M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The personal finance landscape is getting a makeover.

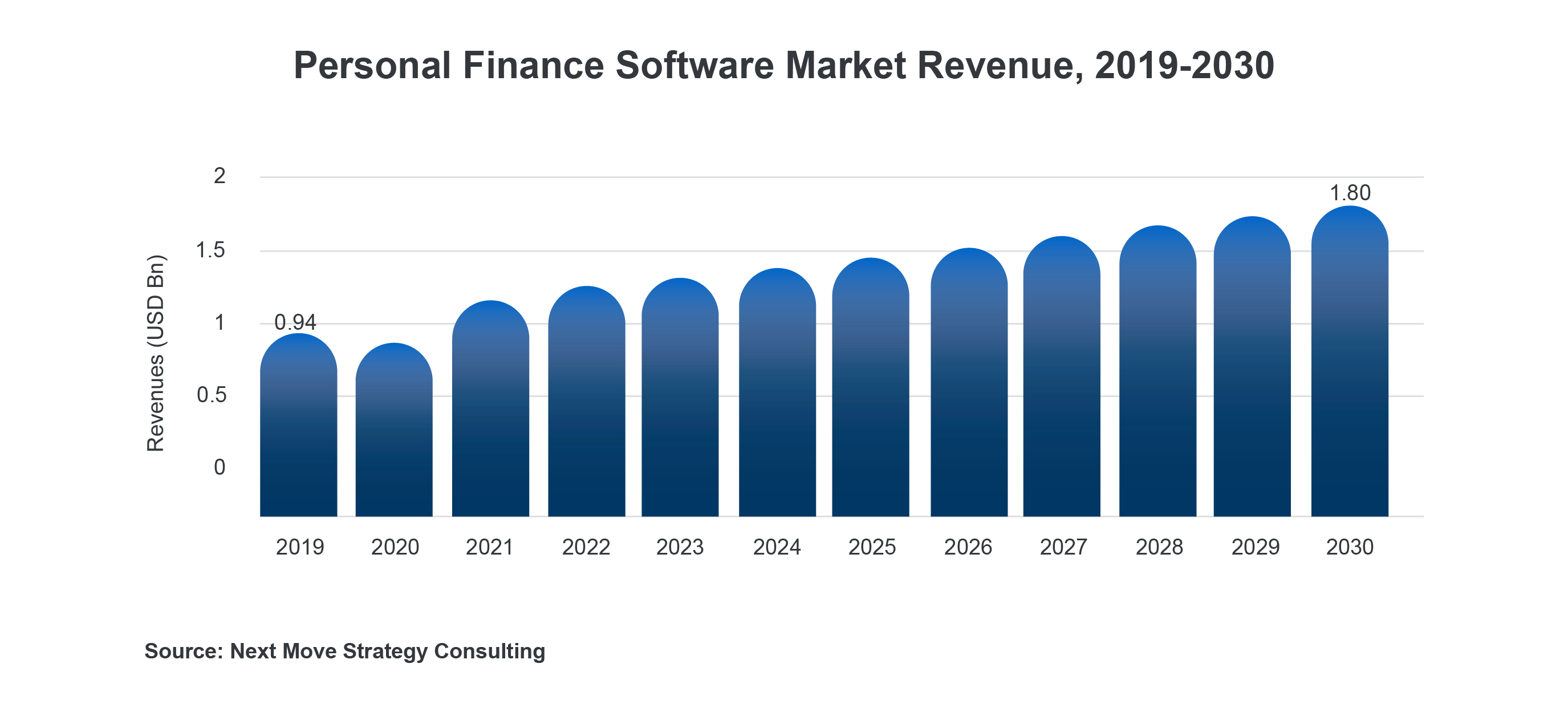

From slick apps that have gamified saving money to robots giving financial advice, technology and personal finance are coming together in new and exciting ways. With a CAGR of 5.7%, the personal finance software market value is expected to reach USD 1.57 billion by 2027.

What’s driving this transformation?

It’s the fintech industry.

These trends are expected to evolve and grow in the years to come, with gadgets, green banks, algorithms, assets, and investments converging in new and innovative ways.

One thing is for sure; we’re in for an exciting ride!

The personal finance software market is projected to experience significant growth, with its value expected to rise from USD 0.94 billion in 2019 to USD 1.80 billion by 2030.

Our case study highlighting the successful implementation of M2P's eKYC and eSign solutions for Angel One has been featured in CXO Today. The case study delves into the specific challenges encountered by Angel One and outlines how M2P effectively addressed them by seamlessly integrating eKYC and eSign functionalities. Check out the article here.