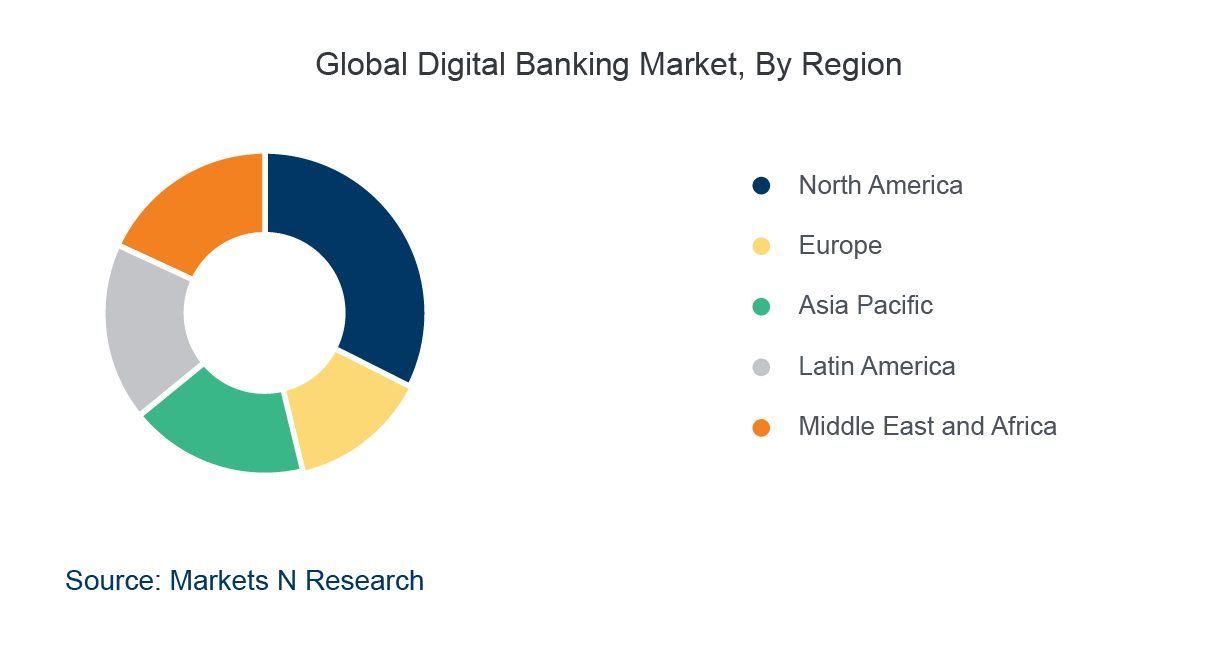

It is expected that North America will hold the largest share of the digital banking market.

Our co-founder, Madhusudanan Rangarajan, was featured in a story with Silicon India titled, ‘An era of Innovationville, National Technology Day 2023’ on the occasion of National Technology Day.

M2P Fintech was featured in a standalone story in 'The Times of India' for the successful migration of North East Small Finance Bank’s legacy Core Banking System to our Turing CBS. Read the article here.

Friends of Figma, Chennai organized ‘Figma Palooza: Plugins, Marketplace, and Best Practices’, a designers meetup where Figma fanatics network and engage in knowledge-sharing sessions. M2P Fintech was the ‘Venue Partner’, and the event was hosted in our Chennai office.