M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

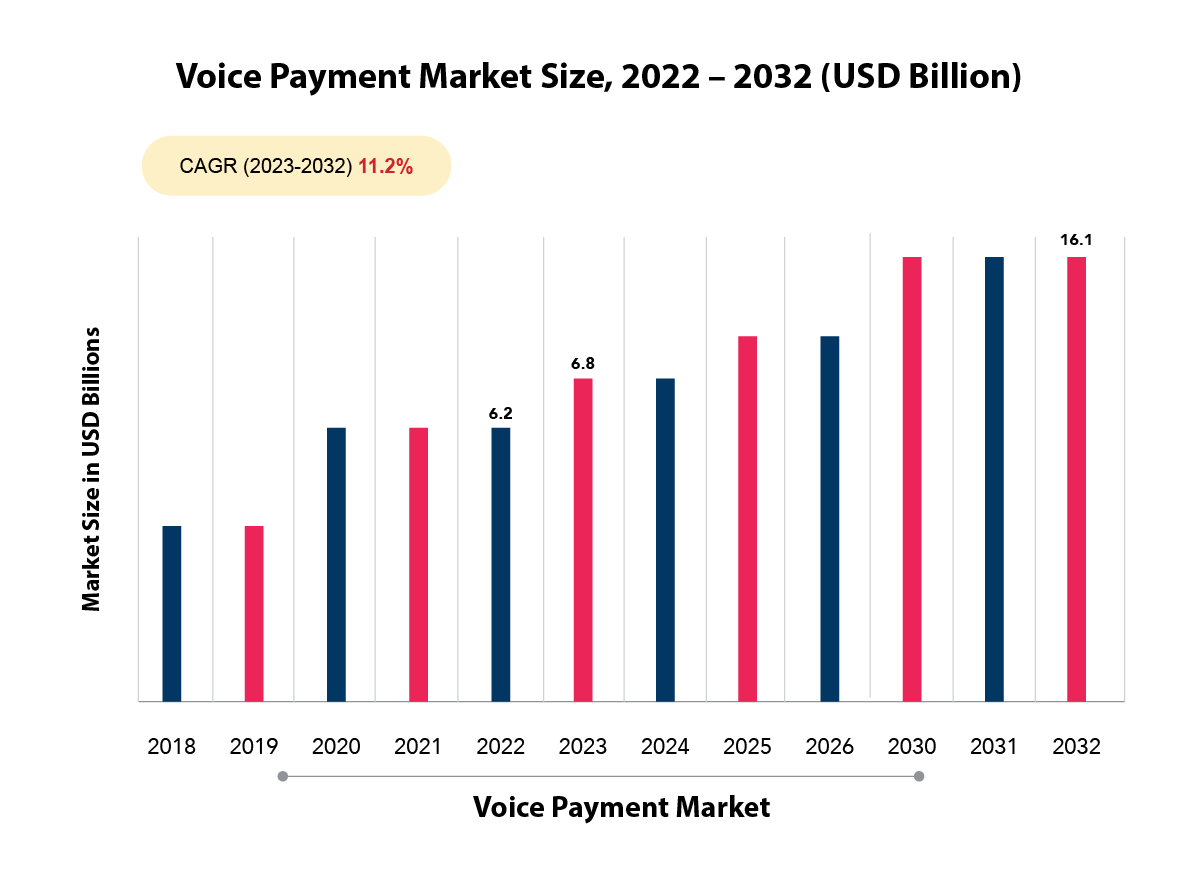

Voice-enabled payments are taking over the way we do business by allowing us to use spoken commands instead of traditional activities. As this advanced technology enters the financial market, it is expected to enhance both the efficiency and convenience of interactions.

Voice-enabled payments integrate the use of voice to perform payments through voice-controlled devices such as smart speakers and smartphones. When associating the numerous forms of payment systems with these devices, the user will be able to make transactions by saying actions like ‘Transfer Funds’ or ‘Pay my Bill.’ This technology uses NLP (Natural Language Processing) and ML (Machine Learning), allowing it to understand a range of accents as well as multiple languages, and thus, being inclusive where people can use it from any part of the world.

Voice-enabled payments are on a rapid growth trajectory owing to the below factors/ use some other word also instead of factors:

Voice-enabled payments offer several benefits to users such as,

Most voice assistants and digital platforms now allow payments, money transfers, and bill payments through simple voice commands, revolutionizing the financial industry.

However, there are some challenges, such as security perspective, privacy perspective, or perspective of the demand for more sophisticated NLP solutions, are to be resolved.

While we highlight the advantages, it's also essential to address areas for improvement:

Voice payments are a rapidly emerging trend in the digital payments landscape. With the ever-increasing rate of technology use in various sectors, voice payments can be considered one of the key features of payment in the future. Whether or not they will eliminate traditional methods of training altogether or simply offer an alternate way to train will remain to be seen.

Madhusudanan R, our Co-founder, was honored as a prominent jury member at the Global Fintech Awards. He also took part in a closed-door session at GFF'24

Visham Sikand, our Executive Vice President, Business Development, partook in a panel discussion at the GFF'24

Prabhu Rangarajan, our Co-founder, lit up the stage as a moderator for a panel discussion at GFF 2024

Jack, our Senior Vice President - Marketing & Design, shared his insights at Nasscom's CMO Roundtable discussion

Our organization raises $100 million in Series D financing led by Helios Investment Partners.