M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

From booking a cab and shopping online to paying for healthcare, financial transactions now happen effortlessly within apps—all thanks to Embedded Finance.

Over the years, embedded finance has quietly transformed the way we interact with money, making payments, lending, insurance, and investments seamlessly accessible within everyday platforms.

While the pandemic and the smartphone revolution brought it into the spotlight, its journey to this pivotal stage began long before.

Let’s take a closer look at how it evolved.

The origins can be traced back to the early 2000s when the fintech revolution began with digital payment solutions. In the early days, the initial focus was on streamlining payment gateways for online transactions. Around 2015, companies started offering POS financing options, allowing consumers to make purchases and pay in installments. This laid the groundwork for the Buy Now, Pay Later (BNPL) model, which is now a core feature of countless e-commerce platforms.

Fast forward to 2025, embedded finance has emerged as a powerful force, redefining how we interact and engage with financial products. Today, financial services are seamlessly integrated into everyday platforms, such as ride-hailing apps, social media, e-commerce platforms, and gaming apps, powered by APIs, cloud computing, and artificial intelligence (AI).

Frictionless Transactions: One of the standout features of embedded finance is its ability to facilitate frictionless transactions across various industries like retail, healthcare, EdTech, etc. By integrating financial services directly into these platforms users can manage their finances within a single ecosystem. For instance, in loan applications, embedded finance reduces friction and improves customer journey at every touchpoint.

Financial Inclusion: Serving the underserved is one of the most impactful benefits of embedded finance. By integrating solutions such as budgeting tools and microloans into familiar platforms, embedded finance lowers barriers to financial access and empowers unbanked and underbanked communities.

Looking ahead, embedded finance will play a pivotal role in shaping a more inclusive and equitable financial system, driving financial literacy and accessibility as technology continues to evolve. From innovations like AR and VR enabling immersive learning experiences to AI-driven automation enhancing personalized insights and collaborations with educational institutions, embedded finance is more than just a financial technology innovation—it’s a movement toward greater financial equity.

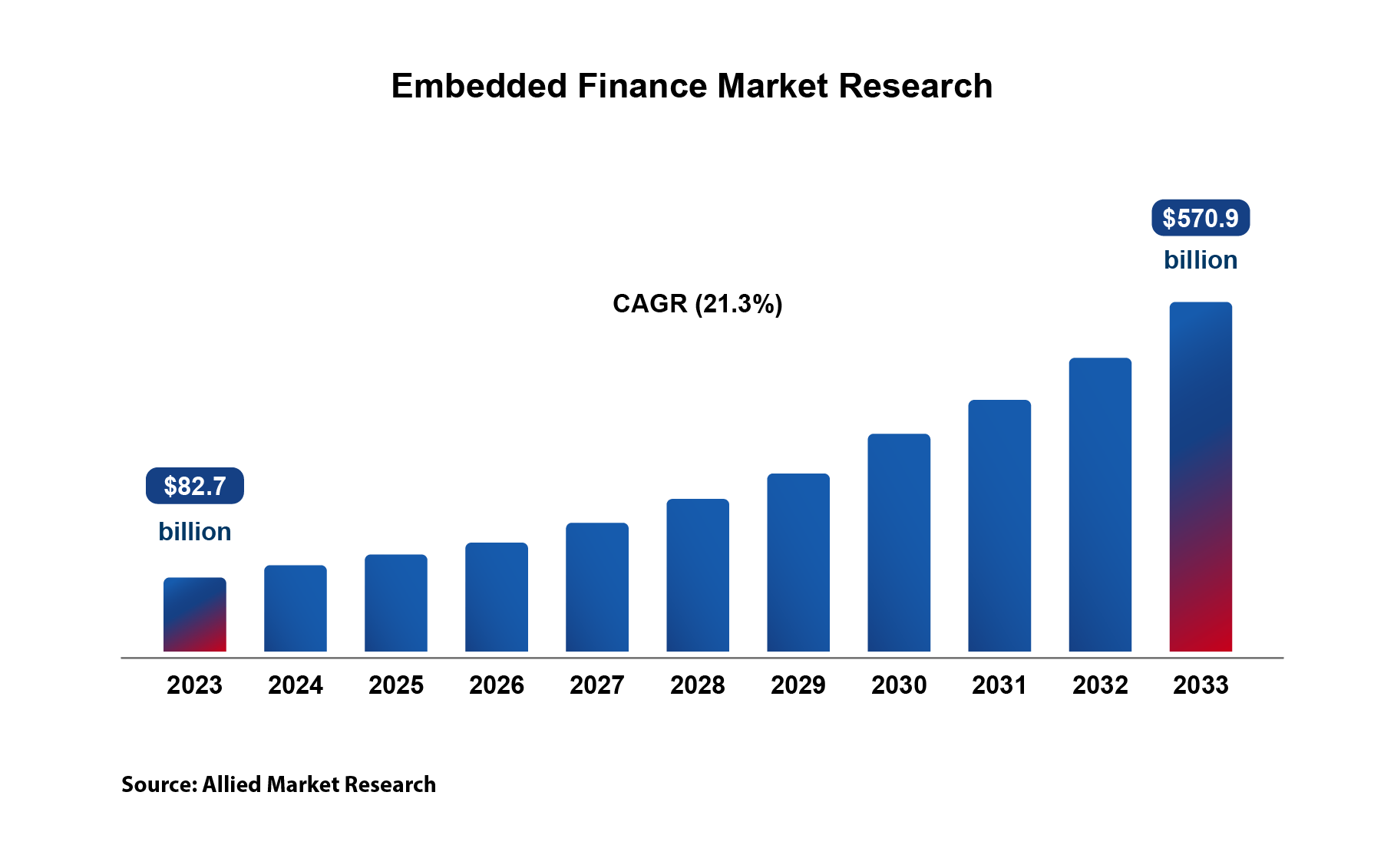

Embedded Finance Market is on track to hit USD 570.9 billion by 2033.

Co-founder Madhusudanan R, shared his journey of building a global fintech powerhouse from India, highlighting opportunities, challenges, and India's rise as a leader in the global fintech ecosystem. Know more here.

Join Madhusudanan R, Co-founder, at ICH 2025 on February 15-16 for expert insights on leadership, fintech innovation, and digital payments. Check out the post for tickets and more details.

At Sa-Dhan's Microfinance Tech Workshop, our team showcased how M2P’s MFI Lending Suite empowers MFIs with scalable, cost-effective, and compliant digital solutions. Click here for more.