M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Nearly half of all cyberattacks in India target MSMEs, the backbone of the country’s economy. A recent CISCO study reveals that 40% of SMEs impacted by these attacks experience downtime of eight hours or more, significantly affecting the productivity.

There are three challenges that MSMEs face in terms of cybersecurity: limited awareness of cyber threats, insufficient cybersecurity protocols, and lack of customized solutions for their unique needs.

This is where fintech plays a crucial role—offering tailored solutions that transcend conventional finance to empower MSMEs to effectively mitigate evolving cyber threats.

Fintechs are revolutionizing cybersecurity for MSMEs through innovative, tiered subscription models that deliver robust protection without straining limited financial resources. By offering scalable, budget-aligned security solutions, these platforms empower small businesses to fortify their digital defenses strategically and cost-effectively.

With managed security services, fintechs offer comprehensive cybersecurity management that includes threat monitoring, vulnerability assessments, and incident response. MSMEs can leverage this expertise without the need for in-house IT teams, ensuring they receive professional-grade protection.

Fintechs deliver real-time threat intelligence and updates, keeping MSMEs informed about emerging risks and vulnerabilities. This empowers businesses to adapt proactively, building a stronger line of defense against evolving cyber threats.

Payment security is central to fintech offerings, with robust encryption and advanced fraud prevention embedded in every transaction. These solutions safeguard sensitive financial and customer data, protecting MSMEs from financial fraud and data breaches.

Through intuitive, user-friendly tools, fintechs offer periodic assessments of MSMEs' cybersecurity health. These insights come with data-driven recommendations, helping businesses identify and fix potential vulnerabilities before they are exploited.

Fintech solutions include advanced monitoring tools that track suspicious activity around the clock. Automated threat responses and alerts provide MSMEs with immediate insights and actions, ensuring a vigilant, responsive cybersecurity posture.

By aligning security with affordability and ease of use, fintechs are helping MSMEs bridge the cybersecurity gap and thrive in an increasingly digital economy. Through this support, MSMEs are not only better protected but also empowered to compete confidently on a global stage.

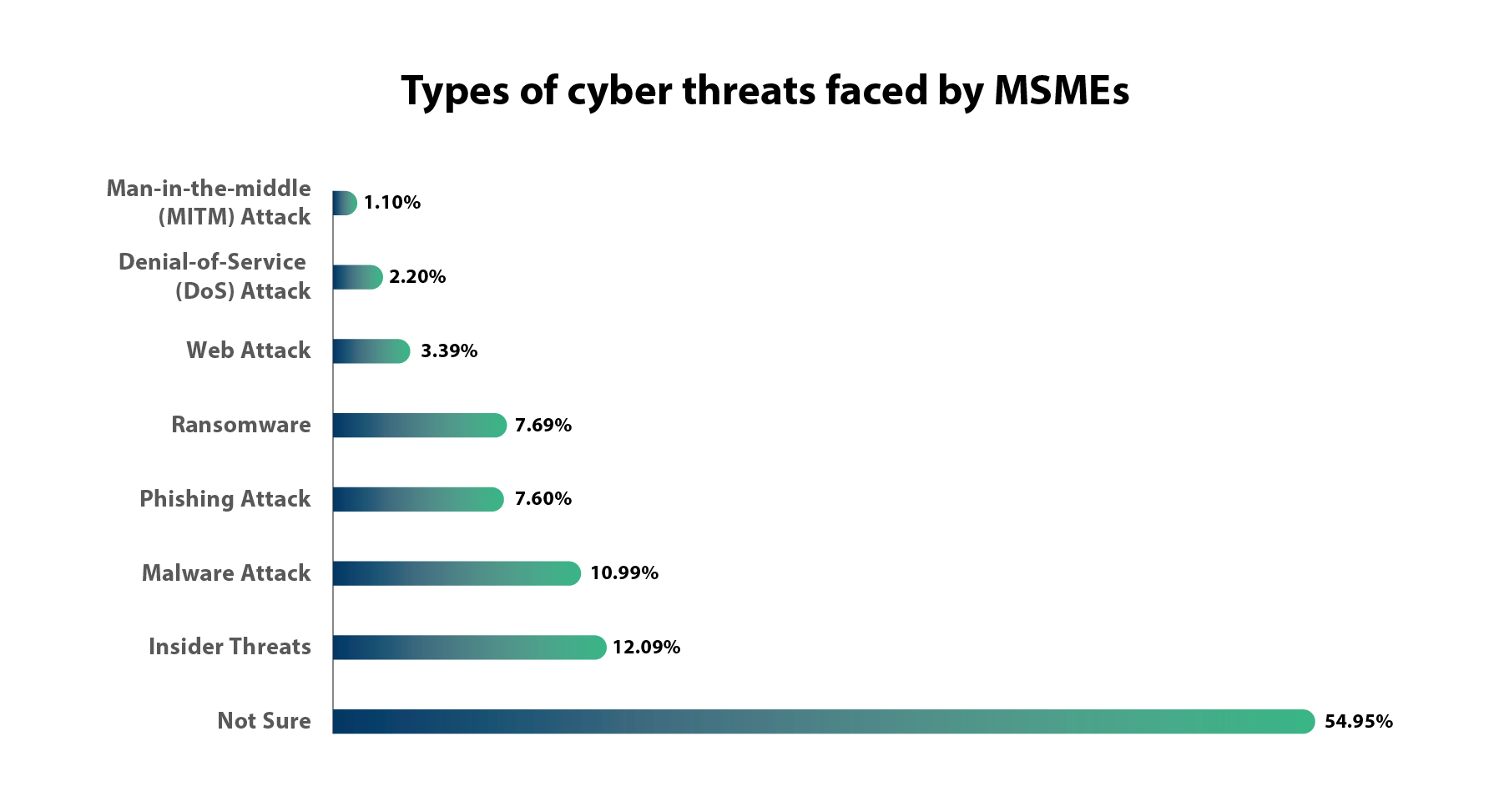

Businesses Struggle to Identify Cyber Threats

We marked our 10th year in the fintech industry, driving innovation and reshaping the global fintech landscape with a transformative impact.

Co-founder, Madhusudanan R shared valuable insights at The Founders Peak session during the Singapore FinTech Festival 2024.

Senior Vice President, Bharat Srinivasarangan represented M2P as a panelist at the NASSCOM Technology Confluence 2024.

We participated as a platinum sponsor at the Rural Bankers Association of the Philippines 2024, fostering collaboration and innovation in rural banking.

Our partnership with USSC Money Services Incorporated (UMSI) marks a step forward in revolutionizing prepaid card issuance in the Philippines.

We welcomed students from SSN College of Engineering, Chennai, as interns through our ‘Level Up’ program, embarking on an inspiring journey with M2P.