M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The way people are banking is changing at an unprecedented scale—thanks to open banking. Today, open banking has leaped beyond the foundational framework, revolutionizing how individuals and businesses interact with financial services around the world. For instance,

In India, open banking is propelled by the robust infrastructure of the India Stack, which includes the Unified Payments Interface (UPI) and an account aggregation framework. This ecosystem enables secure data sharing to enhance financial inclusion for the underbanked populations.

In MENA, the UAE and Saudi Arabia are leading the way in open banking with strong regulatory frameworks. The UAE's Open Finance regulation enables seamless data sharing for personalized services, while Saudi Arabia's SAMA regulations enhance operational efficiency and customer experiences, driving digital transformation and financial inclusion.

In Southeast Asia, Singapore is taking a market-led approach to open banking, while Indonesia focuses on regulatory support for digital transformation. The Philippines is transitioning towards open finance, expanding beyond traditional banking to include investments and other financial services through APIs, enhancing consumer experience and financial accessibility.

In Africa, open banking is gaining momentum, with Nigeria leading the way. The launch of its open banking regime in March 2023 promotes data sharing between banks and fintechs. Meanwhile, Ghana is exploring opportunities through initiatives like regulatory sandboxes, despite the absence of a formal framework.

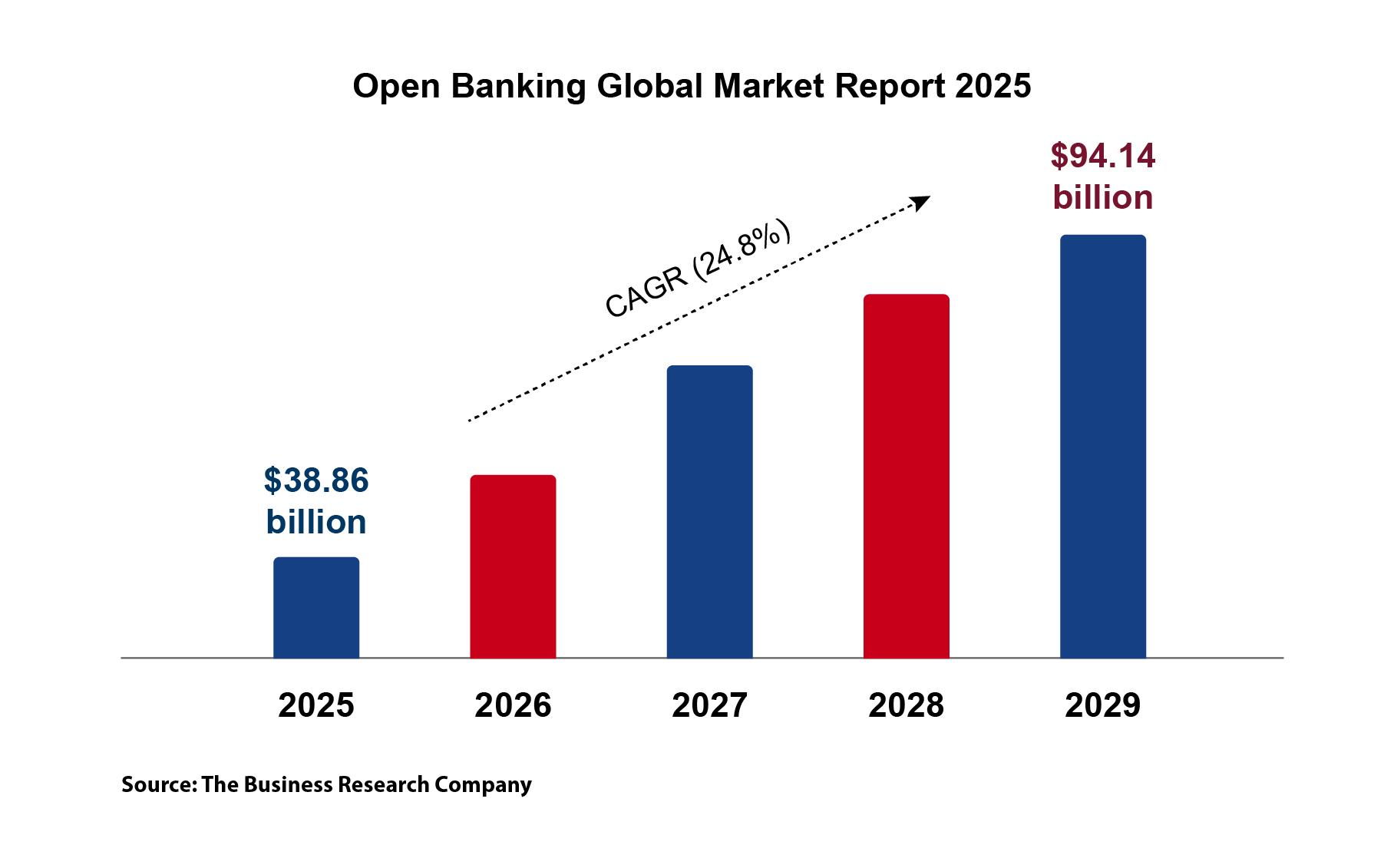

All in all, open banking is set for substantial growth worldwide, projected to reach USD 38.86 billion in 2025, highlighting its potential to reshape financial services across diverse markets.

At M2P, we are closely monitoring these developments and have identified key trends poised to transform the open banking industry. We believe the future of open banking lies in:

With that said, open banking is no longer just a buzzword, it’s the foundation of a smarter, safer, and more inclusive financial future.

Open Banking Adoption to Surge in the Near Future

Co-founder, Prabhu Rangarajan participated in a panel discussion at Umagine TN 2025 sharing insights on fostering a robust startup ecosystem, enhancing tech infrastructure, and driving innovation in Tamil Nadu.

We were honored to host Mr. Sopnendu Mohanty, Chief Fintech Officer of Monetary Authority of Singapore, and the GFTN team at our Chennai Quest office. Their visit sparked impactful discussions with operators, investors, and ecosystem leaders.

We’re glad to welcome talented interns from Chennai and Bangalore, who joined us following a successful ‘WOW’ onboarding.

Abhishek Arun, President of Business Development, partook in a panel discussion at SAMVAAD. He shared his vision on advanced solutions like tokenization and confidential computing to ensure robust privacy in the open data era.

We are delighted to welcome the brilliant minds from our hiring drive at University Visvesvaraya College of Engineering (UVCE), Bengaluru to the M2P family.