M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

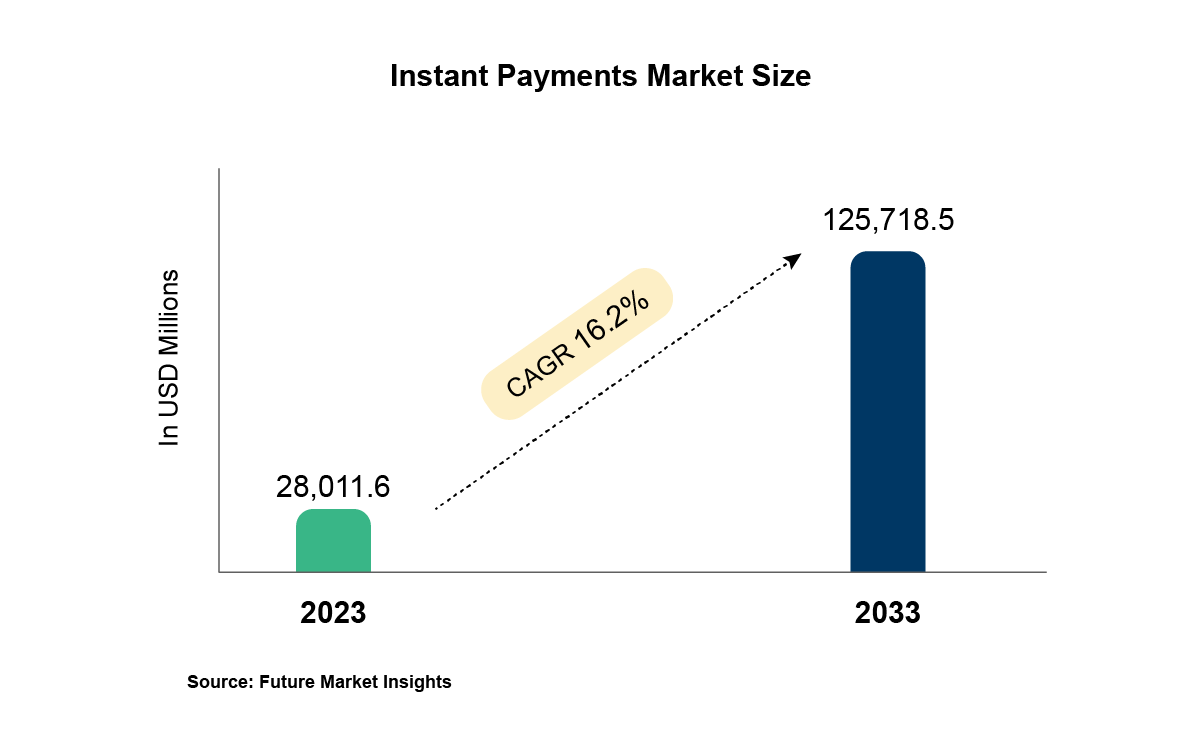

Instant payments are revolutionizing the payment landscape, providing faster and more convenient methods embraced by both businesses and consumers. Projections indicate a robust growth trajectory, with the global market expected to soar to USD 125,718.5 million by 2033, driven by a compound annual growth rate (CAGR) of 16.2%.

The surge in instant payments is propelled by several key factors.

There's a notable transition towards cashless and contactless transactions, driven by changing consumer preferences and advancements in technology.

Significant government investments are fueling the increase of instant payment infrastructures, promoting financial inclusion and digitalization efforts.

Increased awareness of alternative payment options is driving adoption, encouraging users to explore faster and more convenient payment methods.

Demonetization, coupled with high mobile penetration, acted as a catalyst for the widespread adoption of instant payments which is a more convenient and viable option for everyday transactions.

Incorporation of cutting-edge technologies such as AI and IoT further accelerates instant payments, enhancing transaction efficiency and security. This is achieved by verifying multiple QR codes simultaneously, troubleshooting errors efficiently, and introducing new advanced payment methods.

As a result, instant payments have become a diverse landscape, offering options to cater to various needs. From real-time fund transfers between individuals and businesses to seamless solutions for online purchases and bill payments, instant payment systems are becoming increasingly versatile. This growth enhances consumer convenience while driving efficiency and cost-effectiveness for businesses across various sectors.

The future of instant payments promises streamlined processing, reduced costs, enhanced transaction security and speed with the adoption of cloud-based payment solutions and the rollout of 5G networks.

Instant payments are not just a passing trend; they are the foundation of a financial future that is faster, more convenient, and more inclusive than ever before.

Instant payments market is predicted to skyrocket to USD 125,718.5 million by 2033.

Mahesh Karuppiah, our AVP - Product Management, showcased M2P's Credit Line on UPI product at the NPCI partner series event. We at M2P are excited to bring this platform to market since this innovative solution is set to revolutionize lending distribution, offering extensive use cases for banks.

Sriram KS, our President - Head of Engineering shared his insights at the roundtable discussion hosted by YourStory Media. He discussed the ways AI can improve customer satisfaction and highlighted how privacy features can build stronger customer relationships.