M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Did you know that half of India's adult population has no access to credit? More than 16 crore Indians have limited access to credit. This is a major barrier to personal and economic growth.

This is where the role of Microfinance Institutions (MFIs) is crucial. They bridge the gap by providing small loans to low-income groups and focus particularly on women and rural area residents (More than 99% of their borrower base comprises women).

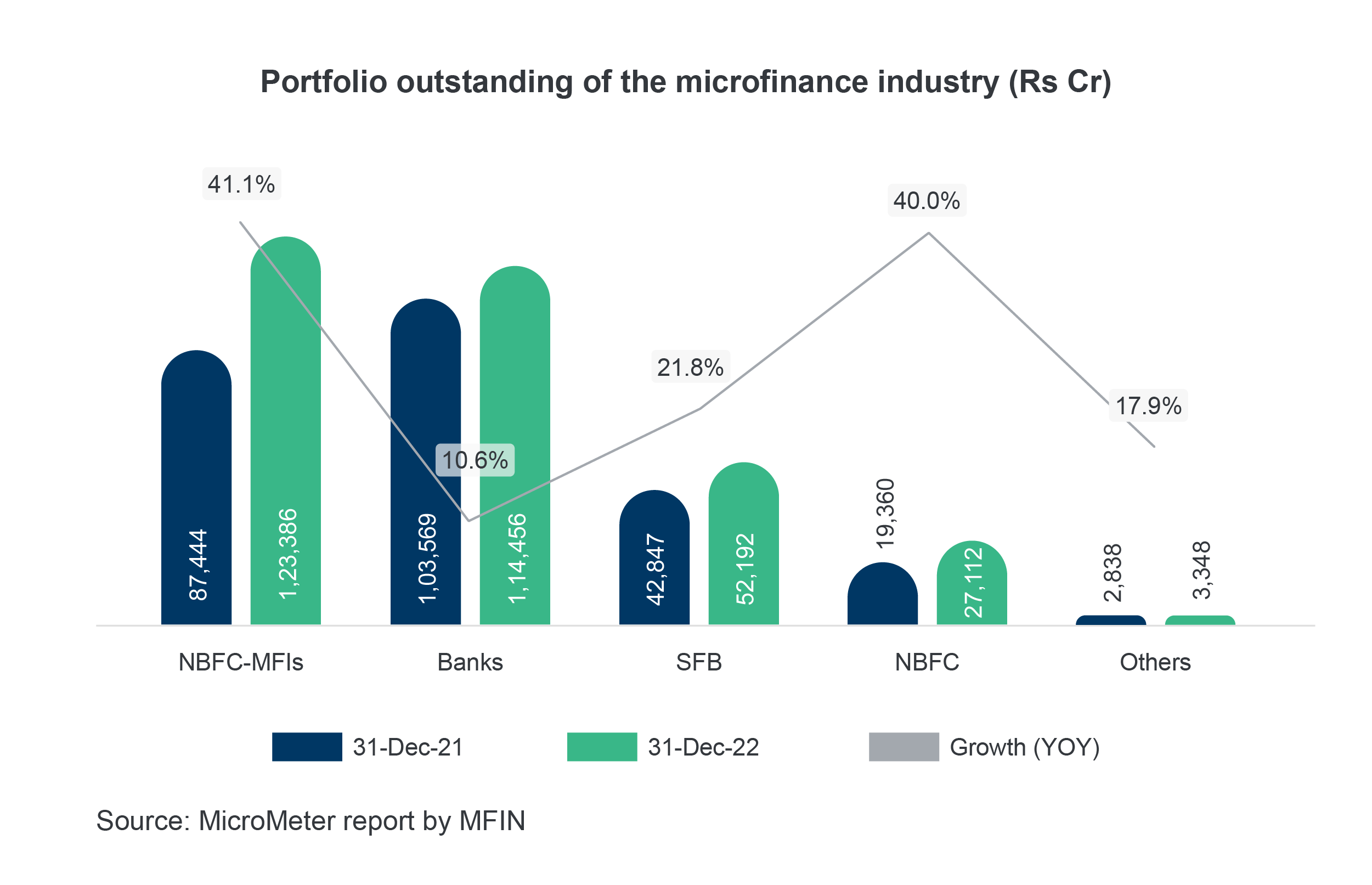

Projected to grow at 25% CAGR, the Microfinance industry is marching toward a digital future due to increased convenience and efficiency. Digital microfinance entails the use of technology to digitize, automate, and streamline loan disbursement, management, and collections. The process reduces the time and cost associated with traditional loan origination methods.

The ease of loan access has played a vital role in India's Financial Inclusion Index, which stands at 56.4. Digital Microfinance holds the potential to increase inclusion through credit access in the forthcoming years.

Our case study on Aadhaar Enabled Payment System (AePS) for Gayatri Bank was featured in CXO Today on how the bank experienced a significant boost in revenue and transaction volumes, as they were able to service more customers with greater convenience without incurring the costs of opening new bank branches or ATM machines. Read the full article here.