M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Customer data has become the cornerstone of modern banking.

Financial institutions are harnessing a wealth of information to provide personalized services, streamline operations, and make data-driven decisions, fundamentally transforming the banking experience. This shift not only enhances customer satisfaction but also drives loyalty and retention, making it a key strategic priority for banks worldwide.

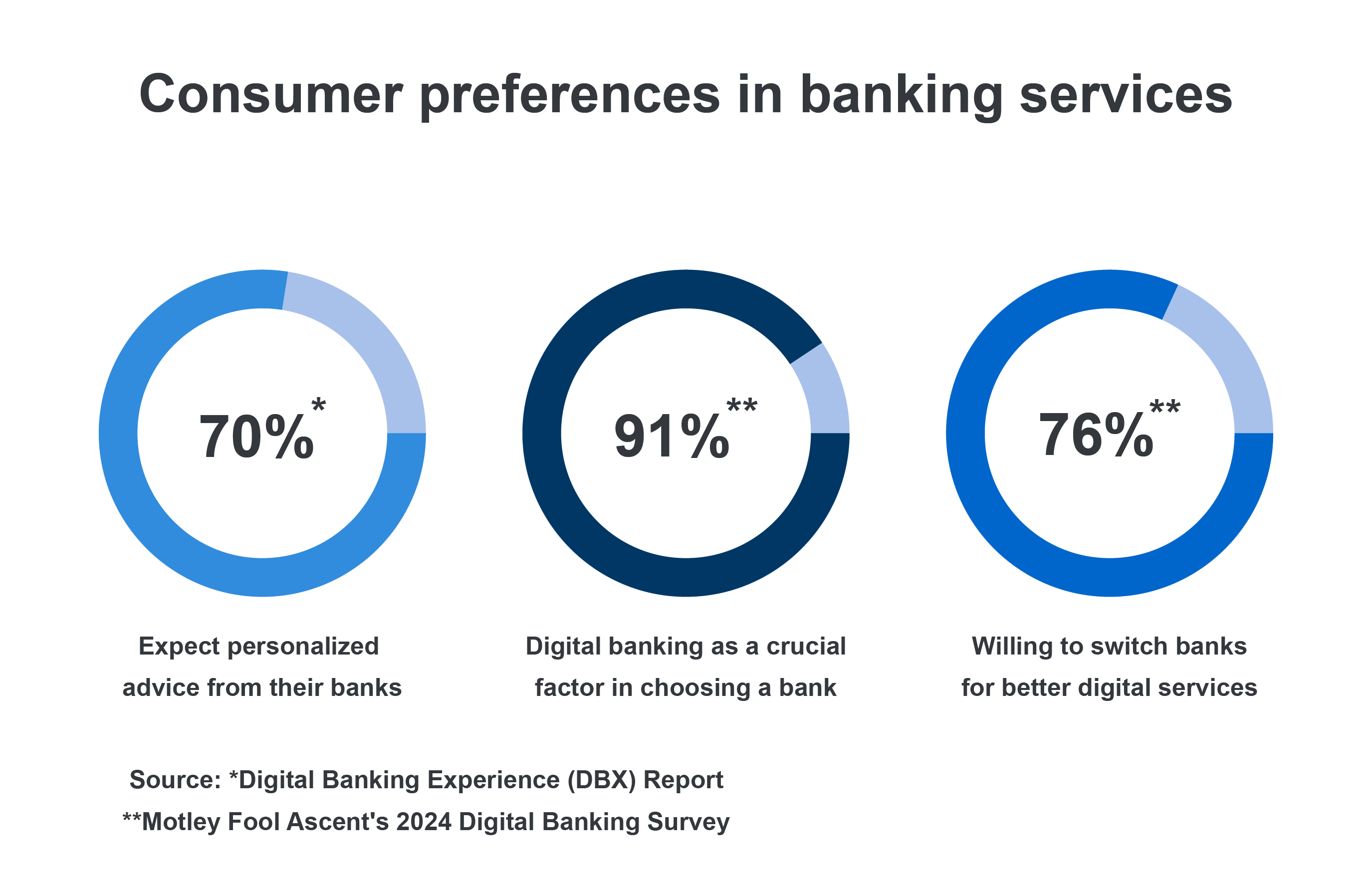

By analyzing transaction history and spending patterns, banks can offer personalized recommendations for products such as credit cards, loans, or investment opportunities. This data-driven approach also offers tailored financial advice, aligning services with individual customer needs. In fact, 66% of customers expect banks to understand their preferences, and personalization can drive a 10-15% increase in bank revenue, according to McKinsey.

Data analytics enables banks to segment their customers based on factors like income, spending habits, and risk profiles. With these insights, banks can develop more targeted marketing strategies, improving both cross-selling and up-selling opportunities. Studies show that banks using data analytics for customer segmentation can boost their marketing ROI by up to 200%, highlighting the value of personalization in increasing engagement.

Real-time personalization takes customer engagement a step further by offering context-aware products instantly. Whether it’s providing an immediate loan after a large purchase or suggesting travel insurance upon booking flights, banks are increasingly responsive to real-time customer needs. This kind of engagement can increase conversion rates, making it a crucial tool for customer retention.

While personalization offers numerous benefits, banks must carefully balance this approach with privacy concerns. Although 75% of customers are willing to share their data for personalized offers (as per a report by Forrester), banks must use this data responsibly to create a win-win situation.

Madhusudanan R, our Co-founder, was honored as a prominent jury member at the Global Fintech Awards. He also took part in a closed-door session at GFF'24.

Prabhu Rangarajan, our Co-founder, lit up the stage as a moderator for a panel discussion at GFF 2024.

Visham Sikand, our Executive Vice President, Business Development, partook in a panel discussion at the GFF'24.

Jack, our Senior Vice President - Marketing & Design, shared his insights at Nasscom's CMO roundtable discussion.

Our organization raises $100 million in Series D financing led by Helios Investment Partners.