M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

By 2050, many influential banks globally have pledged to produce a net zero carbon footprint.

How do they plan on achieving this?

With the help of the technologies provided by fintechs, banks are incorporating ESG objectives into their loan offerings. Companies that borrow money from the banks can leverage the benefits of ESG goals through reduced loan interest, adjustment in loan tenures, etc.

Fintechs specialize in advanced data analytics and reporting tools. They can assist banks in collecting, analyzing, and reporting ESG-related data from their operations, customers, and investments.

By utilizing technology to match banks' investment criteria with suitable ESG-aligned opportunities, streamlining the process of identifying and investing in impactful projects or ventures.

Fintechs can provide banks with ESG screening tools and algorithms to assess the sustainability credentials of potential borrowers, clients, and investments by leveraging big data and machine learning.

By developing compliance software and solutions tailored to ESG standards and guidelines, fintech firms help banks navigate the evolving regulatory landscape while ensuring transparency and accountability in their ESG practices.

With the help of ESG principles, fintech has the potential to lead in a new age of inclusive and environmentally responsible finance. Additionally, the integration of ESG factors with fintech solutions has the potential to help the banking sector cater to a wider audience.

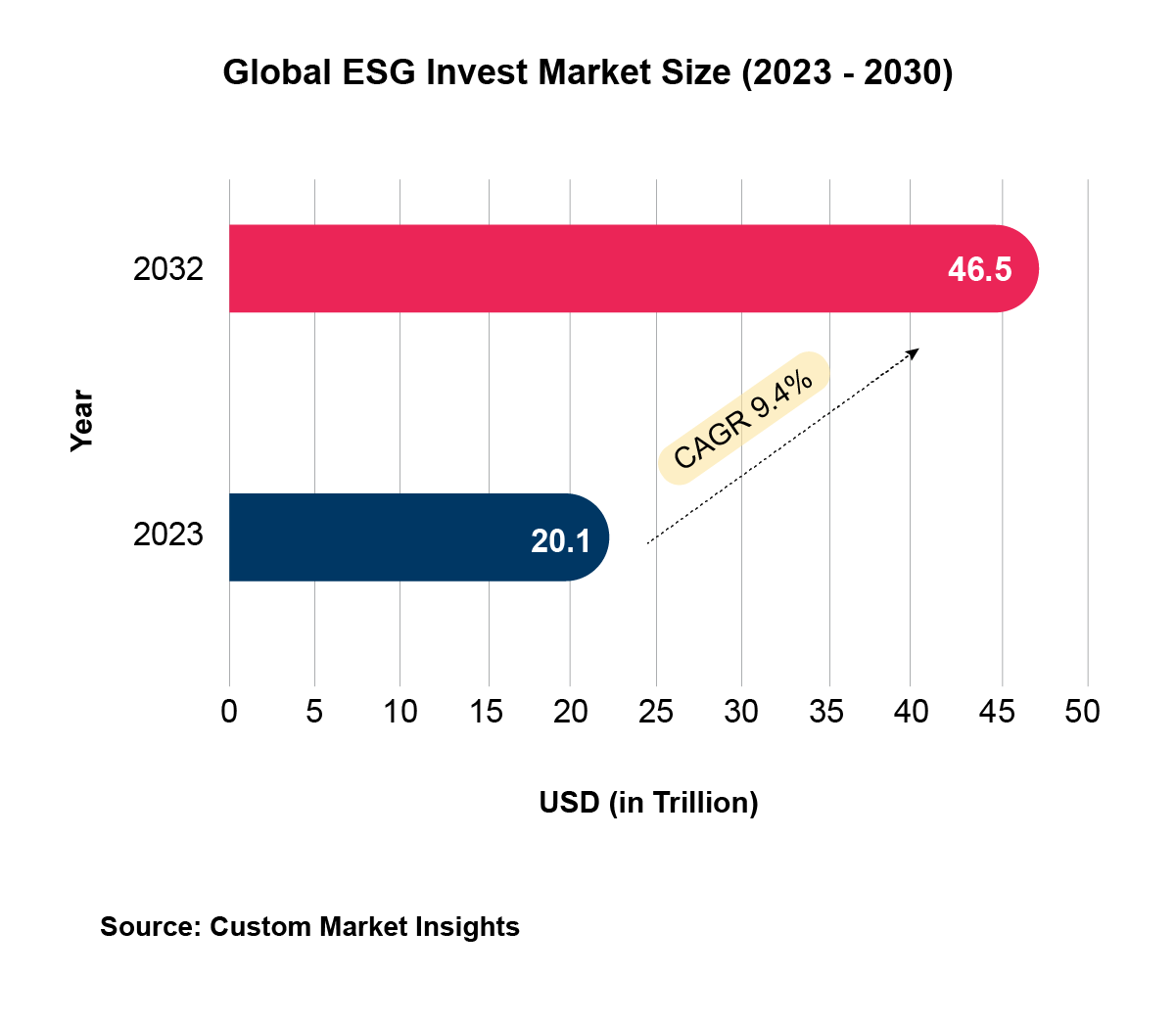

The global ESG Investing Market is projected to reach USD 46.5 Trillion by the year 2032 with a CAGR of 9.4%.

Prabhu Rangarajan, our co-founder, participated in a sparking panel discussion at the CEO Conference 2024 in Nepal. In this event, he shared his vision on ‘How to Build Inclusive Financial System for the Future’.

Our President of International Expansion, Sanjoy Bose, represented M2P Fintech at the RBAP Symposium in Bacolod City, Philippines, and delivered an engaging keynote.