M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Fintechs rely on strong digital infrastructure to thrive in the evolving financial landscape.

Cloud computing can be their technological lifeblood to stay agile and competitive.

Cloud-first strategies empower fintechs to scale, innovate, and swiftly deliver technically sound solutions. Also, the cloud acts as a catalyst for enhancing data management and accelerating product development.

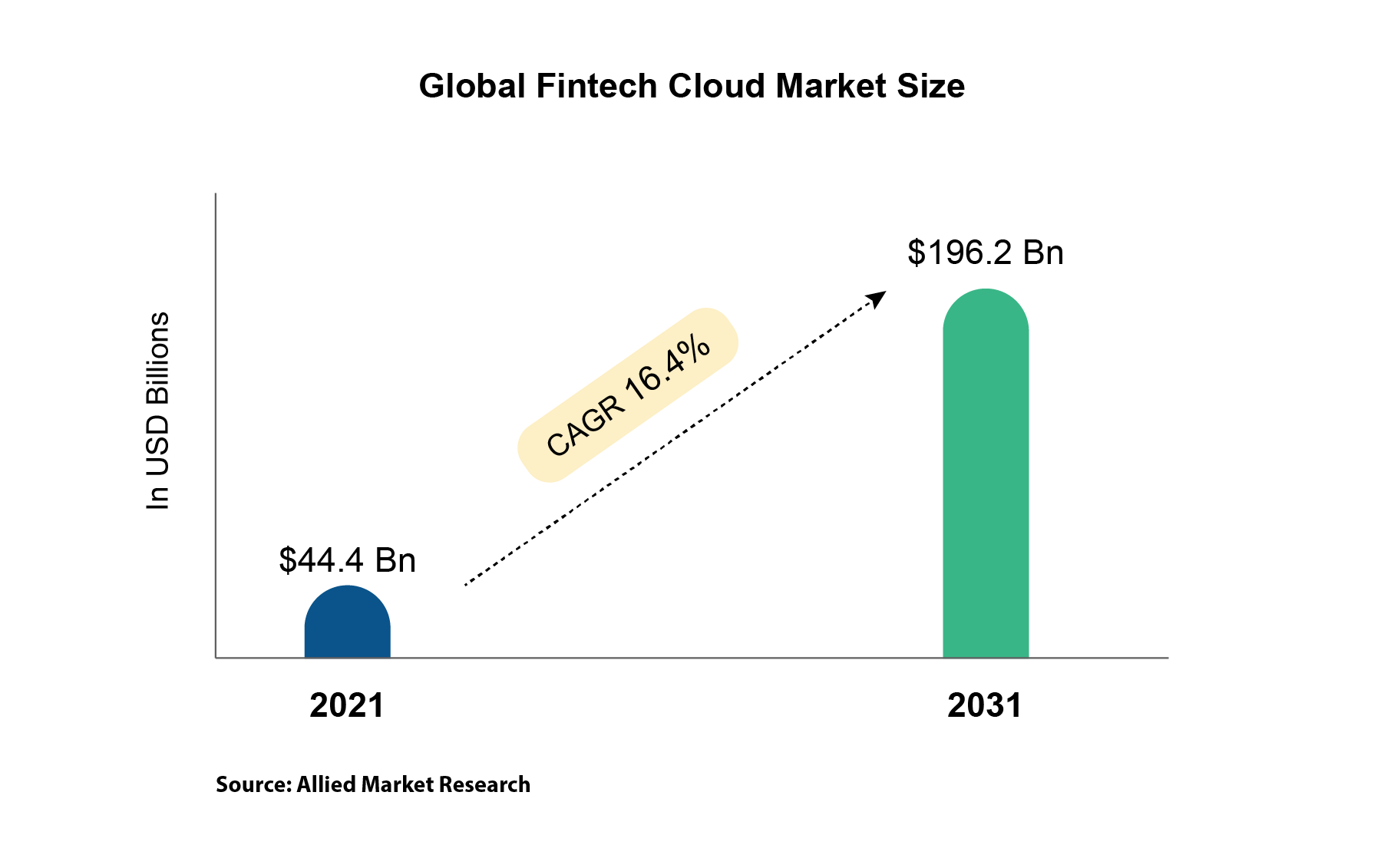

The global fintech cloud industry is projected to reach $196.2 billion by 2031, growing at a rate of 16.4%, highlighting the increasing reliance of fintech firms on cloud solutions for delivering cutting-edge products.

By migrating to the cloud, fintechs can better handle large-scale data processing, enhance cybersecurity measures, and leverage advanced analytics. Fintech firms have consistently reaped numerous benefits from the cloud, aligning with their specific needs and objectives.

Swiftly adapt to market shifts and manage varying transaction volumes with ease, boosting agility and competitiveness. The cloud's flexibility allows fintech firms to scale operations swiftly, launch new services seamlessly, and tap into global markets with ease.

Eliminate the need for costly on-premises infrastructure. Pay-as-you-go models allow for optimal resource allocation, freeing up funds for innovation.

Advanced security measures and simplified compliance tools, including data encryption and access management.

Effectively monitor and manage cloud infrastructure with comprehensive visibility into performance, security, and compliance, empowering fintech to optimize operations and deliver exceptional customer experiences.

Harness big data and analytics to improve risk assessment, fraud detection, and investment strategies through sophisticated data processing tools.

Access a wide range of tools and services that foster rapid product development. Cloud-based AI and machine learning drive predictive analytics and personalization.

Robust disaster recovery solutions ensure business continuity by replicating data across multiple data centers.

The integration of cloud solutions in fintech is more than a trend. It fosters a more inclusive financial ecosystem and accelerates technological advancements, paving the way for more accessible, secure, and efficient financial services worldwide.

The global fintech cloud market was valued at $44.4 billion in 2021, and is projected to reach $196.2 billion by 2031, growing at a CAGR of 16.4% from 2022 to 2031.

Our Co-founder, Madhusudanan R, participated in a fireside chat hosted by Shradha Sharma, Founder & CEO, YourStory Media. He shared his thoughts on creating people-first fintech products and building the fintech future of Tamil Nadu.

We are excited to announce the opening of our new office in Delhi, marking a new chapter in our company's journey. This prime location in the heart of India will serve as a hub for fostering innovation and driving our continued growth.