M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

2024 has been a pivotal year for the fintech industry, marked by groundbreaking innovations, shifting consumer expectations, and a relentless drive for digital transformation. From the rise of AI-powered personalization to the resurgence of decentralized finance, fintech has not only met current demands but has also paved the way for future innovation.

Let’s explore the key trends that reshaped the industry.

These trends are more than just advancements—they represent a shift toward a more customer-centric, efficient, and inclusive financial ecosystem. Fintech is paving the way for innovation, growth, and staying future-ready in a digital-first world.

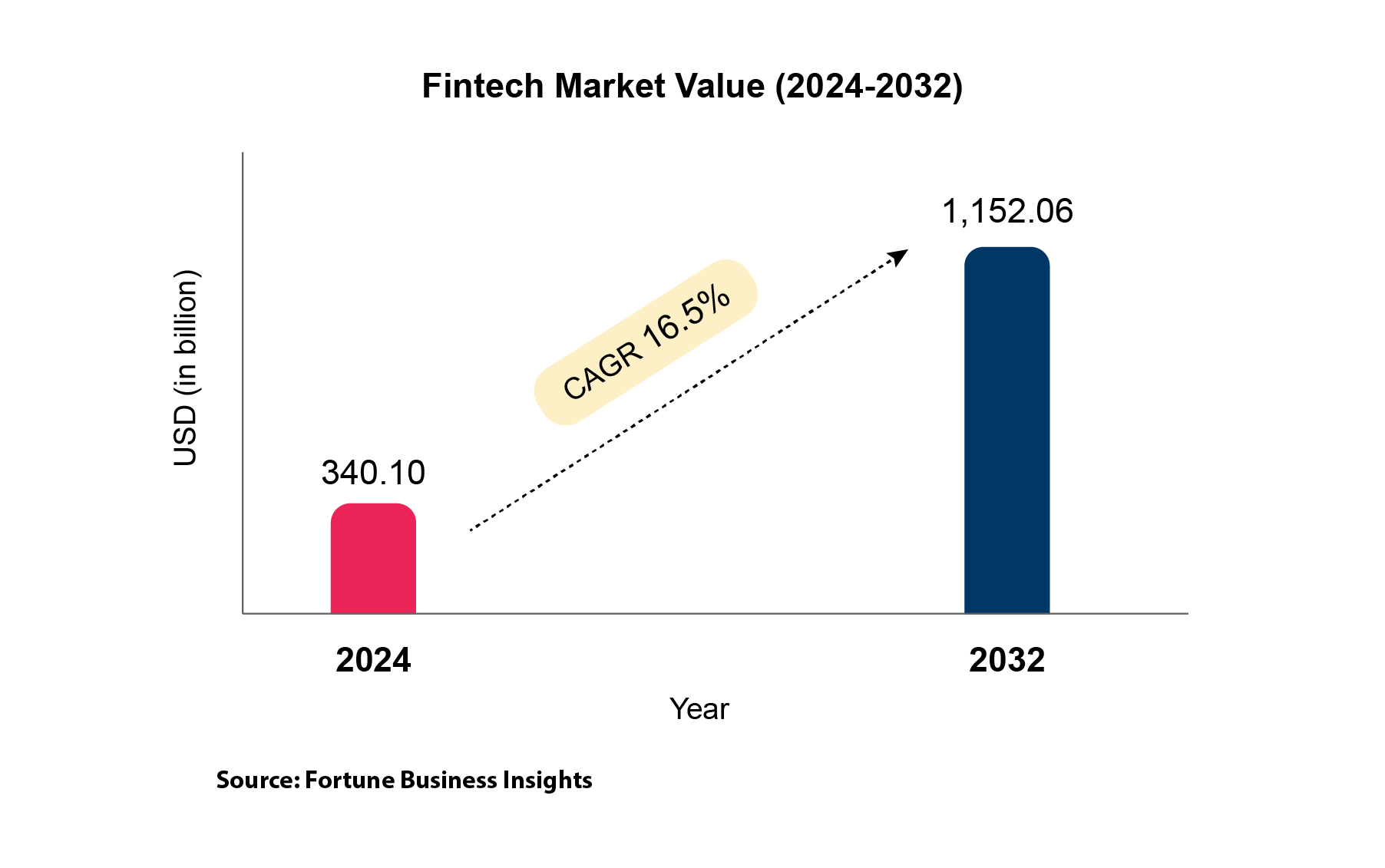

Fintech Market Set to Triple by 2032.

Co-founder Madhusudanan R. participated in a panel discussion at the WSFx Global Pay launch, introducing the innovative WSFx Student Pay Card.

Tradeflock has recognized Gopal Majumder, our Head of Business—Banking, as one of India’s Best Fintech Leaders for 2024.

We are proud to have been a mini-bronze sponsor at IFSE 2024 in Jakarta offering key insights into Indonesia's RegTech landscape.

We’re excited to launch LEAP—our Leadership Excellence & Accelerator Program that served as a platform for our leaders to embrace collaboration and redefine leadership.

At KubeCon 2024, our M2Peers delivered insights on tailored internal developer platforms and observability as a product, at the Google Cloud booth.