M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

By the time you finish reading this newsletter, the world would have witnessed one cyber security attack.

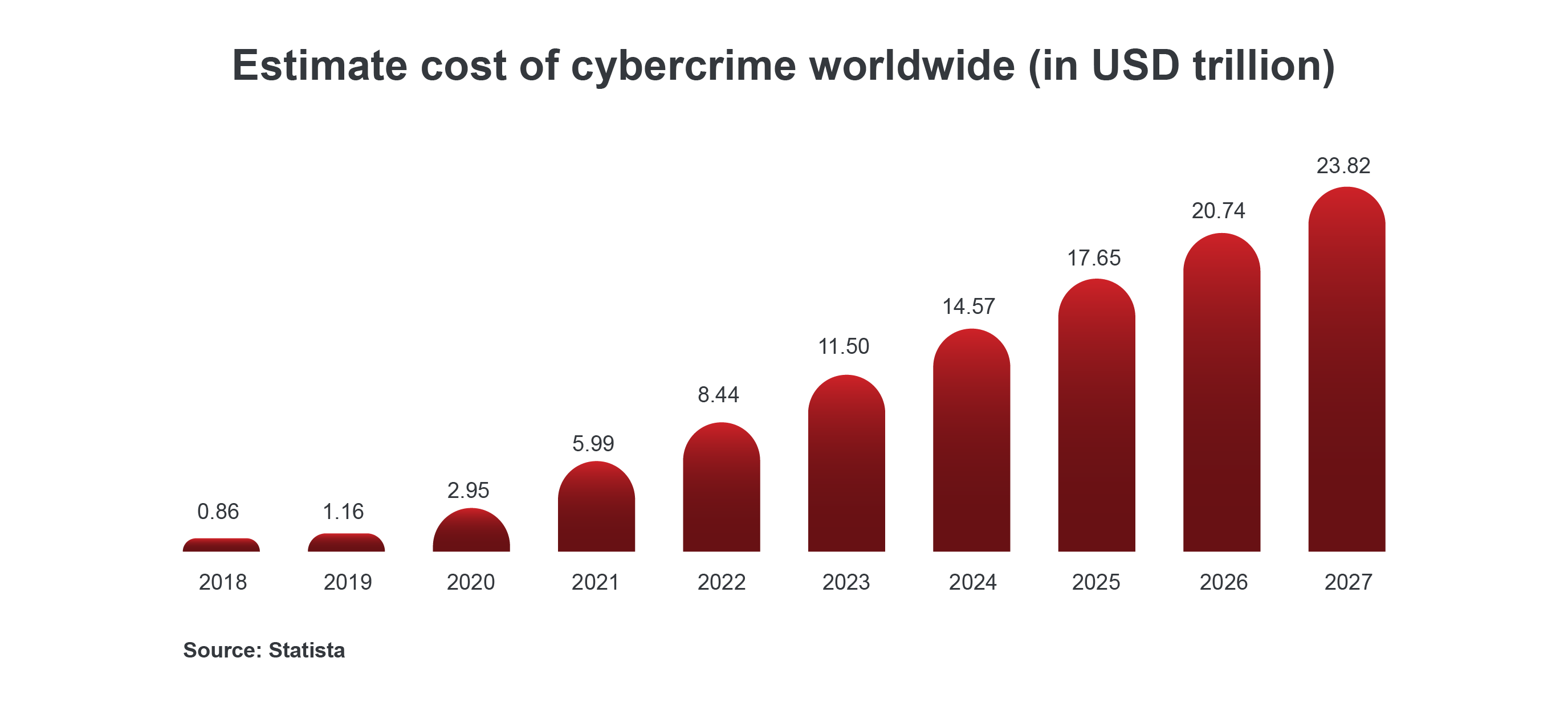

With a cyberattack occurring every 39 seconds, Financial Institutions (FIs) cannot afford to slack off. Research firm Statista estimates that losses from cybercrime will increase from $8.44 trillion in 2022 to a staggering $23.84 trillion by 2027. And 66% of Chief Information Officers (CIOs) are planning to increase investment in cybersecurity, reflecting a clear urgency to strengthen defenses.

With threats such as phishing, data breaches, and ransomware attacks evolving every day, here’s how the fintech sector builds a reliable defense against online fraud.

Implementing advanced cutting-edge technologies powered by Artificial Intelligence (AI) and Machine Learning (ML) helps identify and neutralize potential risks in real-time.

Robust state-of-the-art encryption techniques ensure the confidentiality and security of customer data. It offers an additional layer of protection against potential breaches or unauthorized access.

By implementing additional verification factors such as biometrics, SMS codes, or security tokens, MFA enhances security and successfully defends against cyber threats.

Regular security audits and updates, along with comprehensive employee training programs, bolster cyber resilience. Additionally, fostering partnerships with cybersecurity experts and keeping up with industry best practices adds to the preparedness quotient.

With automated workflows, strong monitoring capabilities, and comprehensive reporting tools, FIs can proactively identify and address compliance gaps, minimizing the risk of penalties and protecting brand reputation.

Remember, this is an evolving space. Cybersecurity is not a destination but a constant endeavor.

The global cost of cybercrime is projected to experience a significant surge, skyrocketing from $8.44 trillion in 2022 to a staggering $23.84 trillion by 2027.

Our co-founder, Prabhu Rangarajan, participated in an exciting panel discussion on 'How to manage finances when you are past the seed stage?' at the DBS Business Class FoundED event. The panel discussion explored insights on financial management, seed funds, investments, and more.

M2P participated as a Silver Sponsor for Seamless North Africa 2023 on the 17th & 18th of July in New Cairo, Egypt. We had the opportunity to interact with numerous industry leaders and stakeholders. Vaanathi Mohanakrishnan, our Regional Business Head - MENA, spoke in a panel discussion on 'The startup edge: Fintech's influence in accelerating financial inclusion'.

We participated as a Platinum Sponsor in the 2023 MCPI Annual Conference on the 25th & 26th of July in Manila, Philippines. Our crew had the pleasure of meeting and greeting experts and enthusiasts from the microfinance industry. Deepti Mittimani, our VP – International Expansion, presented a session on 'Enhance your microfinance business through technology' at the event.