M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

A few years ago, the rise of neobanks, digital-first (and often digital-only) fintech companies, disrupted the banking landscape like never before. These innovative platforms transformed everyday banking by offering faster, fully digital onboarding, seamless user experiences, higher interest rates, and lower fees.

Today, digital banking is on the brink of a massive expansion. By 2028, neobanks are expected to attract 386.3 million users, marking a significant shift toward a digital-first financial ecosystem.

This rapid growth isn’t just about technology; it’s about a fundamental shift in consumer expectations. Here’s a closer look at the key factors shaping the neobanking landscape.

Advanced & User-Friendly Mobile Banking Apps: With mobile apps at their core, neobanks eliminate the need for physical branches. Features like instant digital account opening, automated KYC, and real-time transaction tracking ensure a frictionless banking experience.

Shared Banking and Personal Finance Management: Options like peer-to-peer payments, shared accounts, spending insights, and budgeting tools are redefining how users manage their finances digitally, making banking more collaborative and accessible. Most offer automatic savings features, with competitive annual percentage yield (APY) and other investment options.

Rewarding Banking experience:Through banking partnerships, neobanks offer debit cards, ATM access, zero monthly fees, no minimum balance requirements, along with cashback on debit card purchases. Free international ATM withdrawals, competitive exchange rates on global transfers, and perks like travel insurance and discounted airport lounge access (with paid plans) offer even more value to consumers.

AI and Machine Learning for Hyper-Personalized Services: Neobanks are leveraging AI to offer tailored financial products by assessing creditworthiness and predicting spending behavior with real-time insights—enhancing the overall customer experience.

Fraud Prevention Alerts: AI-driven fraud detection and real-time alerts help prevent unauthorized transactions. Neobanks also provide round-the-clock support through AI-powered chatbots and human agents, ensuring prompt assistance.

Beyond gaining traction from the aforementioned factors, neobanks must prioritize customer engagement and retention for sustainable growth while they continue to innovate on the products and services that resonate with their customer base.

To remain competitive and meet evolving customer needs, neobanks must strategically partner with fintechs that facilitate

With speed, security, and simplicity at the core, a frictionless digital banking experience as standard, and a low-cost operating model, neobanks are set to make banking more inclusive, efficient, and customer-centric.

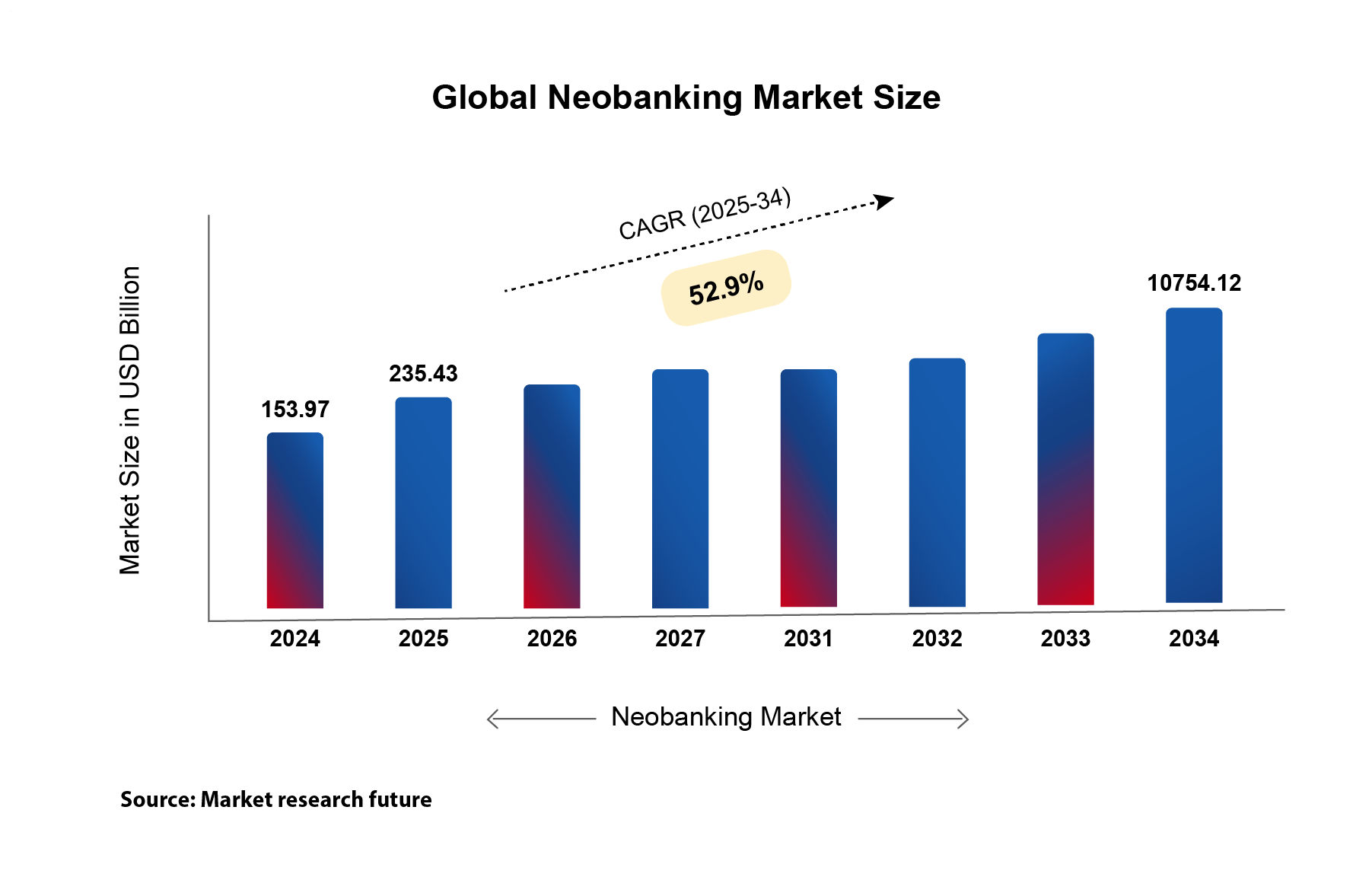

The neobanking market is projected to reach USD 10,754.12 billion by 2034.

At the India Digital Summit 2025, co-founder Madhusudanan R shared insights on scaling a fintech powerhouse globally from India, addressing opportunities and challenges in India’s tech landscape.

Madhusudanan R, co-founder, joined panel discussion at the India Conference at Harvard on 'Banking on Change: How Fintech is Transforming India.' Alongside Anurag Sinha (OneCard) and Abhishant Pant (The Fintech Meetup), he explored fintech's impact on India's financial landscape.

Co-founder Madhusudanan R delivered a keynote at the Bharat Fintech Summit 2025 on 'From Bharat to the World: Fintech and Investment Strategies for Asia and Africa.' He joined Anand Datta (Nexus Venture Partners), Anuradha Ramachandran (TVS Capital Funds), and Vikrant Kulkarni (The Digital Fifth) to discuss Bharat's fintech innovations and their global impact.

Co-founder Madhusudanan R participated in a panel discussion on ‘The Founder’s Playbook for Resilient Growth: Empowering Entrepreneurship’ at the Inclusive FinTech Forum 2025. The panel included Benjamin Fernandes, Founder & CEO of NALA, and Prajit Nanu, Founder & CEO of Nium.