M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

India’s digital identity system is recognized globally for its efficiency and effectiveness in enabling seamless service delivery for the government. As the world’s largest digital identity system, Aadhaar has empowered 1.4 billion individuals to access essential services—ranging from e-governance, m-governance to banking, education, and beyond.

With its biometric, face-recognition, and OTP-based authentication, Aadhaar verification has helped businesses simplify compliance while enhancing security, efficiency, and trust.

Building on the impact in enhancing government services, India’s Ministry of Electronics and Information Technology (MeitY) has now expanded Aadhaar authentication access to private sector entities.

The UIDAI recently announced the extension of Aadhaar services to private entities, broadening its impact across industries such as e-commerce, travel, tourism, hospitality, and healthcare.

This transformative step unlocks new opportunities for large-scale enterprises, particularly those handling high-volume processing or premium brands seeking seamless and secure customer experiences.

From seamless customer experience to improved security, here’s how different industries can benefit from Aadhaar authentication.

In addition to these new services, Aadhaar authentication can be used by businesses that need to do eKYC, especially fintech and digital companies, to improve security, run more smoothly, and give users a better experience.

As the regulatory landscape continues to evolve at an unprecedented pace, businesses must stay agile to remain compliant and competitive. Embracing RegTech-powered solutions such as Aadhaar authentication is essential for future-proofing compliance strategies, mitigating fraud risks, reducing operational costs, and enhancing customer experiences.

At M2P, we are committed to helping businesses navigate regulatory shifts with ease while ensuring seamless adherence to global compliance standards. Our cutting-edge RegTech solutions simplify compliance, enabling organizations to effortlessly leverage Aadhaar authentication and other digital identity services. Trusted by state governments and BFSIs, our solutions drive efficiency, security, and trust in digital identity transactions.

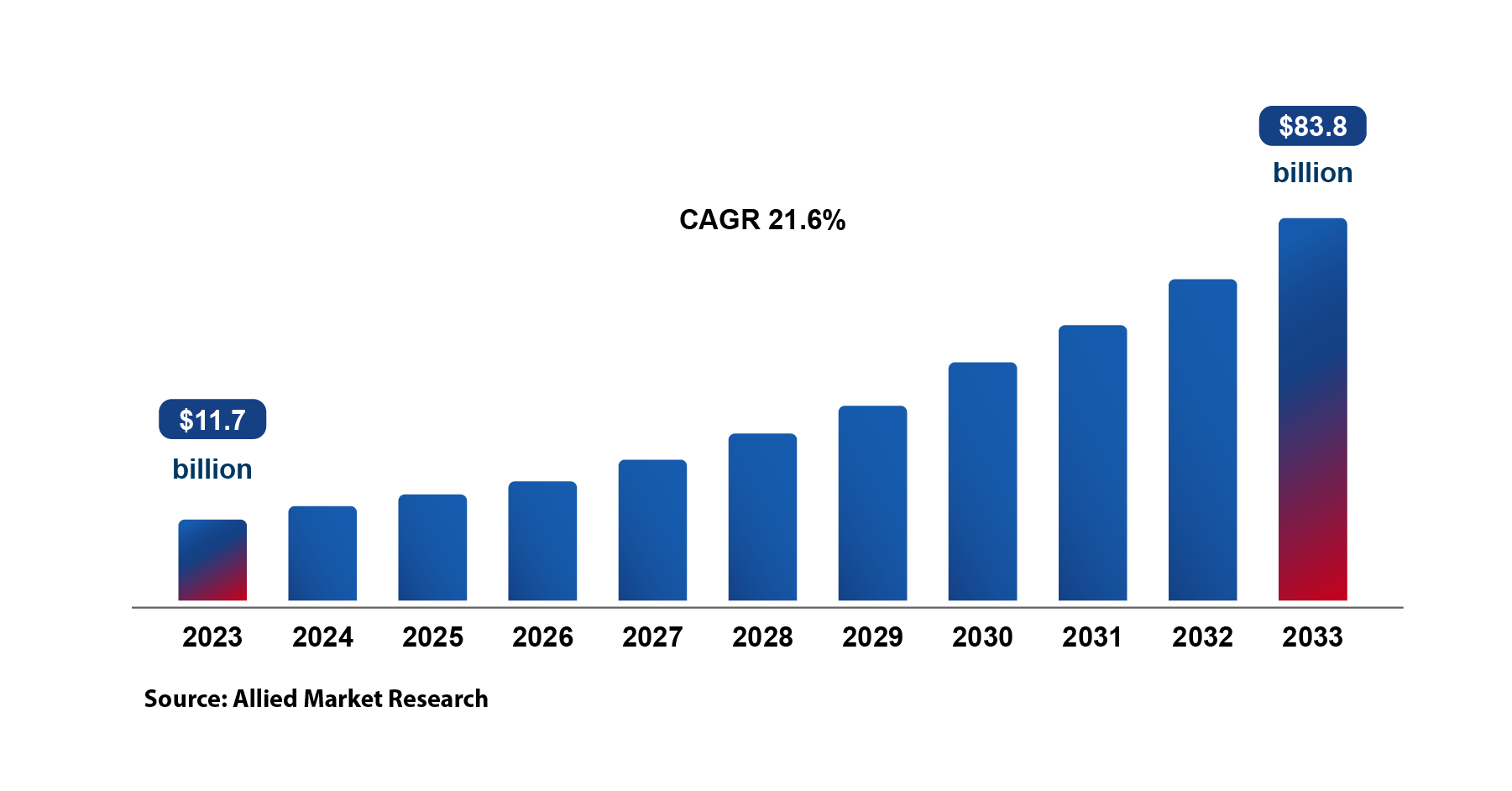

RegTech is booming—projected to hit $83.8 billion by 2033 with a 21.6% CAGR

We’re thrilled to announce our new office at Cairo Festival City. This milestone underscores our commitment to financial inclusion, digital banking, and SME empowerment, creating 80–100 local jobs.

Co-founder, Madhusudanan R, has featured in Khaleej Times article. He shared his vision on how JAM and UPI have revolutionized India's financial landscape.

Co-founder, Prabhu Rangarajan's, keynote at ICON 2025, Stella Maris College, Chennai, highlighted M2P's commitment to Indian engineering and the need for stronger industry-academia collaboration to shape future-ready talents.

Jack Anto, Senior Vice President – Marketing & Design, joined The Brand Table, an exclusive roundtable for marketing leaders. He shared insights on brand positioning, the role of marketing in fintech, M2P's branding strategy, and driving innovation in digital product showcases.